This is the fourth article in a series on asset classes, designed to demonstrate that even in today’s “low interest” environment, one can generate reasonable returns on a diversified portfolio.

(Of course, bets are off should there be a recession or depression).

Given that debt holders generally enjoy priority over equity holders, equity is higher risk, and therefore over the long-term, is rewarded with higher returns than debt. Investment in stocks is one of the most widely used strategies for building high-return investment portfolios. When we talk about “equities” in this article, we refer to stocks in publicly listed companies, not equity in private corporations.

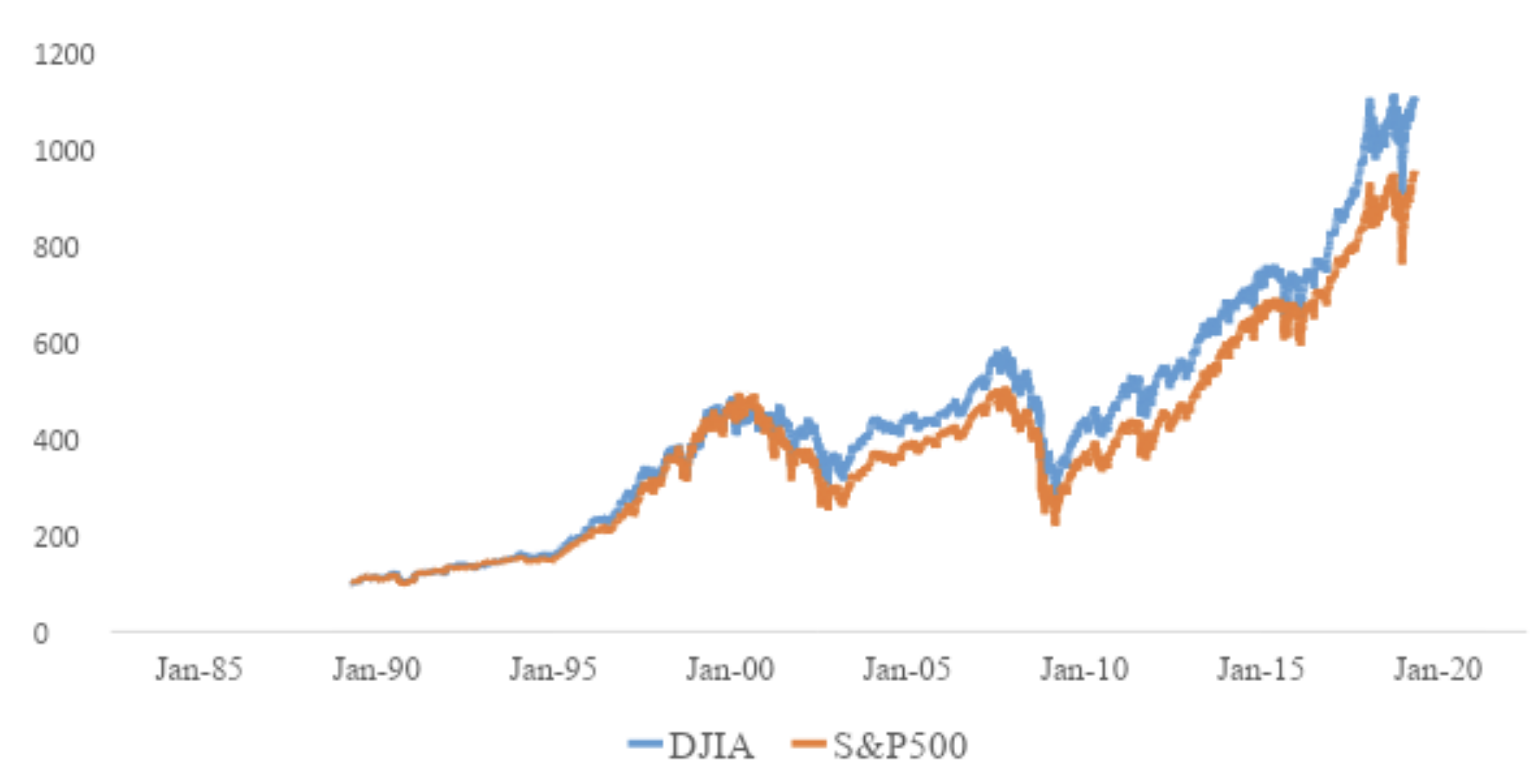

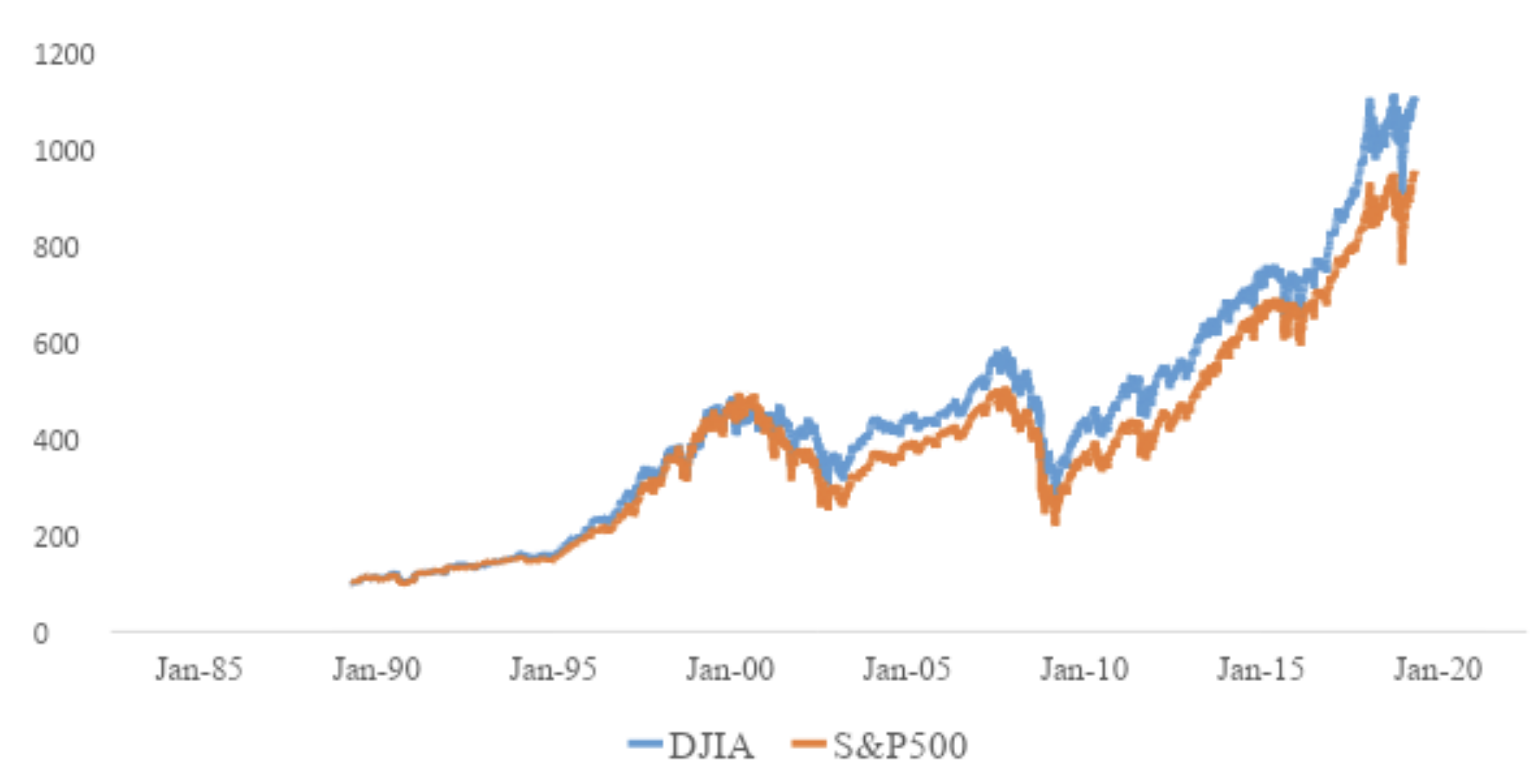

The array of possibilities for equity investments is truly dazzling. There are thousands of equities in publicly listed companies all over the world, with various levels of risk–some that pay out generous levels of dividends, others that pay no dividends, often companies that reinvest their earnings into growth. In general, stock prices are volatile and may rise or fall dramatically. We emphasize again: investment in stocks carries risk. Exhibit 1: Dow Jones Industrial Average vs S&P 500 over last 30 years1 Over virtually any long-term time horizon, a diversified portfolio of equities generally brings excellent returns. The above chart graphically demonstrates the spectacular returns in the Dow Jones Industrial Average or Standard & Poor’s 500 if one held one or the other index since 1989. It should also be emphasized that if one purchases near a peak prior to a recession or depression—e.g. before the dot-com bubble or the 2008 financial crisis—one might experience quite a fall in value and need to wait for quite a few years just to recoup the initial investment. Some investors deal with this by investing a constant amount per year, rain or shine. Others try to determine whether they are buying on a dip that will recover relatively soon, or “catching a falling knife”, e.g. a stock that will continue to fall, perhaps bloodying you in the process. As Baron de Rothschild famously said, “buy when there is blood in the streets, even if the blood is your own.” Warren Buffet warned: “you pay a high price…for a cheery consensus.2” These thoughts constitute the essence of contrarian investing.

Over virtually any long-term time horizon, a diversified portfolio of equities generally brings excellent returns. The above chart graphically demonstrates the spectacular returns in the Dow Jones Industrial Average or Standard & Poor’s 500 if one held one or the other index since 1989. It should also be emphasized that if one purchases near a peak prior to a recession or depression—e.g. before the dot-com bubble or the 2008 financial crisis—one might experience quite a fall in value and need to wait for quite a few years just to recoup the initial investment. Some investors deal with this by investing a constant amount per year, rain or shine. Others try to determine whether they are buying on a dip that will recover relatively soon, or “catching a falling knife”, e.g. a stock that will continue to fall, perhaps bloodying you in the process. As Baron de Rothschild famously said, “buy when there is blood in the streets, even if the blood is your own.” Warren Buffet warned: “you pay a high price…for a cheery consensus.2” These thoughts constitute the essence of contrarian investing.

According to Goldman Sachs, the 10-year trailing annual return for the S&P 500 of 15 percent ranks in the 94th percentile of all 10-year periods going all the way back to 18803. In terms of the best performance sectors, consumer discretionary and information technology significantly outperformed other sectors and S&P500 for the last 10 years. Exhibit 2: S&P 500 sectors performance as of May 01, 20194

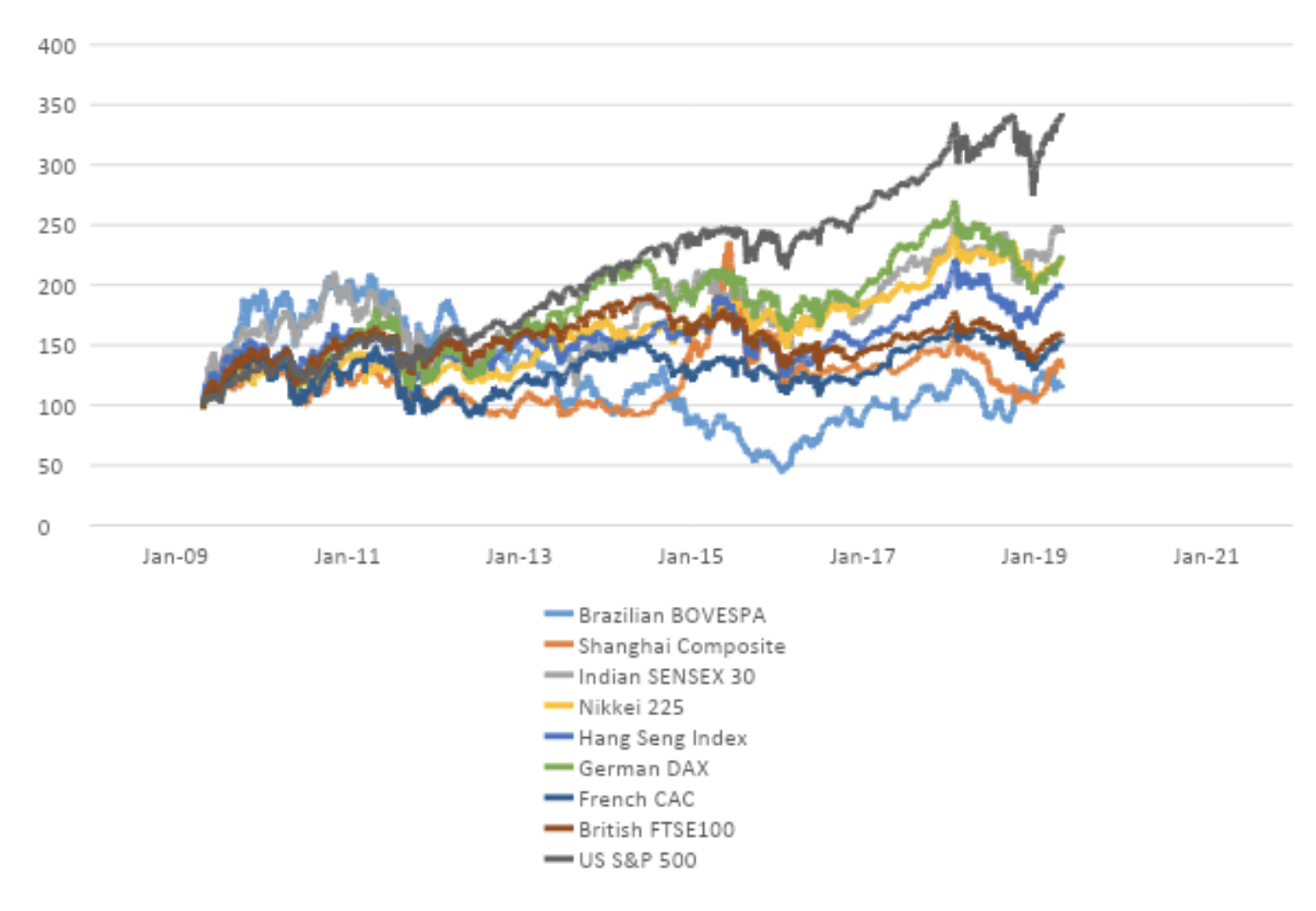

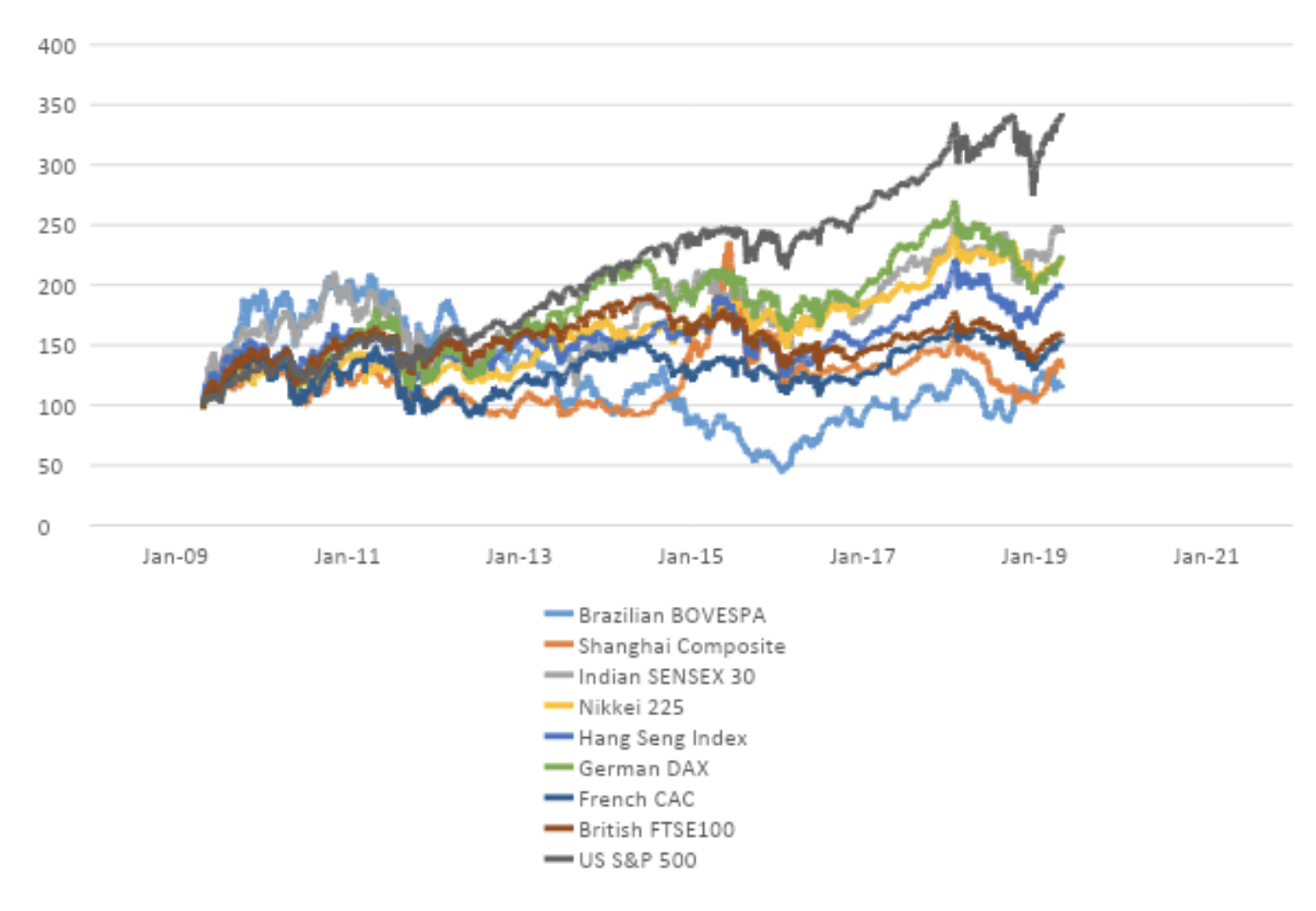

The US still dominates global stock markets in terms of trading volumes, number of listed shares, even equity returns over the last years. Please see the table below that compares returns among key stock markets. Please note that the indexes are converted into US Dollars, to allow for objective comparison.

Exhibit 3: Stock market indexes around the world (in US dollars) since April 20095

Besides building a stock portfolio for themselves, investors may use Exchange-Traded Funds (ETF’s) to establish a low-cost, well-diversified portfolio of stocks. ETFs allow investors to gain portfolio exposure to specific sectors, industries, or countries even if investors do not have expertise in those areas.

Exhibit 4: Selected ETFs based on 3 year return as of May 01, 20196

Besides building a stock portfolio for themselves, investors may use Exchange-Traded Funds (ETF’s) to establish a low-cost, well-diversified portfolio of stocks. ETFs allow investors to gain portfolio exposure to specific sectors, industries, or countries even if investors do not have expertise in those areas.

Exhibit 4: Selected ETFs based on 3 year return as of May 01, 20196

ETF’s may also be leveraged. For example, the top ETF above is a 3X fund, which means that the amplitude of both the upside and downside variations is multiplied by a factor of three. This is achieved by leveraging the ETF portfolio.

As the saying goes, past performance is no guarantee of future performance. After a 10 year bull market, investing in equity warrants extra caution (e.g. consider reducing or eliminating leverage, investing in less risky assets, hedging with gold, etc.). Nevertheless, equities still have their place in any balanced portfolio.

This article is for informational purposes only, not to be construed as investment advice. It is very important to do your own investigation and analysis before making any investments based on your own personal circumstances.

The array of possibilities for equity investments is truly dazzling. There are thousands of equities in publicly listed companies all over the world, with various levels of risk–some that pay out generous levels of dividends, others that pay no dividends, often companies that reinvest their earnings into growth. In general, stock prices are volatile and may rise or fall dramatically. We emphasize again: investment in stocks carries risk. Exhibit 1: Dow Jones Industrial Average vs S&P 500 over last 30 years1

Over virtually any long-term time horizon, a diversified portfolio of equities generally brings excellent returns. The above chart graphically demonstrates the spectacular returns in the Dow Jones Industrial Average or Standard & Poor’s 500 if one held one or the other index since 1989. It should also be emphasized that if one purchases near a peak prior to a recession or depression—e.g. before the dot-com bubble or the 2008 financial crisis—one might experience quite a fall in value and need to wait for quite a few years just to recoup the initial investment. Some investors deal with this by investing a constant amount per year, rain or shine. Others try to determine whether they are buying on a dip that will recover relatively soon, or “catching a falling knife”, e.g. a stock that will continue to fall, perhaps bloodying you in the process. As Baron de Rothschild famously said, “buy when there is blood in the streets, even if the blood is your own.” Warren Buffet warned: “you pay a high price…for a cheery consensus.2” These thoughts constitute the essence of contrarian investing.

Over virtually any long-term time horizon, a diversified portfolio of equities generally brings excellent returns. The above chart graphically demonstrates the spectacular returns in the Dow Jones Industrial Average or Standard & Poor’s 500 if one held one or the other index since 1989. It should also be emphasized that if one purchases near a peak prior to a recession or depression—e.g. before the dot-com bubble or the 2008 financial crisis—one might experience quite a fall in value and need to wait for quite a few years just to recoup the initial investment. Some investors deal with this by investing a constant amount per year, rain or shine. Others try to determine whether they are buying on a dip that will recover relatively soon, or “catching a falling knife”, e.g. a stock that will continue to fall, perhaps bloodying you in the process. As Baron de Rothschild famously said, “buy when there is blood in the streets, even if the blood is your own.” Warren Buffet warned: “you pay a high price…for a cheery consensus.2” These thoughts constitute the essence of contrarian investing.

According to Goldman Sachs, the 10-year trailing annual return for the S&P 500 of 15 percent ranks in the 94th percentile of all 10-year periods going all the way back to 18803. In terms of the best performance sectors, consumer discretionary and information technology significantly outperformed other sectors and S&P500 for the last 10 years. Exhibit 2: S&P 500 sectors performance as of May 01, 20194

| Sector name | Performance | ||||||||

| 1 Day | 5 Day | 1 Month | 3 Month | YTD | 1 Year | 3 Year | 5 Year | 10 Year | |

| Consumer Discretionary | -1.13% | -1.23% | +4.46% | +9.28% | +20.46% | +14.06% | +49.72% | +86.00% | +412.98% |

| Information Technology | -0.27% | -0.42% | +6.07% | +18.47% | +26.62% | +20.67% | +97.76% | +130.59% | +410.36% |

| Health Care | -0.30% | +2.13% | -3.03% | -1.68% | +2.91% | +8.31% | +27.77% | +53.10% | +267.27% |

| Industrials | -0.75% | -1.26% | +3.27% | +8.16% | +20.45% | +7.55% | +33.91% | +42.76% | +242.21% |

| Financials | -0.86% | +1.43% | +7.91% | +7.23% | +16.44% | +1.23% | +46.97% | +55.66% | +217.04% |

| Consumer Staples | -1.17% | 0.29% | +1.13% | +7.07% | +12.42% | +13.42% | +9.53% | +29.27% | +160.27% |

| Materials | -1.84% | -1.63% | +1.72% | +5.76% | +11.56% | -0.98% | +19.49% | +17.58% | +129.53% |

| Utilities | -1.06% | 0.55% | -0.19% | +6.09% | +9.67% | +12.70% | +19.86% | +34.21% | +124.97% |

| Communication Services | -0.67% | -0.58% | +5.51% | +8.92% | +19.88% | +12.23% | -0.45% | +7.31% | +59.18% |

| Energy | -2.17% | -3.85% | -2.19% | +1.68% | +12.89% | -12.09% | -4.71% | -30.24% | +34.47% |

| Real Estate | 0.04% | 0.66% | -0.53% | +4.78% | +16.01% | +17.09% | – | – | – |

| S&P 500 Index | -0.75% | -0.12% | +3.15% | +8.12% | +16.63% | +10.41% | +41.56% | +55.19% | +234.98% |

Besides building a stock portfolio for themselves, investors may use Exchange-Traded Funds (ETF’s) to establish a low-cost, well-diversified portfolio of stocks. ETFs allow investors to gain portfolio exposure to specific sectors, industries, or countries even if investors do not have expertise in those areas.

Exhibit 4: Selected ETFs based on 3 year return as of May 01, 20196

Besides building a stock portfolio for themselves, investors may use Exchange-Traded Funds (ETF’s) to establish a low-cost, well-diversified portfolio of stocks. ETFs allow investors to gain portfolio exposure to specific sectors, industries, or countries even if investors do not have expertise in those areas.

Exhibit 4: Selected ETFs based on 3 year return as of May 01, 20196

| Name | Category | Return, % | ||||

| YTD | 1 Month | 3 Month | 1 Year | 3 Year | ||

| Direxion Daily Semicondct Bull 3X ETF (SOXL) | Trading–Leveraged Equity | 120.54 | 24.22 | 66.82 | 44.86 | 103.01 |

| Direxion Daily Technology Bull 3X ETF (TECL) | Trading–Leveraged Equity | 94.23 | 14.03 | 60.61 | 41.4 | 70.29 |

| ProShares UltraPro QQQ (TQQQ) | Trading–Leveraged Equity | 76.44 | 10.94 | 40.82 | 32.65 | 61.84 |

| ProShares Ultra Semiconductors (USD) | Trading–Leveraged Equity | 59.9 | 8.67 | 36.64 | 14.54 | 56.68 |

| ProShares Ultra Technology (ROM) | Trading–Leveraged Equity | 57.9 | 9.56 | 33.5 | 32.75 | 52.33 |

This article is for informational purposes only, not to be construed as investment advice. It is very important to do your own investigation and analysis before making any investments based on your own personal circumstances.

1Data source: Yahoo Finance

2https://www.investopedia.com/articles/financial-theory/08/contrarian-investing.asp

3 CNBC – The stock market’s gain in the last 10 years is one of its best runs since the 1800s 4Fidelity, Sectors & Industries – Performance, https://eresearch.fidelity.com/eresearch/markets_sectors/sectors/si_performance.jhtml?tab=siperformance

5Long Term Trends, https://www.longtermtrends.net/stock-market-indices-around-the-world/

6MorningStar, http://news.morningstar.com/etf/Lists/ETFReturns.html

2https://www.investopedia.com/articles/financial-theory/08/contrarian-investing.asp

3 CNBC – The stock market’s gain in the last 10 years is one of its best runs since the 1800s 4Fidelity, Sectors & Industries – Performance, https://eresearch.fidelity.com/eresearch/markets_sectors/sectors/si_performance.jhtml?tab=siperformance

5Long Term Trends, https://www.longtermtrends.net/stock-market-indices-around-the-world/

6MorningStar, http://news.morningstar.com/etf/Lists/ETFReturns.html