This is the sixth and final article in a series on asset classes, which examines luxury goods as an alternative investment asset class.

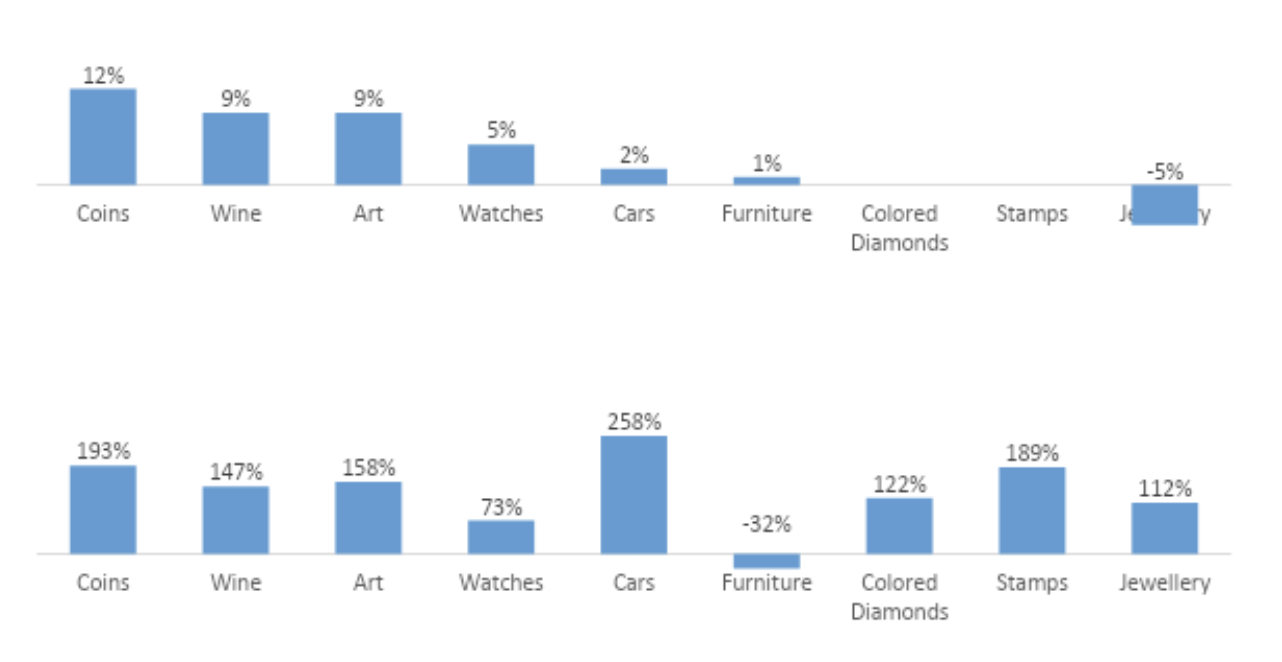

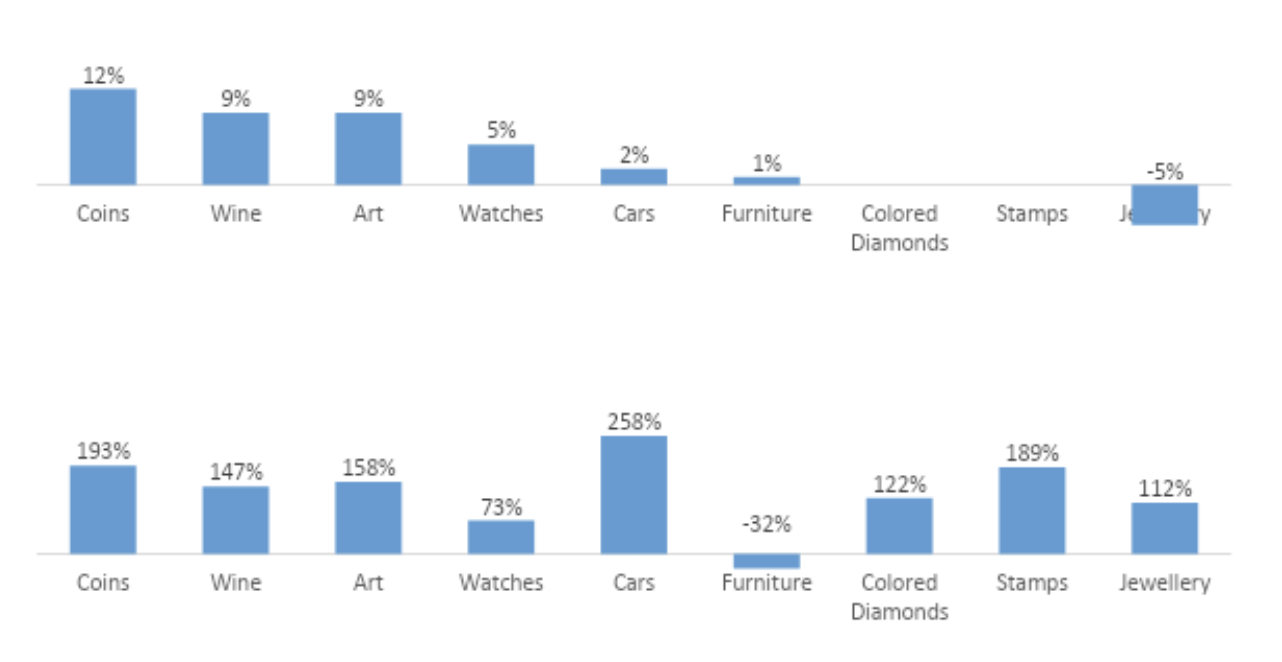

Luxury goods or collectibles suitable for investment might include fine art, stamps, coins, wine, old cars and other collectibles and are typically characterized as high-risk, illiquid, and unregulated investments, with high transactions costs. It typically takes a large entry ticket to purchase a single quality collectible item, let alone to create a diversified portfolio. However, despite the aforementioned discouraging characteristics, there are also quite a few positive features:

This article will focus primarily on the art market (paintings, drawings, sculptures, etc.), the largest portion of the collectibles market; similar analysis could also be applied to other groups of collectible assets, such as fine wines, rare watches, old cars, and stamps.

The world is full of examples of exemplary returns on art. For instance, in July of 1992, an artwork of Jean-Michel Basquiat, a prominent contemporary American artist, was purchased for $122k. After 21 years in private hands, the same masterpiece sold for $29.3 million, bringing an impressive 28.43% annual return. The point here is that for every piece of art that experiences spectacular returns there are perhaps hundreds or thousands of pieces of art that experience unspectacular or even negative returns. Knowledge is key.

Art is a heterogeneous product: every work of art is unique. Assessing the value of a given artwork is difficult and usually includes a subjective component. Every work of art may have both an investment value and a highly personal aesthetic value.

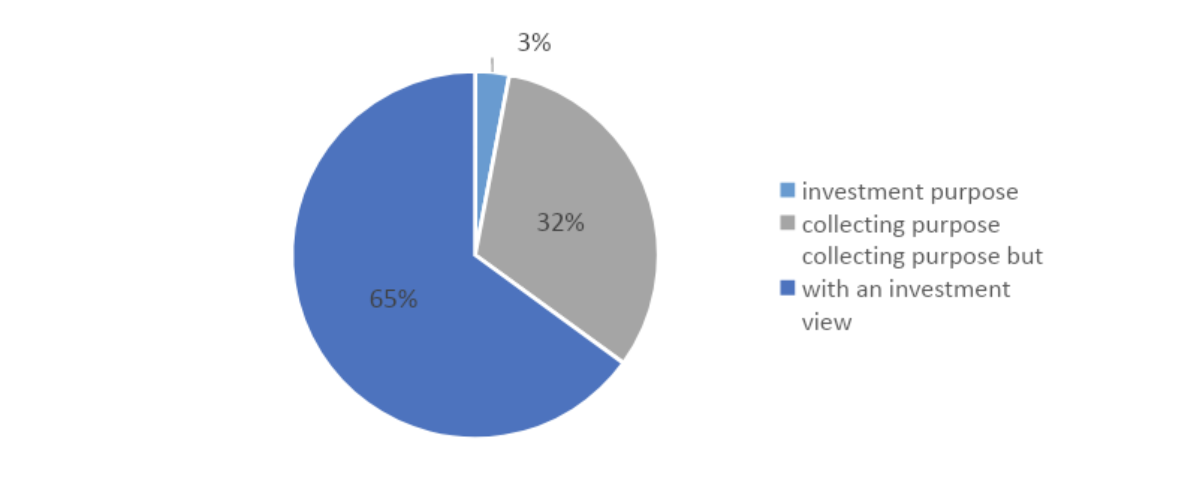

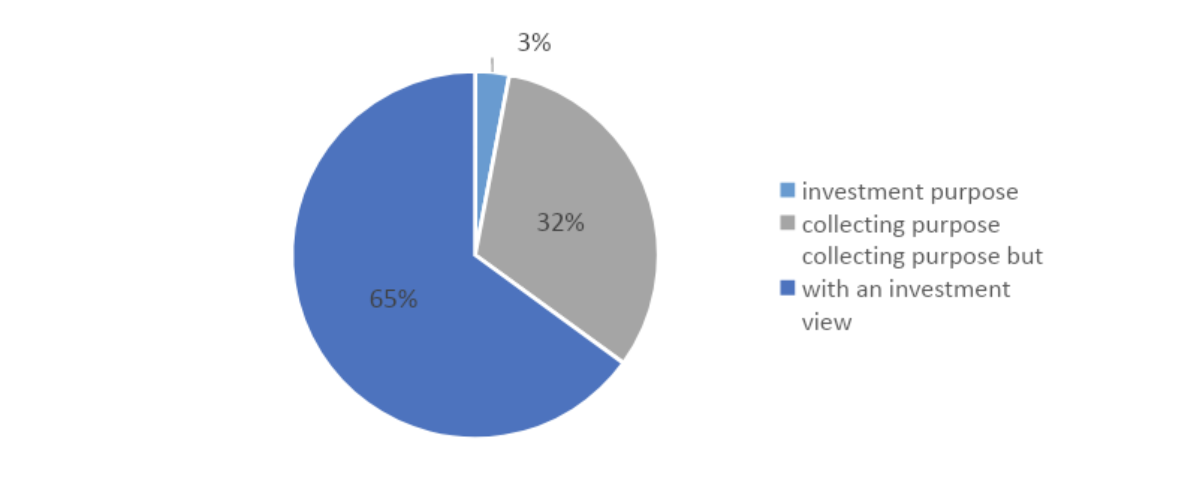

Art is seldom purchased for investment purposes only (according to the survey below, only in 3% of cases); in the majority of cases (65% of respondents) there is both an investment and collecting perspective:

Exhibit 2: Why do you buy art? (Art collectors)2

This article will focus primarily on the art market (paintings, drawings, sculptures, etc.), the largest portion of the collectibles market; similar analysis could also be applied to other groups of collectible assets, such as fine wines, rare watches, old cars, and stamps.

The world is full of examples of exemplary returns on art. For instance, in July of 1992, an artwork of Jean-Michel Basquiat, a prominent contemporary American artist, was purchased for $122k. After 21 years in private hands, the same masterpiece sold for $29.3 million, bringing an impressive 28.43% annual return. The point here is that for every piece of art that experiences spectacular returns there are perhaps hundreds or thousands of pieces of art that experience unspectacular or even negative returns. Knowledge is key.

Art is a heterogeneous product: every work of art is unique. Assessing the value of a given artwork is difficult and usually includes a subjective component. Every work of art may have both an investment value and a highly personal aesthetic value.

Art is seldom purchased for investment purposes only (according to the survey below, only in 3% of cases); in the majority of cases (65% of respondents) there is both an investment and collecting perspective:

Exhibit 2: Why do you buy art? (Art collectors)2

Tracking art industry performance and determining trends requires huge arrays of auction sale statistics and is a difficult task. There are several indices designed to measure art market performance. Some of them are based on repeat sales 3, and some of them track changes in auction volumes for selected artists.

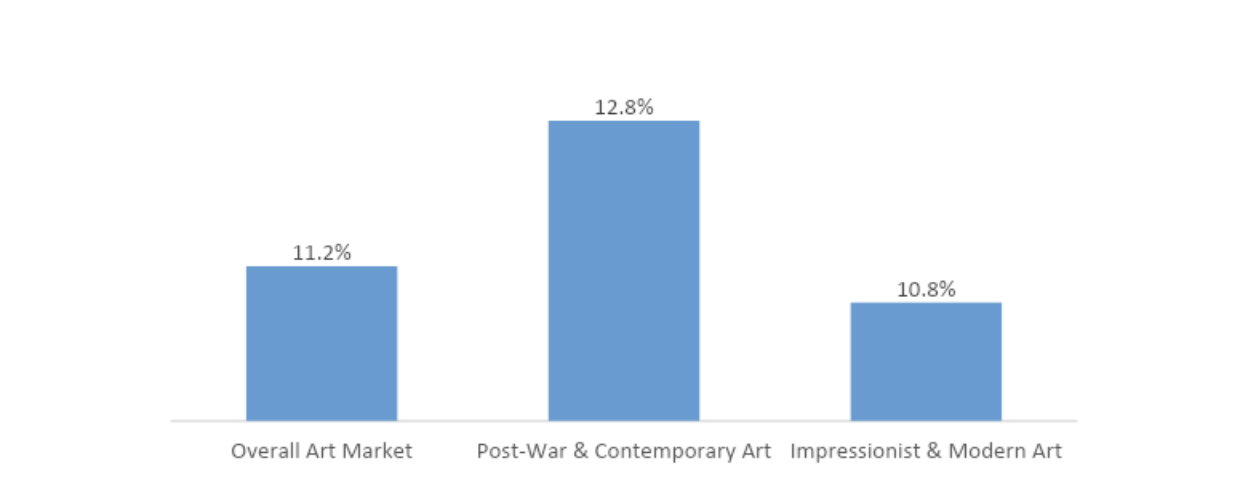

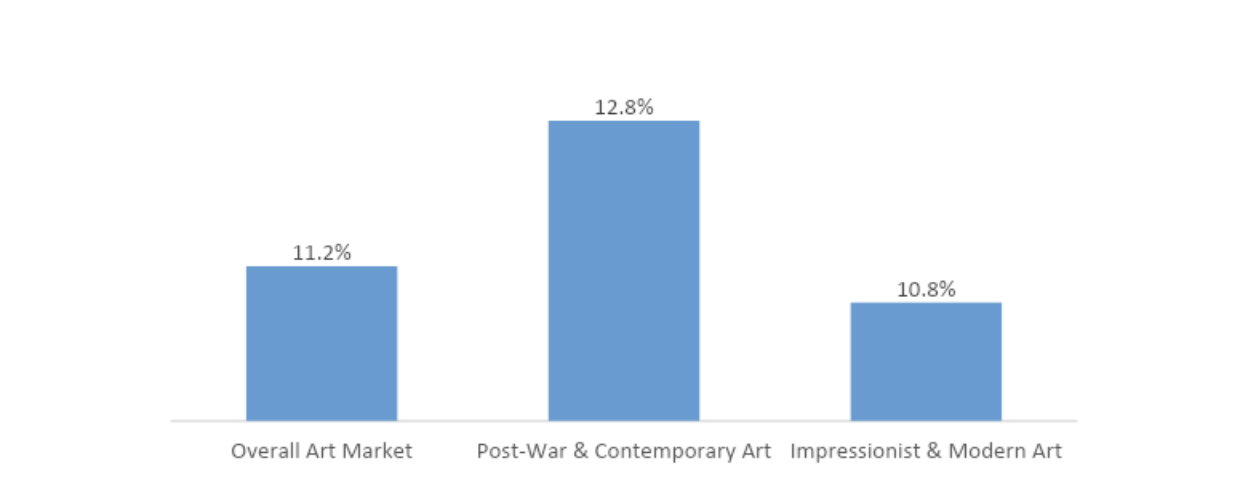

One of the most well-known and recognized art index family is the Sotheby’s Mei Moses Indices, which uses data on over 60,000 repeat auction sales over time (e.g. where the same object is sold on multiple occasions):

Exhibit 3: Sotheby’s Mei Moses Indices: 2016-2018 % Growth4

Tracking art industry performance and determining trends requires huge arrays of auction sale statistics and is a difficult task. There are several indices designed to measure art market performance. Some of them are based on repeat sales 3, and some of them track changes in auction volumes for selected artists.

One of the most well-known and recognized art index family is the Sotheby’s Mei Moses Indices, which uses data on over 60,000 repeat auction sales over time (e.g. where the same object is sold on multiple occasions):

Exhibit 3: Sotheby’s Mei Moses Indices: 2016-2018 % Growth4

As we can see, art is composed of several sectors that do not react in the same way. Therefore, potential art investors need to remember that, for example, the old masters sector does not have the same return/risk profile as the contemporary sector.

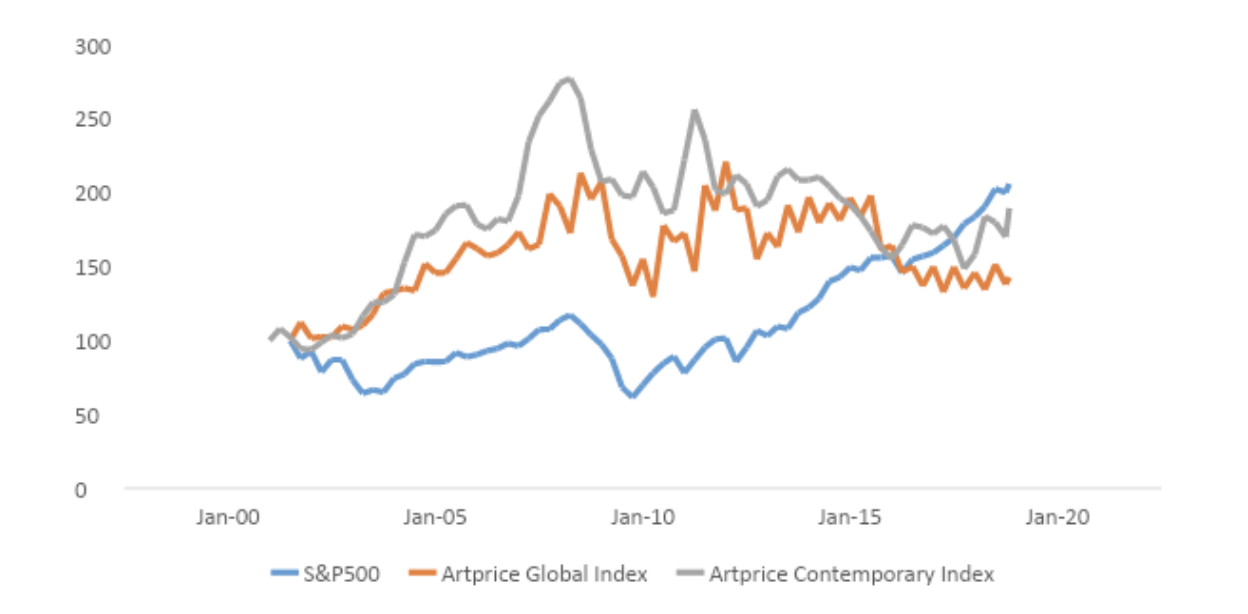

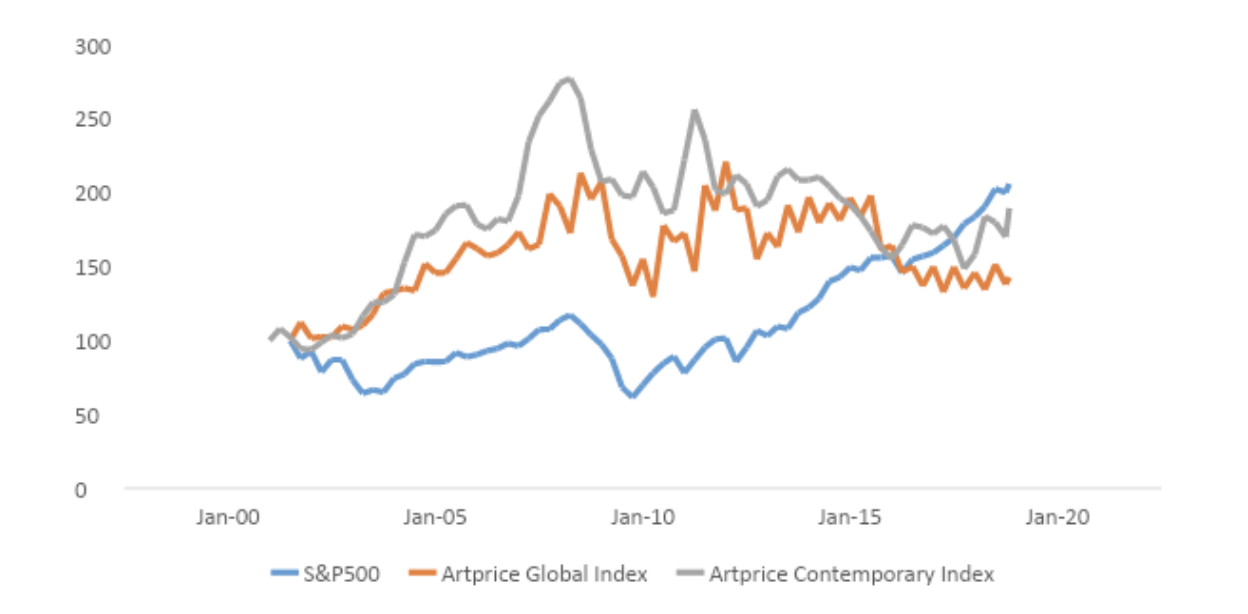

Artprice, the world leader in databases of prices and indices for works of art, calculates indices based on changes in auction volumes:

Exhibit 4: Artprice global index vs S&P 500 since 20015

As we can see, art is composed of several sectors that do not react in the same way. Therefore, potential art investors need to remember that, for example, the old masters sector does not have the same return/risk profile as the contemporary sector.

Artprice, the world leader in databases of prices and indices for works of art, calculates indices based on changes in auction volumes:

Exhibit 4: Artprice global index vs S&P 500 since 20015

As the above chart illustrates, the global art market showed better returns than the US stock market until the end of 2015 and only underperformed in subsequent years, however, the contemporary segment of the art market showed comparable results to S&P500 returns throughout the period, despite the longest bull market in Wall Street history.

As the above chart illustrates, the global art market showed better returns than the US stock market until the end of 2015 and only underperformed in subsequent years, however, the contemporary segment of the art market showed comparable results to S&P500 returns throughout the period, despite the longest bull market in Wall Street history.

Art also offers the benefit of a low correlation with stock markets, offering the potential for hedging and portfolio diversification (correlation factors are -0.035, 0.102 and 0.135 between the Mei Moses All Art Index and S&P500 for the last 50, 25 and 10 years respectively6). However, potential art investors should also bear in mind: there are no dividends or interest payments!

The decision to invest in art is a highly personal decision, depending on one’s personal situation and objectives. One great investor, Larry Fink, the CEO of Blackrock, the world’s largest investment management corporation called contemporary art one of the “… greatest stores of wealth internationally today …”7.

This article is for informational purposes only, not to be construed as investment advice. It is very important to do your own investigation and analysis before making any investments based on your own personal circumstances.

- A hedge against inflation and currency devaluation

- Low correlation with other financial assets, hence helps to diversify portfolio

- It can bring aesthetic pleasure to its owners, not just financial returns

- Some very attractive returns have been achieved , usually by highly knowledgeable investors within a specialized field.

This article will focus primarily on the art market (paintings, drawings, sculptures, etc.), the largest portion of the collectibles market; similar analysis could also be applied to other groups of collectible assets, such as fine wines, rare watches, old cars, and stamps.

The world is full of examples of exemplary returns on art. For instance, in July of 1992, an artwork of Jean-Michel Basquiat, a prominent contemporary American artist, was purchased for $122k. After 21 years in private hands, the same masterpiece sold for $29.3 million, bringing an impressive 28.43% annual return. The point here is that for every piece of art that experiences spectacular returns there are perhaps hundreds or thousands of pieces of art that experience unspectacular or even negative returns. Knowledge is key.

Art is a heterogeneous product: every work of art is unique. Assessing the value of a given artwork is difficult and usually includes a subjective component. Every work of art may have both an investment value and a highly personal aesthetic value.

Art is seldom purchased for investment purposes only (according to the survey below, only in 3% of cases); in the majority of cases (65% of respondents) there is both an investment and collecting perspective:

Exhibit 2: Why do you buy art? (Art collectors)2

This article will focus primarily on the art market (paintings, drawings, sculptures, etc.), the largest portion of the collectibles market; similar analysis could also be applied to other groups of collectible assets, such as fine wines, rare watches, old cars, and stamps.

The world is full of examples of exemplary returns on art. For instance, in July of 1992, an artwork of Jean-Michel Basquiat, a prominent contemporary American artist, was purchased for $122k. After 21 years in private hands, the same masterpiece sold for $29.3 million, bringing an impressive 28.43% annual return. The point here is that for every piece of art that experiences spectacular returns there are perhaps hundreds or thousands of pieces of art that experience unspectacular or even negative returns. Knowledge is key.

Art is a heterogeneous product: every work of art is unique. Assessing the value of a given artwork is difficult and usually includes a subjective component. Every work of art may have both an investment value and a highly personal aesthetic value.

Art is seldom purchased for investment purposes only (according to the survey below, only in 3% of cases); in the majority of cases (65% of respondents) there is both an investment and collecting perspective:

Exhibit 2: Why do you buy art? (Art collectors)2

Tracking art industry performance and determining trends requires huge arrays of auction sale statistics and is a difficult task. There are several indices designed to measure art market performance. Some of them are based on repeat sales 3, and some of them track changes in auction volumes for selected artists.

One of the most well-known and recognized art index family is the Sotheby’s Mei Moses Indices, which uses data on over 60,000 repeat auction sales over time (e.g. where the same object is sold on multiple occasions):

Exhibit 3: Sotheby’s Mei Moses Indices: 2016-2018 % Growth4

Tracking art industry performance and determining trends requires huge arrays of auction sale statistics and is a difficult task. There are several indices designed to measure art market performance. Some of them are based on repeat sales 3, and some of them track changes in auction volumes for selected artists.

One of the most well-known and recognized art index family is the Sotheby’s Mei Moses Indices, which uses data on over 60,000 repeat auction sales over time (e.g. where the same object is sold on multiple occasions):

Exhibit 3: Sotheby’s Mei Moses Indices: 2016-2018 % Growth4

As we can see, art is composed of several sectors that do not react in the same way. Therefore, potential art investors need to remember that, for example, the old masters sector does not have the same return/risk profile as the contemporary sector.

Artprice, the world leader in databases of prices and indices for works of art, calculates indices based on changes in auction volumes:

Exhibit 4: Artprice global index vs S&P 500 since 20015

As we can see, art is composed of several sectors that do not react in the same way. Therefore, potential art investors need to remember that, for example, the old masters sector does not have the same return/risk profile as the contemporary sector.

Artprice, the world leader in databases of prices and indices for works of art, calculates indices based on changes in auction volumes:

Exhibit 4: Artprice global index vs S&P 500 since 20015

As the above chart illustrates, the global art market showed better returns than the US stock market until the end of 2015 and only underperformed in subsequent years, however, the contemporary segment of the art market showed comparable results to S&P500 returns throughout the period, despite the longest bull market in Wall Street history.

As the above chart illustrates, the global art market showed better returns than the US stock market until the end of 2015 and only underperformed in subsequent years, however, the contemporary segment of the art market showed comparable results to S&P500 returns throughout the period, despite the longest bull market in Wall Street history.

Art also offers the benefit of a low correlation with stock markets, offering the potential for hedging and portfolio diversification (correlation factors are -0.035, 0.102 and 0.135 between the Mei Moses All Art Index and S&P500 for the last 50, 25 and 10 years respectively6). However, potential art investors should also bear in mind: there are no dividends or interest payments!

The decision to invest in art is a highly personal decision, depending on one’s personal situation and objectives. One great investor, Larry Fink, the CEO of Blackrock, the world’s largest investment management corporation called contemporary art one of the “… greatest stores of wealth internationally today …”7.

This article is for informational purposes only, not to be construed as investment advice. It is very important to do your own investigation and analysis before making any investments based on your own personal circumstances.

1Knight Frank – The Wealth Report 2019

2Deloitte Luxembourg & ArtTactic Art & Finance Report 2017

3A repeat-sale compares changes in sale prices of the same artwork at specific points in time

4Sotheby’s Mei Moses Indices, https://www.sothebys.com/en/the-sothebys-mei-moses-indices

5Sotheby’s Mei Moses Indices, https://www.sothebys.com/en/the-sothebys-mei-moses-indices

6Adriano Picinati di Torcello – Why should art be considered as an asset class?

7CNBC – Art and real estate are the new gold, says Blackrock CEO

2Deloitte Luxembourg & ArtTactic Art & Finance Report 2017

3A repeat-sale compares changes in sale prices of the same artwork at specific points in time

4Sotheby’s Mei Moses Indices, https://www.sothebys.com/en/the-sothebys-mei-moses-indices

5Sotheby’s Mei Moses Indices, https://www.sothebys.com/en/the-sothebys-mei-moses-indices

6Adriano Picinati di Torcello – Why should art be considered as an asset class?

7CNBC – Art and real estate are the new gold, says Blackrock CEO