At the IMF Annual Research Conference on November 9, 2023, Chair Powell stated: “The Federal Open Market Committee is committed to achieving a stance of monetary policy that is sufficiently restrictive to bring inflation down to 2% over time; we are not confident that we have achieved such a stance.”

My translation from Fedspeak: inflation is not under control. Hence, one of two situations is foreseeable: either there would need to be a much higher interest rate to bring down inflation (which may crash the economy), or we tolerate higher inflation for longer. Given that (a) there is the need or temptation to inflate away the debt and (b) the Fed, in my opinion, has a bias against triggering a recession, especially in a pre-election period, the higher inflation rate scenario is likelier to prevail.

The S&P immediately fell 220 points after Chair Powell’s statement.

Let’s examine a little more closely some of the mechanisms at play here.

1. Deficits are out of control

As a percentage of GDP, the US deficit was 6.3 percent for the year ended September 30, 2023, an increase from 5.4 percent in FY 2022 and is expected to remain at a remarkably high 7-8lk% over the coming years.

The US does not have a monopoly on this phenomenon. Italy had a deficit of nearly 8%, Hungary at over 6%.

2. Need for the Fed to float more Treasuries

Deficits of course needs to be financed. Central banks can either print money (which beyond a certain point is inflationary) or can sell Treasuries.

With the Fed trying to bring down very high inflation rates, it has chosen to sell Treasury bonds to finance recent deficits rather than print money, and has sold huge quantities of bonds over the past months.

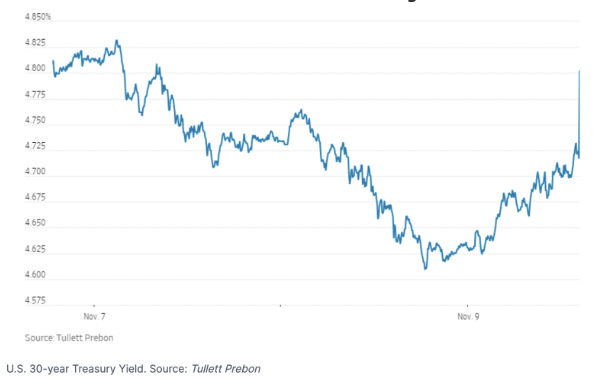

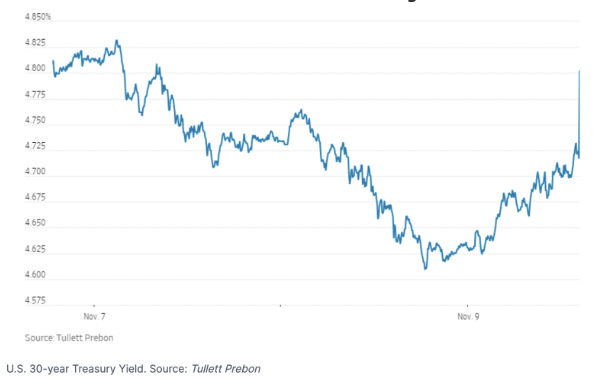

As with most markets, the price of Treasuries (e.g. interest rates) is governed by supply and demand. On the November 9 Treasury sale, the Fed tried to sell $24 billion worth of bonds, and failed, due to low demand. This triggered a remarkable spike in interest rates:

Exhibit 1: US 30 Year Treasury Yields

The US Treasury has colossal financing requirements, having financed $1.5 trillion in the last four months, and is estimated to require a further $1.5 trillion in the coming six months. This surge in financing requirements comes at a time when the main Treasury holders (China, Japan, Russia) have switched from being net buyers to net sellers themselves.

When supply of bonds greatly exceeds supply, there may be a loss in market confidence, causing Central Bank to lose control over interest rates. Moody’s just downgraded its outlook on US Treasuries from stable to neutral, which it explained by rising interest rates and lack of effective policy measures to contain deficits.

3. Nominal debt increasing at a near exponential rate

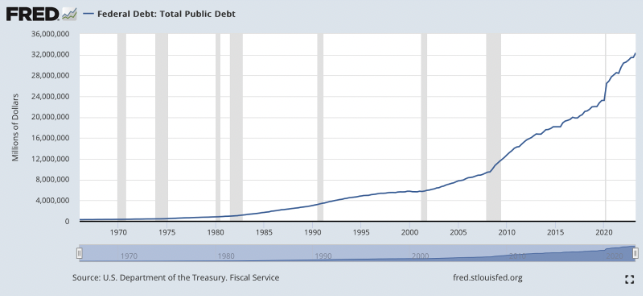

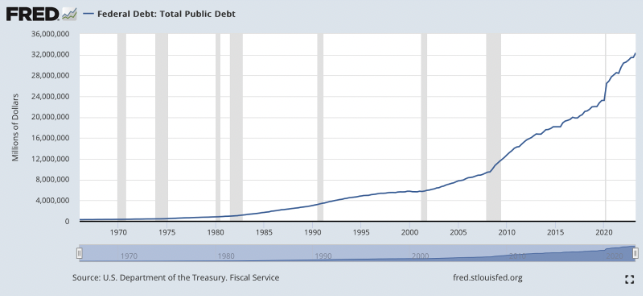

To put the above numbers into perspective, in September 2023, total U.S. federal debt recently passed the $33 trillion mark. In less than a year, the national debt grows by approximately 10%!

Exhibit 2: US Federal Public Debt

Note the steepening curve on the above graph. This approximates a typical curve showing a compounding effect. Unless policy measures are taken to control deficits, this curve is likely to continue to steepen. Same with the curve for interest costs: according to the US Congressional Budget Office, net interest payments on the federal debt were $475 billion in 2022, and are projected to rise to $640 billion in 2023. This trend is likely to further accelerate, due to a combination of increasing debt levels, and refinancing existing low interest debt in the portfolio, as it becomes due, with more expensive debt.

This may either result in a debt spiral, and/or the squeezing out of other spending. The latter is already happening throughout the developing world. According to the IMF, to meet debt payments, at least 100 countries will have to reduce spending on health, education and social protection.

When low-income countries go into debt distress, this may result in “protracted recessions, high inflation and fewer resources going to essential sectors like health, education and social safety nets, with a disproportionate impact on the poor,” according to the World Bank.

Should debt continue to grow exponentially (e.g. along the current path), such effects could also affect the US and other developed countries.

It is important to highlight the compounding effect of debt growth curves, and the corresponding cost of debt service. The human mind is somehow programmed to think in linear terms; we are all too often surprised by the cumulative effects of compound curves, and how difficult they are to reverse.

If there is a loss of confidence and interest rates rise, the compounding effect has the potential to suddenly and unexpectedly accelerate even further.

As Albert Einstein once said, “The most powerful force in the universe is compound interest.”

My translation from Fedspeak: inflation is not under control. Hence, one of two situations is foreseeable: either there would need to be a much higher interest rate to bring down inflation (which may crash the economy), or we tolerate higher inflation for longer. Given that (a) there is the need or temptation to inflate away the debt and (b) the Fed, in my opinion, has a bias against triggering a recession, especially in a pre-election period, the higher inflation rate scenario is likelier to prevail.

The S&P immediately fell 220 points after Chair Powell’s statement.

Let’s examine a little more closely some of the mechanisms at play here.

1. Deficits are out of control

As a percentage of GDP, the US deficit was 6.3 percent for the year ended September 30, 2023, an increase from 5.4 percent in FY 2022 and is expected to remain at a remarkably high 7-8lk% over the coming years.

The US does not have a monopoly on this phenomenon. Italy had a deficit of nearly 8%, Hungary at over 6%.

2. Need for the Fed to float more Treasuries

Deficits of course needs to be financed. Central banks can either print money (which beyond a certain point is inflationary) or can sell Treasuries.

With the Fed trying to bring down very high inflation rates, it has chosen to sell Treasury bonds to finance recent deficits rather than print money, and has sold huge quantities of bonds over the past months.

As with most markets, the price of Treasuries (e.g. interest rates) is governed by supply and demand. On the November 9 Treasury sale, the Fed tried to sell $24 billion worth of bonds, and failed, due to low demand. This triggered a remarkable spike in interest rates:

Exhibit 1: US 30 Year Treasury Yields

The US Treasury has colossal financing requirements, having financed $1.5 trillion in the last four months, and is estimated to require a further $1.5 trillion in the coming six months. This surge in financing requirements comes at a time when the main Treasury holders (China, Japan, Russia) have switched from being net buyers to net sellers themselves.

When supply of bonds greatly exceeds supply, there may be a loss in market confidence, causing Central Bank to lose control over interest rates. Moody’s just downgraded its outlook on US Treasuries from stable to neutral, which it explained by rising interest rates and lack of effective policy measures to contain deficits.

3. Nominal debt increasing at a near exponential rate

To put the above numbers into perspective, in September 2023, total U.S. federal debt recently passed the $33 trillion mark. In less than a year, the national debt grows by approximately 10%!

Exhibit 2: US Federal Public Debt

Note the steepening curve on the above graph. This approximates a typical curve showing a compounding effect. Unless policy measures are taken to control deficits, this curve is likely to continue to steepen. Same with the curve for interest costs: according to the US Congressional Budget Office, net interest payments on the federal debt were $475 billion in 2022, and are projected to rise to $640 billion in 2023. This trend is likely to further accelerate, due to a combination of increasing debt levels, and refinancing existing low interest debt in the portfolio, as it becomes due, with more expensive debt.

This may either result in a debt spiral, and/or the squeezing out of other spending. The latter is already happening throughout the developing world. According to the IMF, to meet debt payments, at least 100 countries will have to reduce spending on health, education and social protection.

When low-income countries go into debt distress, this may result in “protracted recessions, high inflation and fewer resources going to essential sectors like health, education and social safety nets, with a disproportionate impact on the poor,” according to the World Bank.

Should debt continue to grow exponentially (e.g. along the current path), such effects could also affect the US and other developed countries.

It is important to highlight the compounding effect of debt growth curves, and the corresponding cost of debt service. The human mind is somehow programmed to think in linear terms; we are all too often surprised by the cumulative effects of compound curves, and how difficult they are to reverse.

If there is a loss of confidence and interest rates rise, the compounding effect has the potential to suddenly and unexpectedly accelerate even further.

As Albert Einstein once said, “The most powerful force in the universe is compound interest.”