We are in the midst of a global coronavirus pandemic, with worldwide GDP contracting substantially, creating a phenomenon of corporations issuing record amounts of new indebtedness

. This article first examines: (a) activity on corporate bond markets followed by (b) corporate loan markets; finally, we (d) examine motivation for borrowers to take on new indebtedness.

a, Corporate bond markets

Central bank stimulus has made the corporate bond market an attractive fund-raising tool for companies. The U.S. Federal Reserve as well as the European Central Bank (through its Pandemic Emergency Purchase Program) have included corporate bonds in their asset purchase schemes, helping drive down yields, making corporate debt cheaper than ever.

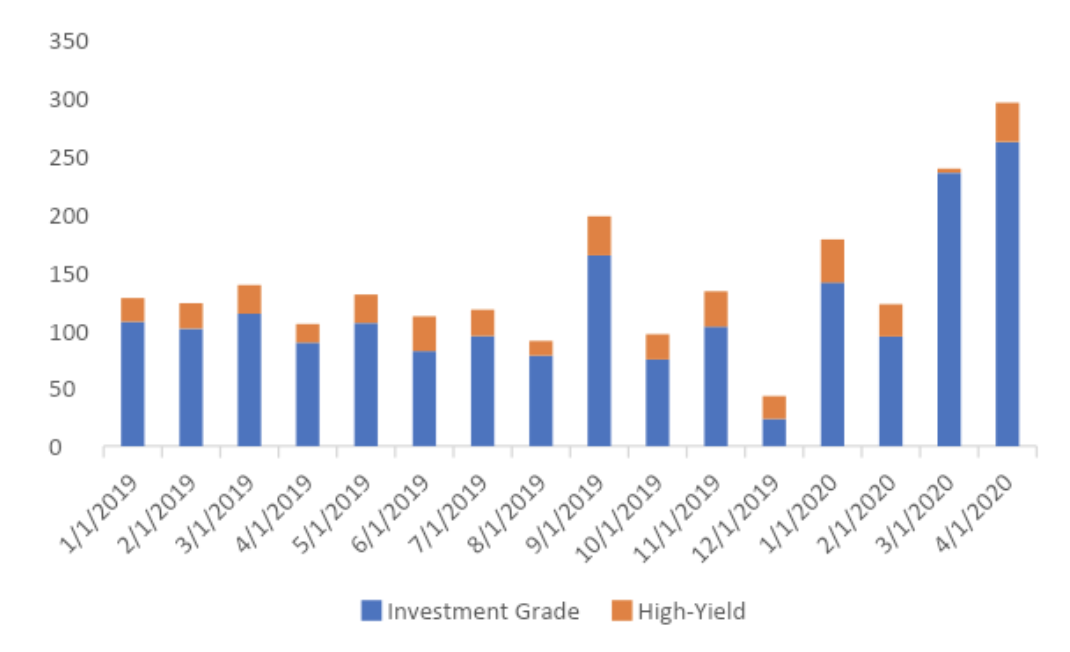

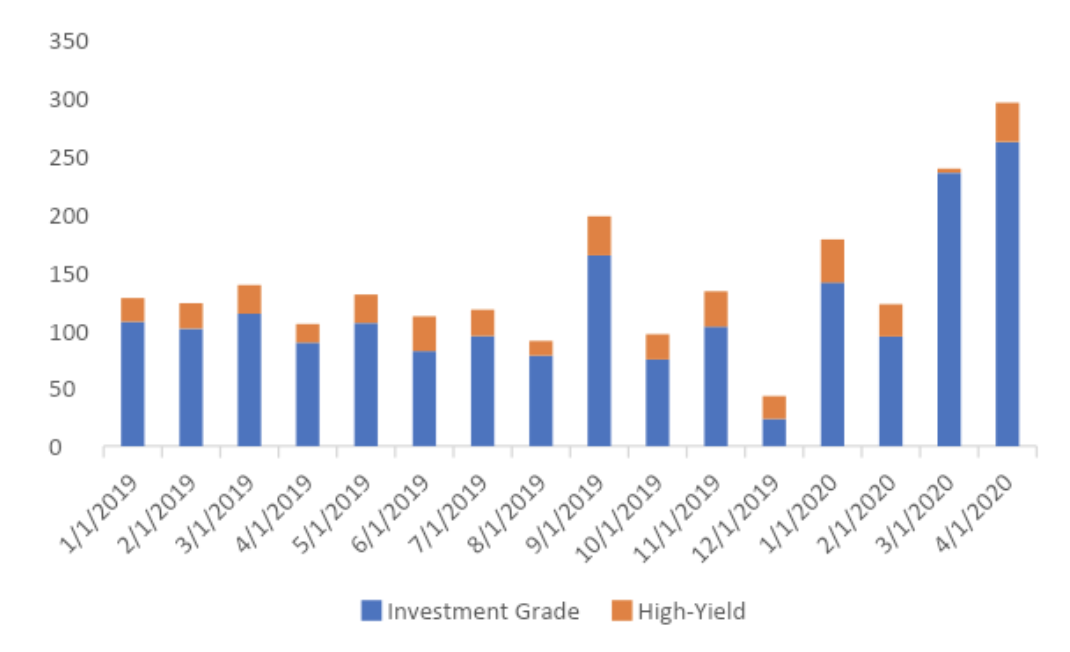

In the United States, investment grade-rated firms issued $261.8 billion 1 of new bonds in April, 2020 alone, almost three times higher than in April, 2019. Exhibit 1: US Corporate Bond Issuance, USD billion2 The FED programs were expanded on April 9 to include certain junk bonds. As a result, the junk bond market also saw a flood of new issuance in April (e.g. Yum Brands (owner of KFC and Pizza Hut) and AMC (cinema operators))—companies struggling to maintain liquidity due to a collapse in revenues.

The FED programs were expanded on April 9 to include certain junk bonds. As a result, the junk bond market also saw a flood of new issuance in April (e.g. Yum Brands (owner of KFC and Pizza Hut) and AMC (cinema operators))—companies struggling to maintain liquidity due to a collapse in revenues.

The data from Europe mirrors the situation in the US: European investment grade-rated companies raised $83.2 billion in April, 2020, reaching levels not seen since 20093.

b, Corporate loan markets

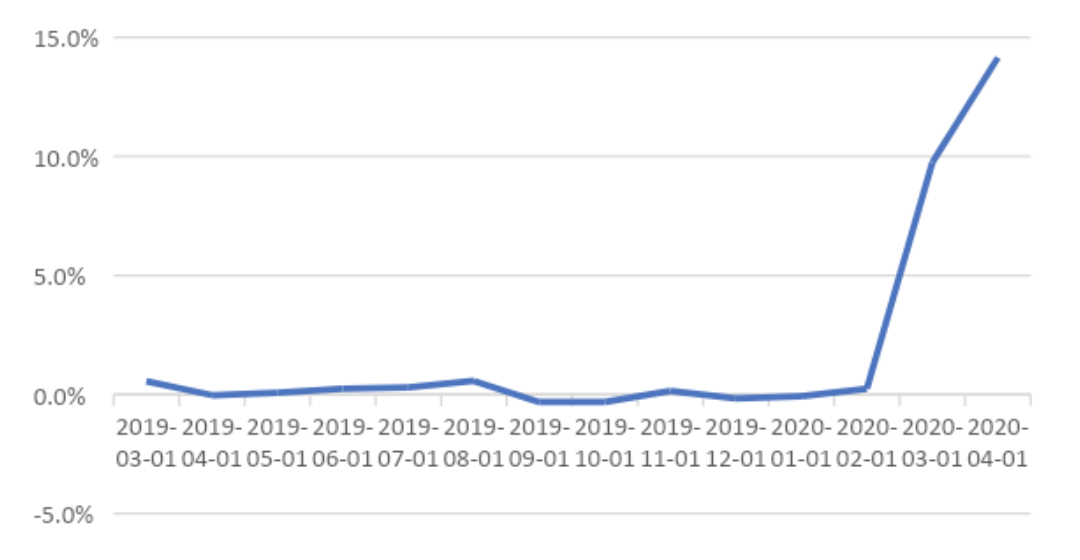

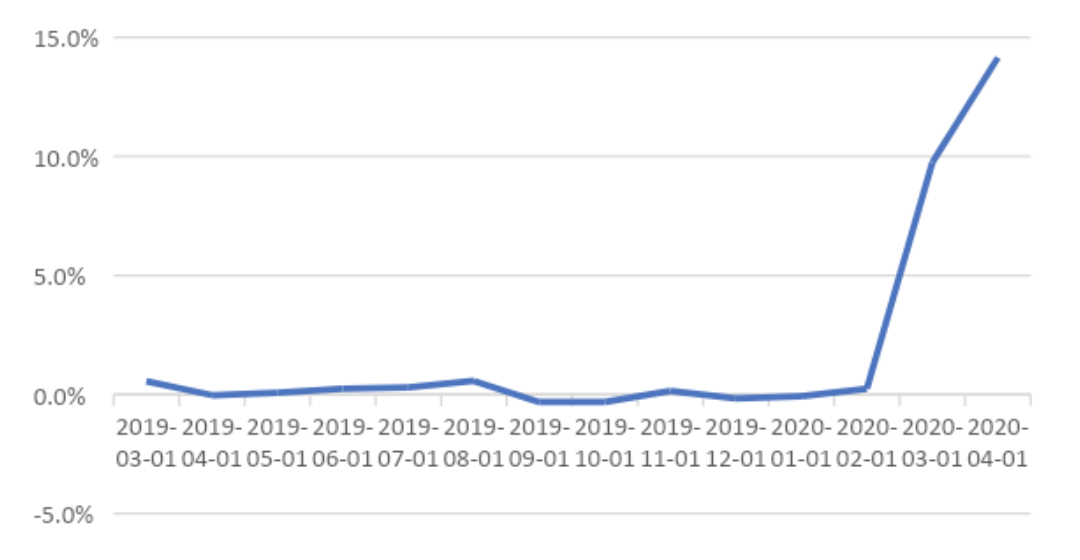

US Corporate lending (commercial and industrial loans) skyrocketed in March and April of 2020: Exhibit 2: Percentage change to previous month in volume of commercial and industrial loans in the U.S4. Corporate loans typically increase when the economy is thriving. The current surge is due to companies striving to maintain liquidity due to the COVID-19 outbreak. Similarly, data from Europe shows that volumes of new euro-denominated revolving loans and overdraft facilities to non-financial corporations increased substantially in March:

Corporate loans typically increase when the economy is thriving. The current surge is due to companies striving to maintain liquidity due to the COVID-19 outbreak. Similarly, data from Europe shows that volumes of new euro-denominated revolving loans and overdraft facilities to non-financial corporations increased substantially in March:

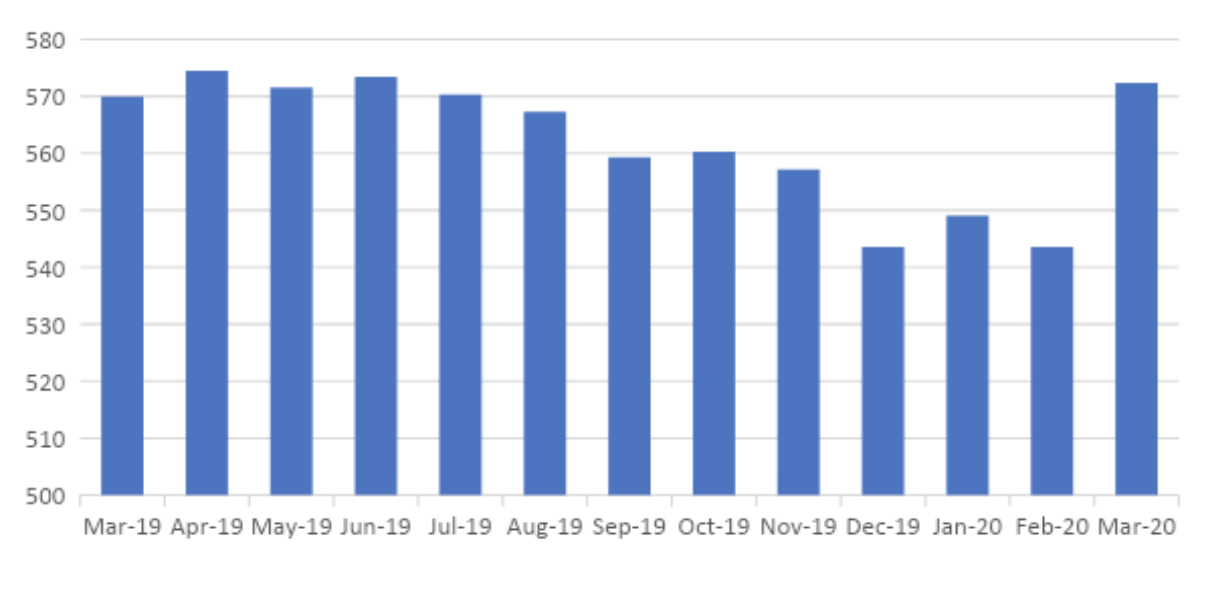

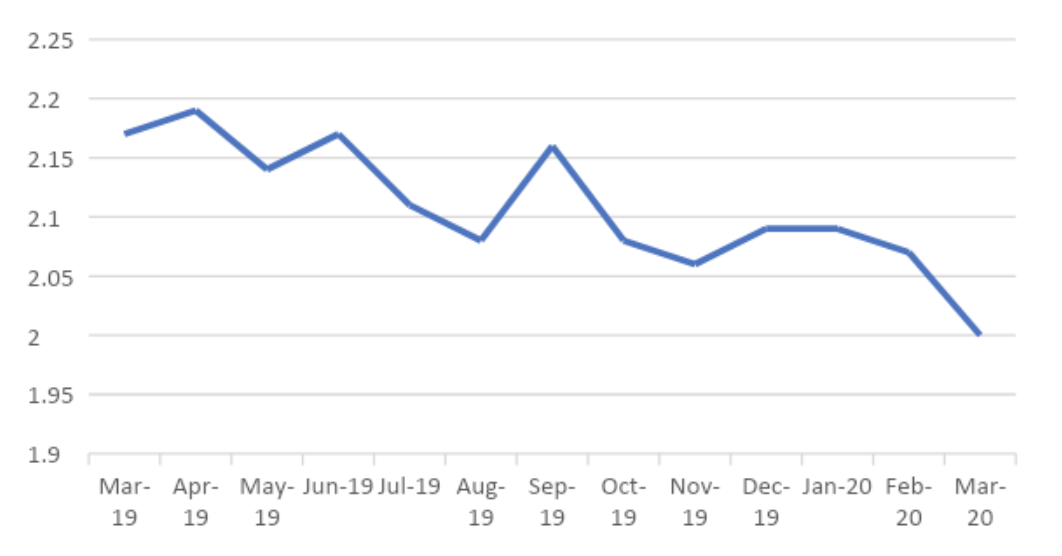

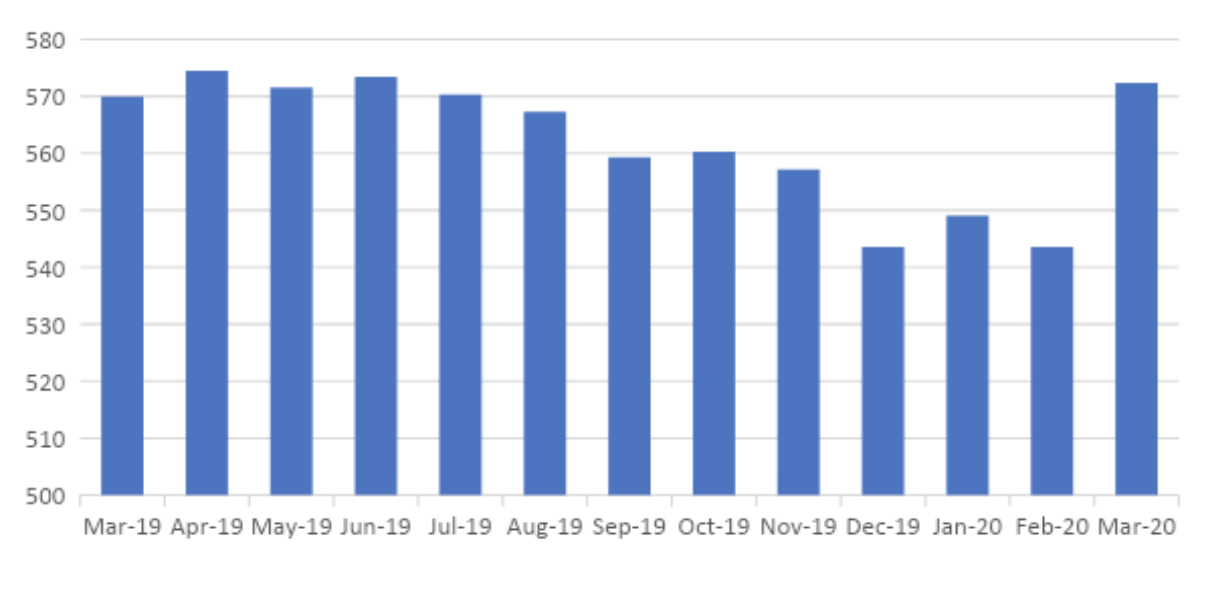

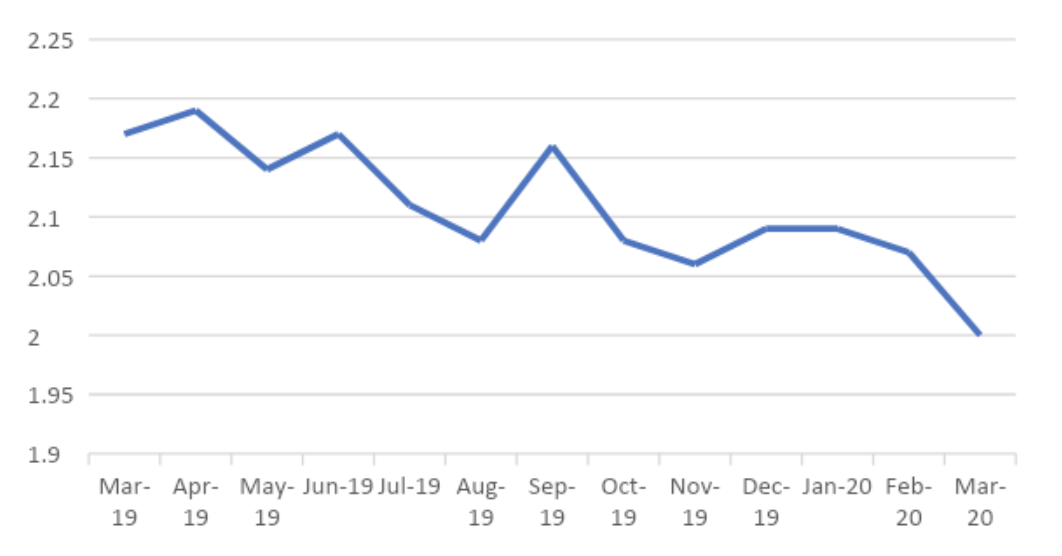

Exhibit 3: Volumes of new euro-denominated revolving loans and overdraft to euro area non-financial corporations (EUR billions)5 The current surge in corporate lending in the euro area is also supported by very low interest rates on new euro-denominated loans (revolving loans and overdrafts) to euro area non-financial corporations – lending rates of approximately 2% in March 2020.

Exhibit 4: Monetary Financial Institution (MFI) interest rates on new euro-denominated loans (revolving loans and overdrafts) to euro area non-financial corporations, percentages per annum6

The current surge in corporate lending in the euro area is also supported by very low interest rates on new euro-denominated loans (revolving loans and overdrafts) to euro area non-financial corporations – lending rates of approximately 2% in March 2020.

Exhibit 4: Monetary Financial Institution (MFI) interest rates on new euro-denominated loans (revolving loans and overdrafts) to euro area non-financial corporations, percentages per annum6

In many countries, banks have been encouraged to loosen their lending criteria via Government guarantee programs, helping to inject liquidity into the economy. The Government of Italy, for example, has offered a €500 billion guarantee program (including guarantees via SACE Simest – the Italian export credit agency) to banks, thereby de-risking lending activity to banks.7

In many countries, banks have been encouraged to loosen their lending criteria via Government guarantee programs, helping to inject liquidity into the economy. The Government of Italy, for example, has offered a €500 billion guarantee program (including guarantees via SACE Simest – the Italian export credit agency) to banks, thereby de-risking lending activity to banks.7

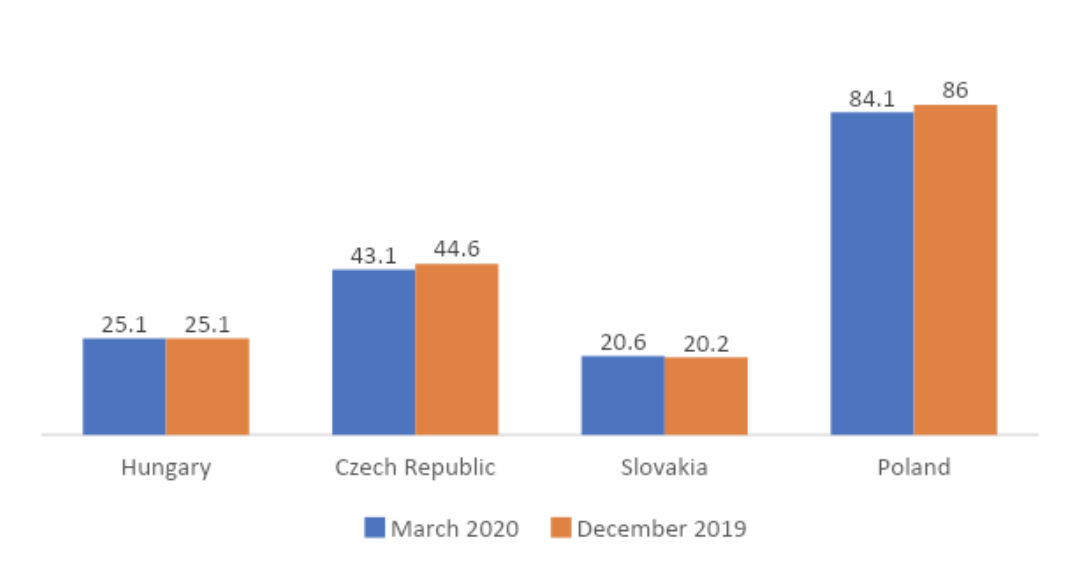

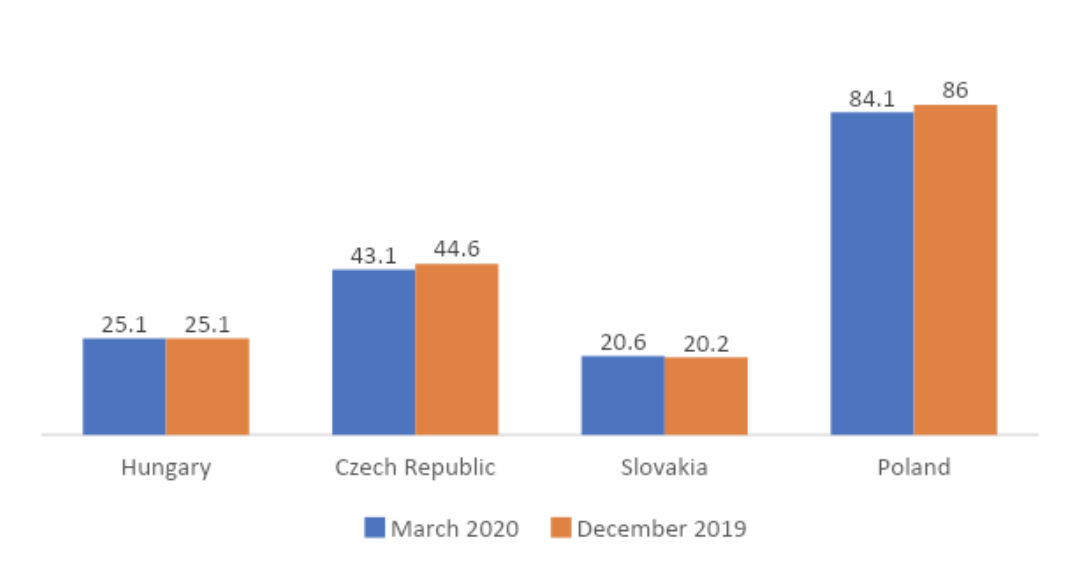

Moreover, the rejection rate by banks for loans to euro area enterprises continued to increase: Exhibit 5: Changes in the Rejection Rate for Loans to Enterprises8 It is interesting to note that in the Visegrad Four countries, lending has been much more subdued. Exhibit 6: Outstanding loans amount to non-financial corporations in Visegrad countries9 Statistics are available only until March, perhaps April will show more of an increase. Depreciation of Central European currencies is perhaps a reason there was little if any growth in euro-denominated amounts.

Statistics are available only until March, perhaps April will show more of an increase. Depreciation of Central European currencies is perhaps a reason there was little if any growth in euro-denominated amounts.

c, Motivation for Borrowers to take on New Indebtedness.

From our exposure to debt markets, we see the following motivations for new indebtedness: First, there are the “losers” from the coronavirus, such as the tourism and automotive, which have seen a dramatic decline in revenues, which face ongoing future uncertainty, and need to create cash or credit reserves to weather the storm. Second, there are also a few “winners” from the coronavirus, such as certain online retailers, pharma companies, etc. which need capital to fund expansion.

A third motivation is simply to lock into interest rates that are incredibly cheap by historic standards. The “take home” message for any owner of a company reading this articles is that now is a good time to raise debt. Interest rates are low, and liquidity helps reduce risk in these highly uncertain times, and allows companies to take advantage of opportunities in this coronavirus environment, especially if the coronavirus triggers a prolonged recession.

a, Corporate bond markets

Central bank stimulus has made the corporate bond market an attractive fund-raising tool for companies. The U.S. Federal Reserve as well as the European Central Bank (through its Pandemic Emergency Purchase Program) have included corporate bonds in their asset purchase schemes, helping drive down yields, making corporate debt cheaper than ever.

In the United States, investment grade-rated firms issued $261.8 billion 1 of new bonds in April, 2020 alone, almost three times higher than in April, 2019. Exhibit 1: US Corporate Bond Issuance, USD billion2

The FED programs were expanded on April 9 to include certain junk bonds. As a result, the junk bond market also saw a flood of new issuance in April (e.g. Yum Brands (owner of KFC and Pizza Hut) and AMC (cinema operators))—companies struggling to maintain liquidity due to a collapse in revenues.

The FED programs were expanded on April 9 to include certain junk bonds. As a result, the junk bond market also saw a flood of new issuance in April (e.g. Yum Brands (owner of KFC and Pizza Hut) and AMC (cinema operators))—companies struggling to maintain liquidity due to a collapse in revenues.

The data from Europe mirrors the situation in the US: European investment grade-rated companies raised $83.2 billion in April, 2020, reaching levels not seen since 20093.

b, Corporate loan markets

US Corporate lending (commercial and industrial loans) skyrocketed in March and April of 2020: Exhibit 2: Percentage change to previous month in volume of commercial and industrial loans in the U.S4.

Corporate loans typically increase when the economy is thriving. The current surge is due to companies striving to maintain liquidity due to the COVID-19 outbreak. Similarly, data from Europe shows that volumes of new euro-denominated revolving loans and overdraft facilities to non-financial corporations increased substantially in March:

Corporate loans typically increase when the economy is thriving. The current surge is due to companies striving to maintain liquidity due to the COVID-19 outbreak. Similarly, data from Europe shows that volumes of new euro-denominated revolving loans and overdraft facilities to non-financial corporations increased substantially in March:

Exhibit 3: Volumes of new euro-denominated revolving loans and overdraft to euro area non-financial corporations (EUR billions)5

The current surge in corporate lending in the euro area is also supported by very low interest rates on new euro-denominated loans (revolving loans and overdrafts) to euro area non-financial corporations – lending rates of approximately 2% in March 2020.

Exhibit 4: Monetary Financial Institution (MFI) interest rates on new euro-denominated loans (revolving loans and overdrafts) to euro area non-financial corporations, percentages per annum6

The current surge in corporate lending in the euro area is also supported by very low interest rates on new euro-denominated loans (revolving loans and overdrafts) to euro area non-financial corporations – lending rates of approximately 2% in March 2020.

Exhibit 4: Monetary Financial Institution (MFI) interest rates on new euro-denominated loans (revolving loans and overdrafts) to euro area non-financial corporations, percentages per annum6

In many countries, banks have been encouraged to loosen their lending criteria via Government guarantee programs, helping to inject liquidity into the economy. The Government of Italy, for example, has offered a €500 billion guarantee program (including guarantees via SACE Simest – the Italian export credit agency) to banks, thereby de-risking lending activity to banks.7

In many countries, banks have been encouraged to loosen their lending criteria via Government guarantee programs, helping to inject liquidity into the economy. The Government of Italy, for example, has offered a €500 billion guarantee program (including guarantees via SACE Simest – the Italian export credit agency) to banks, thereby de-risking lending activity to banks.7

Moreover, the rejection rate by banks for loans to euro area enterprises continued to increase: Exhibit 5: Changes in the Rejection Rate for Loans to Enterprises8 It is interesting to note that in the Visegrad Four countries, lending has been much more subdued. Exhibit 6: Outstanding loans amount to non-financial corporations in Visegrad countries9

Statistics are available only until March, perhaps April will show more of an increase. Depreciation of Central European currencies is perhaps a reason there was little if any growth in euro-denominated amounts.

Statistics are available only until March, perhaps April will show more of an increase. Depreciation of Central European currencies is perhaps a reason there was little if any growth in euro-denominated amounts.

c, Motivation for Borrowers to take on New Indebtedness.

From our exposure to debt markets, we see the following motivations for new indebtedness: First, there are the “losers” from the coronavirus, such as the tourism and automotive, which have seen a dramatic decline in revenues, which face ongoing future uncertainty, and need to create cash or credit reserves to weather the storm. Second, there are also a few “winners” from the coronavirus, such as certain online retailers, pharma companies, etc. which need capital to fund expansion.

A third motivation is simply to lock into interest rates that are incredibly cheap by historic standards. The “take home” message for any owner of a company reading this articles is that now is a good time to raise debt. Interest rates are low, and liquidity helps reduce risk in these highly uncertain times, and allows companies to take advantage of opportunities in this coronavirus environment, especially if the coronavirus triggers a prolonged recession.

1 SIFMA, https://www.sifma.org/resources/research/us-corporate-bond-issuance/

2 ibid

3 Companies tap bond markets at record rate to ride out coronavirus downturn by Reuters

4Fred, Commercial and Industrial Loans, All Commercial Banks

5 ECB, Statistical Data Warehouse

6 ECB, Statistical Data Warehouse

7 The fiscal response to the economic fallout from the coronavirus, https://www.bruegel.org/publications/datasets/covid-national-dataset/

8 The euro area bank lending survey, First quarter of 2020

9 ECB, Statistical Data Warehouse

2 ibid

3 Companies tap bond markets at record rate to ride out coronavirus downturn by Reuters

4Fred, Commercial and Industrial Loans, All Commercial Banks

5 ECB, Statistical Data Warehouse

6 ECB, Statistical Data Warehouse

7 The fiscal response to the economic fallout from the coronavirus, https://www.bruegel.org/publications/datasets/covid-national-dataset/

8 The euro area bank lending survey, First quarter of 2020

9 ECB, Statistical Data Warehouse