On March 4, 2021, Fed Chair Jerome Powell announced “inflation will pick up in the coming months but that it would likely prove temporary and not enough for the Fed to alter its record-low interest rate policies.”

Sure enough, on June 10, 2021, the US Department of Labor announced that Consumer Price Inflation (CPI) reached 5% in May1, the highest rate since 2008. However, the US Fed maintains that this inflation spike is “temporary” in nature.

In this article, we examine (a) use of the word “temporary” by US Government officials in the past; (b) market reaction to the June 10 announcement; and (c) risks going forward.

a, Use of the word “temporary” by US Government officials

Milton Friedman once said “nothing is so permanent as a temporary government program.” His cynicism is not without foundation. Below I cite two of the most blatant and consequential misuses of the word “temporary”:

It seems that markets, for the time being, are taking Chairman Powell’s comments at face value; in other words, they seem to believe that inflation will subside. In support of this thesis, I provide two economic indicators:

1. After the June 10th announcement, 10 year treasuries notched lower by over 10 basis points, to 1.43%– not the behavior of a market expecting a rise in inflation.

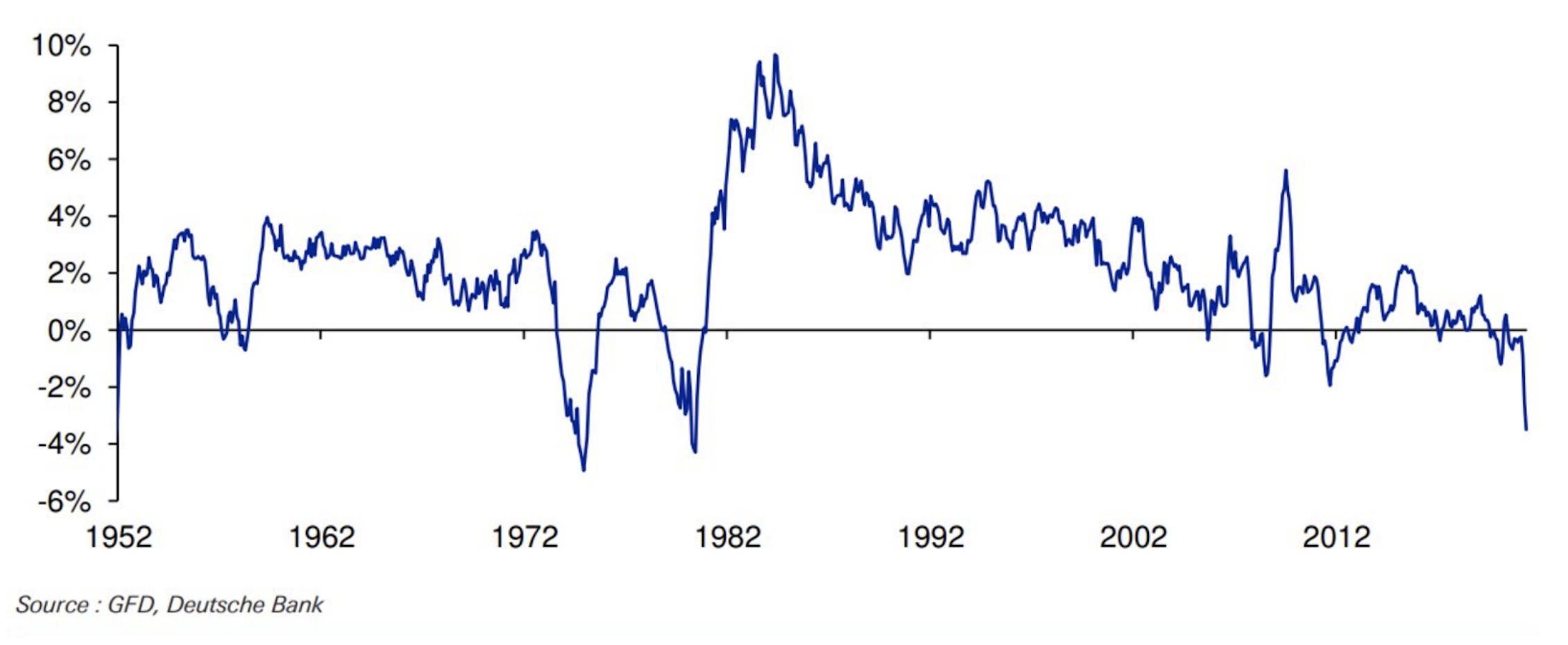

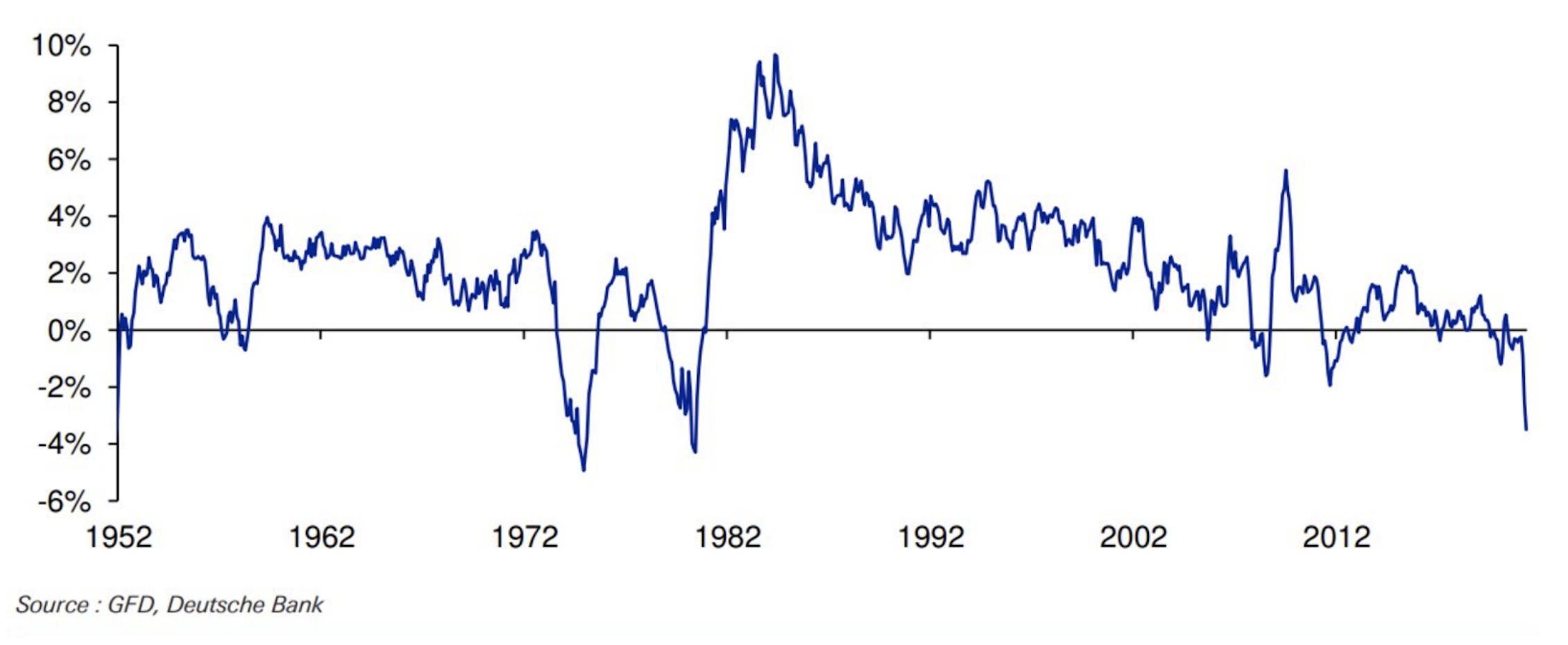

2. The price of gold has moved down by more than 2% since June 10. Gold prices normally go up when inflation expectations arise, especially when real yields are negative—and real yield are now lower than they have been in a long time:

Exhibit 1: Real 10 year US Treasury Yields from 1952 to 2021

To my mind, the only plausible explanation why Treasury yields and gold prices have declined is that markets believe that the inflation spike announced June 10 is temporary.

c, Risks going forward

The announcement of a new statistic or an article by an influential economist could change market sentiment suddenly, and everything from Treasury yields to the price of gold could swing very rapidly. In other words, there could come a moment of truth or inflection point when markets suddenly react to past accumulation of data. This could make market reactions all the more sudden and extreme—damaging to everything from bond and equity valuations to mortgage rates housing starts.

Meanwhile, the debate among economists about whether today’s inflation is temporary rages on. Influential economists, such as David Rosenberg, argue very persuasively that deflation is a much bigger risk than inflation4. Nevertheless, as I have stated in an earlier article “Inflation or Deflation”, I believe on balance, that inflation is the larger risk. There are a number of powerful structural changes occuring in the world economy:

As former US Secretary of Treasury Larry Summers recently said: “We’re taking very substantial risks on the inflation side. The sense of…complacency being projected by the economic policymakers, that this is all something that can easily be managed, is misplaced.5”

In this article, we examine (a) use of the word “temporary” by US Government officials in the past; (b) market reaction to the June 10 announcement; and (c) risks going forward.

a, Use of the word “temporary” by US Government officials

Milton Friedman once said “nothing is so permanent as a temporary government program.” His cynicism is not without foundation. Below I cite two of the most blatant and consequential misuses of the word “temporary”:

- On August 15, 1971, Nixon announced the “temporary suspension” of gold convertibility, thereby ending the Bretton Woods agreement. To this day, gold convertibility remains suspended. A rather long “temporary”.

- To combat the Great Financial Crisis of 2008, the US Fed announced the QE12 program, in November 2008, once again, as a temporary measure. Since then, there has been a QE2, and a QE3; we now seem to be in a “QE permanent” mode, with the Fed constantly adding USD 80-120 billion per month to its balance sheet. The Fed balance sheet just recently surpassed the USD 8 trillion mark; the amount doubled since January 2020.3

It seems that markets, for the time being, are taking Chairman Powell’s comments at face value; in other words, they seem to believe that inflation will subside. In support of this thesis, I provide two economic indicators:

1. After the June 10th announcement, 10 year treasuries notched lower by over 10 basis points, to 1.43%– not the behavior of a market expecting a rise in inflation.

2. The price of gold has moved down by more than 2% since June 10. Gold prices normally go up when inflation expectations arise, especially when real yields are negative—and real yield are now lower than they have been in a long time:

Exhibit 1: Real 10 year US Treasury Yields from 1952 to 2021

To my mind, the only plausible explanation why Treasury yields and gold prices have declined is that markets believe that the inflation spike announced June 10 is temporary.

c, Risks going forward

The announcement of a new statistic or an article by an influential economist could change market sentiment suddenly, and everything from Treasury yields to the price of gold could swing very rapidly. In other words, there could come a moment of truth or inflection point when markets suddenly react to past accumulation of data. This could make market reactions all the more sudden and extreme—damaging to everything from bond and equity valuations to mortgage rates housing starts.

Meanwhile, the debate among economists about whether today’s inflation is temporary rages on. Influential economists, such as David Rosenberg, argue very persuasively that deflation is a much bigger risk than inflation4. Nevertheless, as I have stated in an earlier article “Inflation or Deflation”, I believe on balance, that inflation is the larger risk. There are a number of powerful structural changes occuring in the world economy:

- China is no longer the pool of almost infinite cheap labor. It is facing a demographic implosion of its own. (Some of my Central European clients tell me that their labor costs are less than those in China!)

- We are experiencing bottlenecks in many areas, from computer chips to shipping containers, resulting in price pressures.

- The world breaking down into separate US, Chinese and perhaps European supply chains diminishes efficiency and contributes to inflation.

- The goal to become carbon neutral has strained mineral resources, causing dramatic spikes in commodities, from copper to nickel. According to The Economist, the top 5 minerals used in green vehicle production have enjoyed a 139% price surge over the past year, despite less than 10% of the required investments having been made to date.

- Savings are at a historic high, with many economists predicting a post-pandemic purchasing binge, resulting in an increase in velocity of money.

As former US Secretary of Treasury Larry Summers recently said: “We’re taking very substantial risks on the inflation side. The sense of…complacency being projected by the economic policymakers, that this is all something that can easily be managed, is misplaced.5”

1https://www.wsj.com/articles/us-inflation-consumer-price-index-may-2021-11623288303

2QE = Quantitative Easing

3https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

4https://mx1.europhoenix.com/service/home/~/Rosenberg%20Research.pdf?auth=co&loc=en_US&id=1220125&part=2

5https://www.coindesk.com/videos/recent-videos/larry-summers-i-think-were-taking-very-substantial-risks-on-the-inflation-side

2QE = Quantitative Easing

3https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

4https://mx1.europhoenix.com/service/home/~/Rosenberg%20Research.pdf?auth=co&loc=en_US&id=1220125&part=2

5https://www.coindesk.com/videos/recent-videos/larry-summers-i-think-were-taking-very-substantial-risks-on-the-inflation-side