The US economy is powering forward with almost 5% GDP growth as per the last measured quarter. Global GDP growth is in the range of 3%.

This article will explore whether we are reaching (or have already passed) a tipping point. I will look first at some of the tailwinds the global economy experienced since 1990, then some of the headwinds we are beginning to experience this decade.

Some of the tailwinds over the past few decades:

Just to finish this article on a more positive note — while the world is going through a very rough patch, I offer a few reasons for not losing hope:

Some of the tailwinds over the past few decades:

- The end of the cold war in 1990 gave the world a peace dividend.

- Globalization, including bringing cheap (mostly Chinese) labor into the global economy, kept inflation down and contributed to low consumer prices.

- Increasing levels of trade allowed all countries to exploit their relative advantages, increasing standards of living.

- Levering up balance sheets, from initially low levels of debt, contributed to GDP growth. From 1990-2008, the leveraging happened mostly in Europe and the US; by the time of the 2008 financial crisis, the Chinese economy was the only major relatively unlevered economy. Perhaps fortunately for the world, the Chinese began rapidly ramping up their debt in 2008, triggering importation of vast amounts of commodities, machinery and luxury goods, acting as an engine of global growth.

- Interest rates have declined steadily since the early 1980’s right through to the early 2020’s. This has helped keep debt service costs in line despite burgeoning debt.

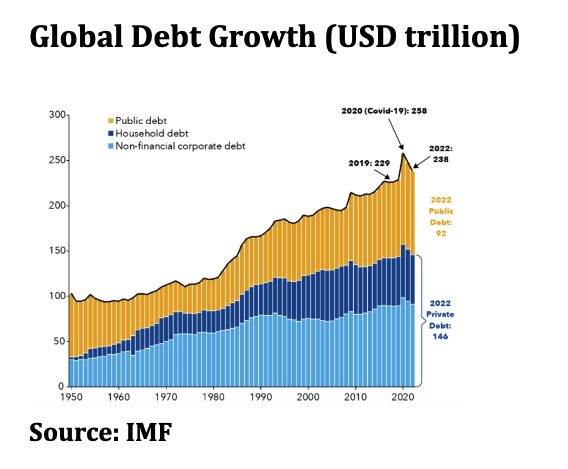

- Global debt is growing out of control and is approaching $250 trillion; the public debt portion is increasing particularly rapidly (see below).

Very few Governments pay down debt. Austerity and growth restraint are unpopular. Inflating it away seems to be the strategy of choice. This is partly why inflation is so baked into our system. In some countries debt service is squeezing out other budgetary items, whereas in most countries growth in interest coverage costs swells the deficit and accelerates national debt accumulation. Compounding interest is an exponential curve—we are approaching the steeper part of the curve. All of the above is detrimental to growth. China has become one of the most over-levered nations on earth, overbuilt with real estate and infrastructure, hence the Chinese economy is likely to be a much weaker engine of global growth in the coming decade.

Very few Governments pay down debt. Austerity and growth restraint are unpopular. Inflating it away seems to be the strategy of choice. This is partly why inflation is so baked into our system. In some countries debt service is squeezing out other budgetary items, whereas in most countries growth in interest coverage costs swells the deficit and accelerates national debt accumulation. Compounding interest is an exponential curve—we are approaching the steeper part of the curve. All of the above is detrimental to growth. China has become one of the most over-levered nations on earth, overbuilt with real estate and infrastructure, hence the Chinese economy is likely to be a much weaker engine of global growth in the coming decade.

- Climate change seems to be accelerating, with increasing numbers of hurricanes, droughts, forest fires etc., making many types of risk uninsurable. Climate-induced natural disasters have tremendous economic cost, and reduce many people to poverty. Governments are forced to raise debt to alleviate hardship of those affected, and to fund reconstruction.

- A unipolar world and Pax Americana have given way to a multipolar world, bringing political instability. Not only does this put a damper on global trade and investment flows, we now have two major conflicts raging (Ukraine, Gaza), a number of smaller ones, and at least one other potential major conflict on the horizon, namely Taiwan. War contributes to poverty, waves of refugees, instability, populism, rising military spending, etc. An ever-increasing portion of the world’s population is living in war zones.

- Demographics. Throughout most of the world, every working person will have to support more and more retirees over the coming decades.

- Populism is spreading. It contributes to polarization of societies, diminution of dialogue, decisions being made on ideological lines, resulting in sub-optimal economic management.

Just to finish this article on a more positive note — while the world is going through a very rough patch, I offer a few reasons for not losing hope:

- 1. Innovation and Technology. To illustrate with a dramatic example: imagine that at some point in the future, we were suddenly to have cheap fusion energy. That would be a development of such magnitude— reducing energy costs, increasing standards of living and ushering in a new era of sustainable growth. Closer to current reality: there are thousands of smaller innovations in the world every year, which have a similar beneficial cumulative effect. While technology poses challenges, it is the hope of the future.

- 2. Good governance. Quality of decisions, in governments and corporations, can make the difference between superior performance and default. I am inspired by the recent electoral victory in Poland. Of much larger impact for the world will be the upcoming US elections.