Business owners often wonder: if they were to sell their business, what would they do with their money?

To answer this question an understanding of passive vs. active investing would be helpful. We start by (a) defining terms; (b) analysing some relevant statistics; (c) looking at some implications of the rise of passive investing; and (d) some concluding comments.

a, Defining Terms

Passive investing first became part of the American investors’ portfolio in 1976, when John Bogle, then CEO of Vanguard, enabled retail investors to buy a basket of stocks that represented the market—without buying every single stock. A revolutionary idea at the time!

While active investing is the art of picking stock in the hope of beating the market, passive investing is a long-term strategy that removes the investor from the need to pick stocks. Instead, he or she can buy a fund (e.g. an Exchange Traded Fund, commonly referred to as an ETF or a mutual fund). For example, there are ETF’s that reflect the performance of the S&P 5000, or the Russell 2000, emerging market indices, Junior Gold Miners, etc. Sometimes the weightings are tied to the weightings of the stocks within the index, sometimes the fund manager decides on weightings. The investor must still decide what asset class he or she wishes to purchase, and then buy into a passive investment vehicle. The managers of the vehicle purchase and sell the individual securities, to make sure they conform to the policy of the fund. The investor still has a large responsibility here, because choosing an asset class (e.g. commodities, emerging markets, precious metals, etc. ) may have more effect on returns than stock picks.

While active investing is the art of picking stocks in the hope of beating the market, passive investing is an “investment strategy that aims to maximize returns by minimizing buying and selling. Index investing is a common passive investing strategy whereby investors purchase a representative benchmark, such as the S&P 500 index, and hold it over a long time horizon”1.

b, Relevant Statistics

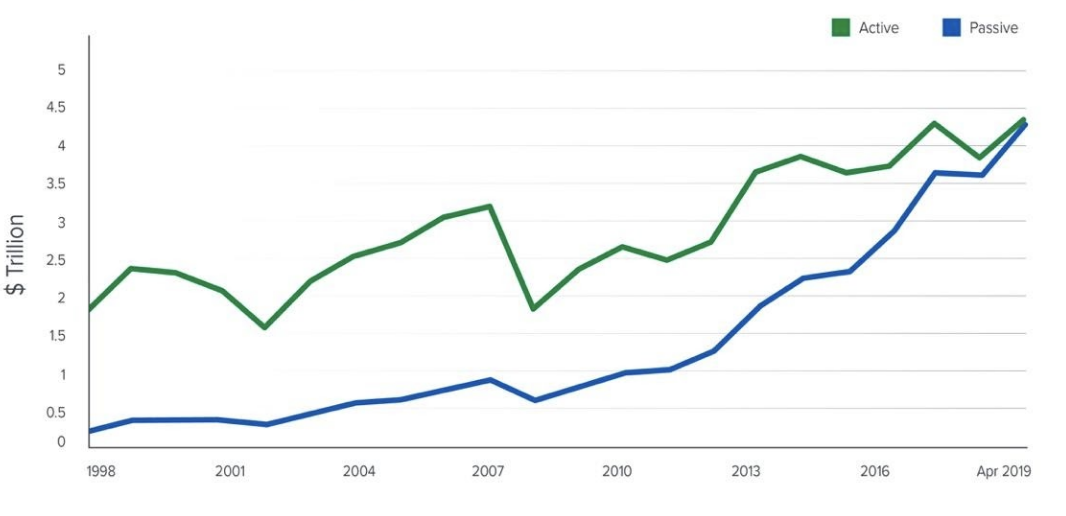

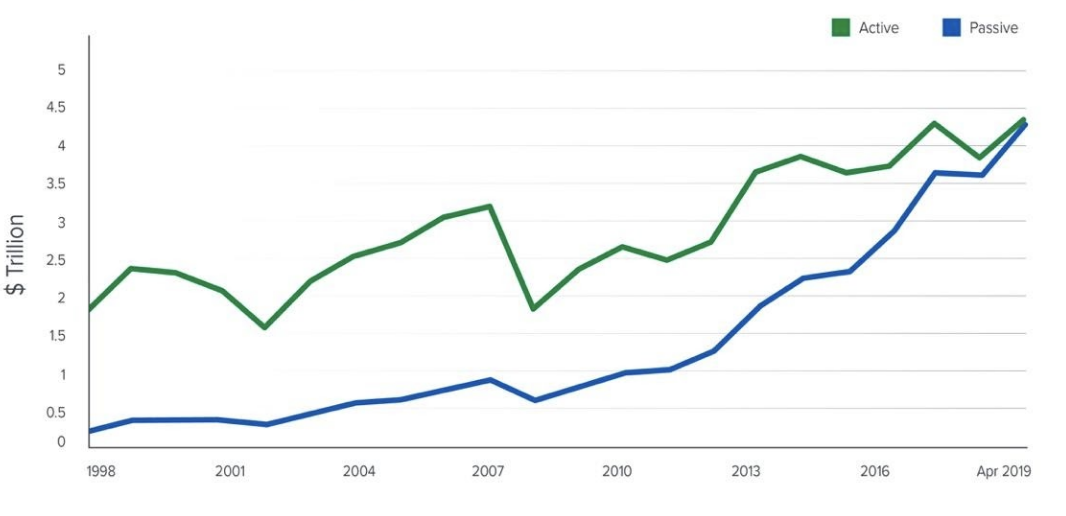

In September 2019, passive equity funds overtook active funds in the United States for the first time.

Exhibit 1: U.S Equity Funds Active vs Passive Assets from 1998 to mid-2019 Even activist hedge funds managers, allocated som $50 billion to index funds in 20172–typically where an ETF may play a niche role within an activist strategy.

Even activist hedge funds managers, allocated som $50 billion to index funds in 20172–typically where an ETF may play a niche role within an activist strategy.

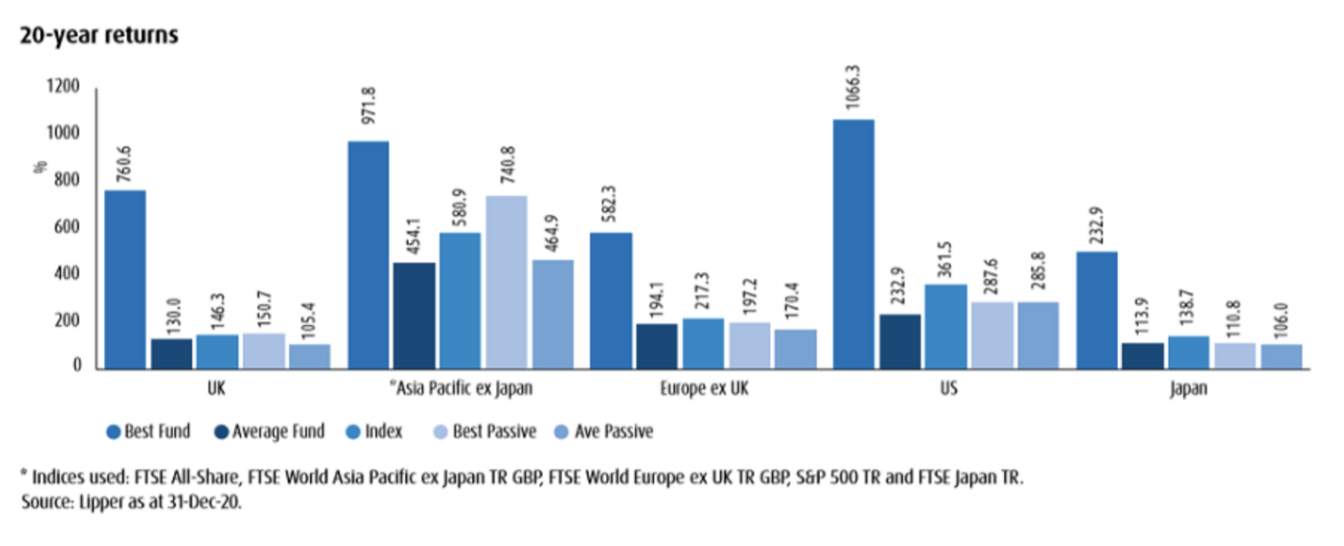

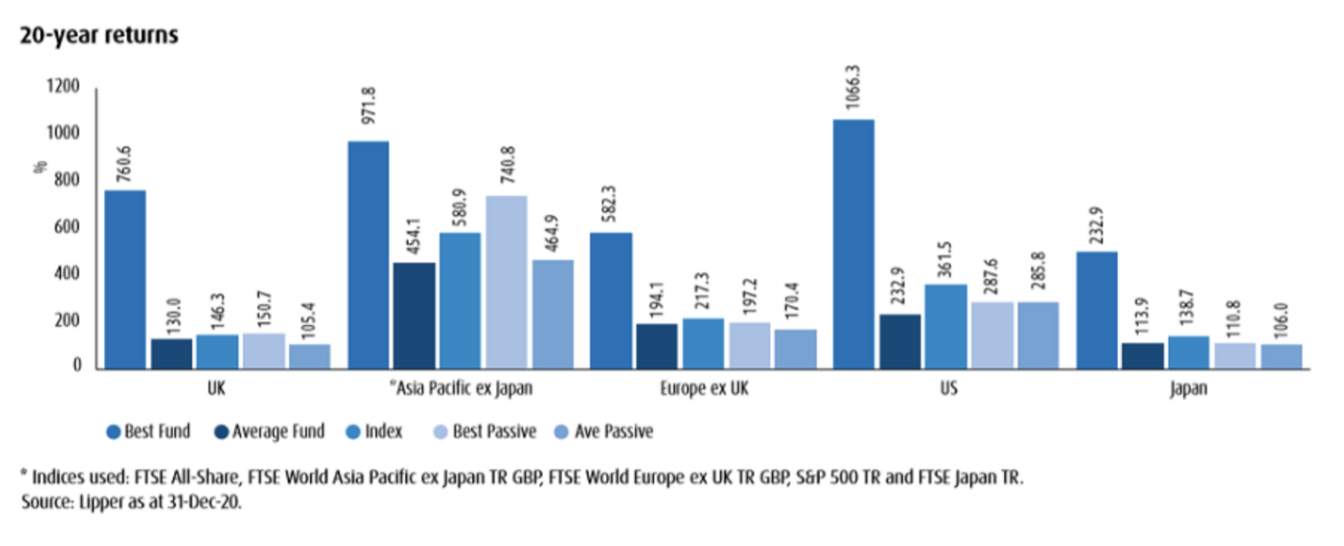

In today’s low yield world, paying even a percentage point or two of assets deployed on management fees may have an enormous effect on net portfolio returns. This is the main reason why passive investing outperforms active investing more often than not. According to Morningstar, in 2019 investors saved $6 billion in fees by investing passively.3 Only 23% of active funds topped the average of their passive rivals over a 10-year period ending in June 2019. As the chart below shows, if you invest in the best activist fund, you outperform passive investing by a country mile, but if you are invested in an average activist fund, passive investment vehicles will outperform.

Exhibit 2: 20-year return comparison of active and passive fund in different areas4 The passive asset management industry is largely dominated by Blackrock and the Vanguard Group which had a combined asset under management of about $13.6 trillion in 2019. In March 2021, BlackRock hit an all-time high with $9.01 trillion in Assets Under Management (AUN)5:

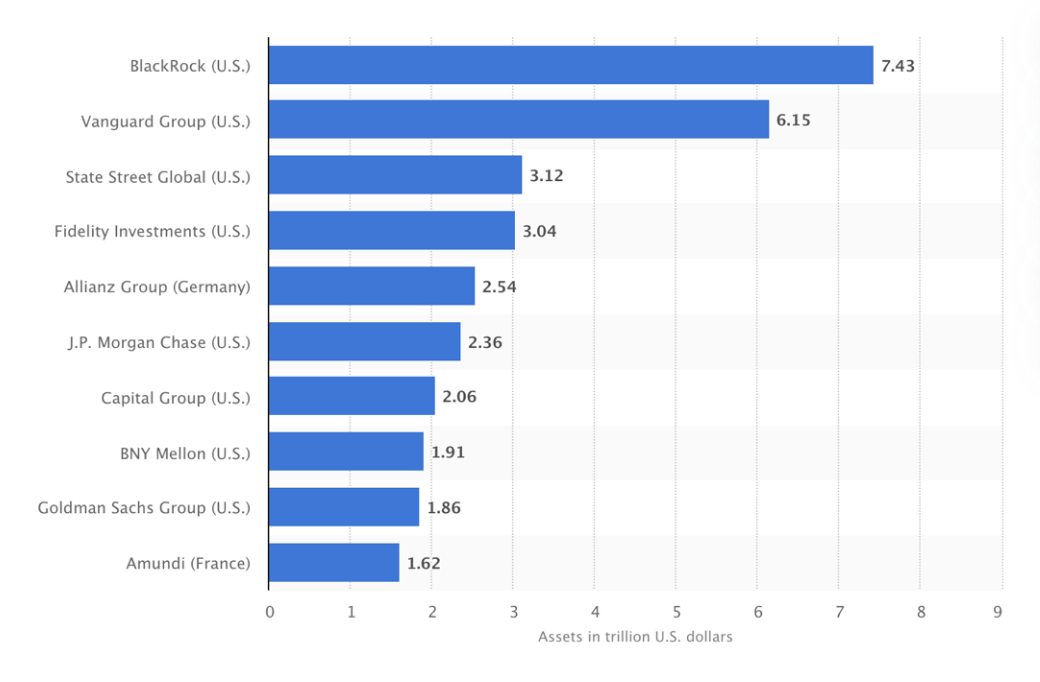

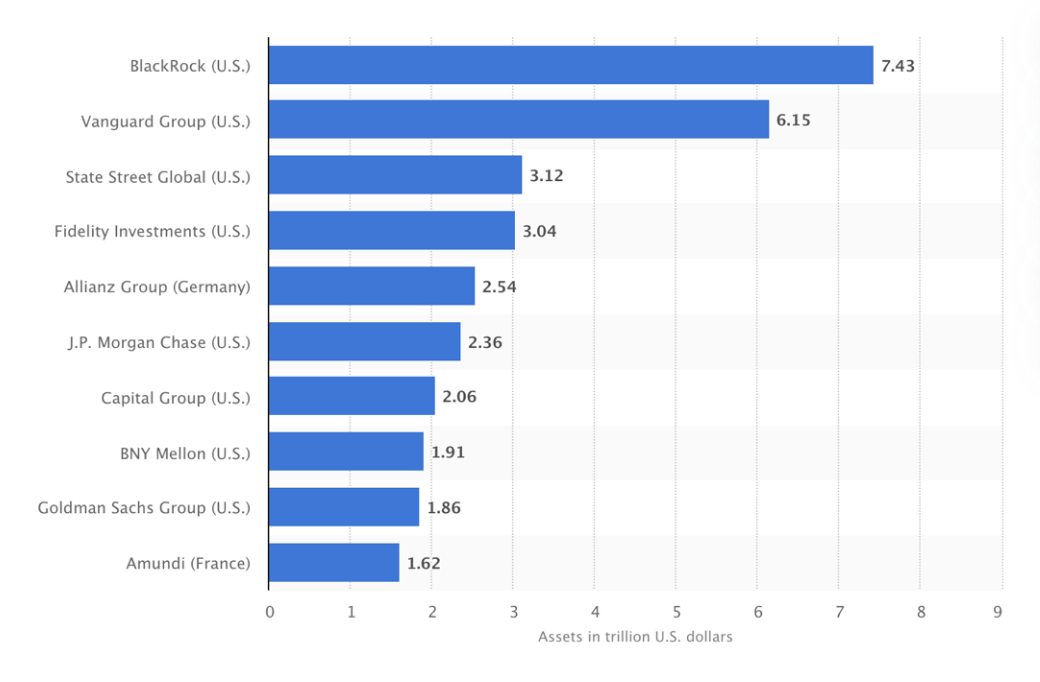

The passive asset management industry is largely dominated by Blackrock and the Vanguard Group which had a combined asset under management of about $13.6 trillion in 2019. In March 2021, BlackRock hit an all-time high with $9.01 trillion in Assets Under Management (AUN)5:

Exhibit 3: Largest asset management companies worldwide in 2019, by managed assets (in trillion USD)6 The trend towards passive management is expected to grow further:

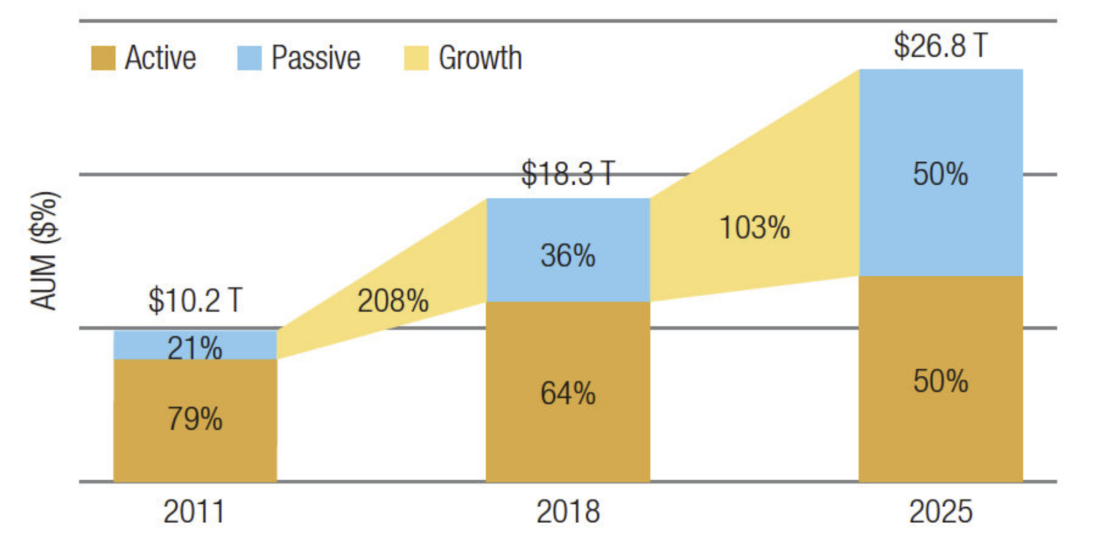

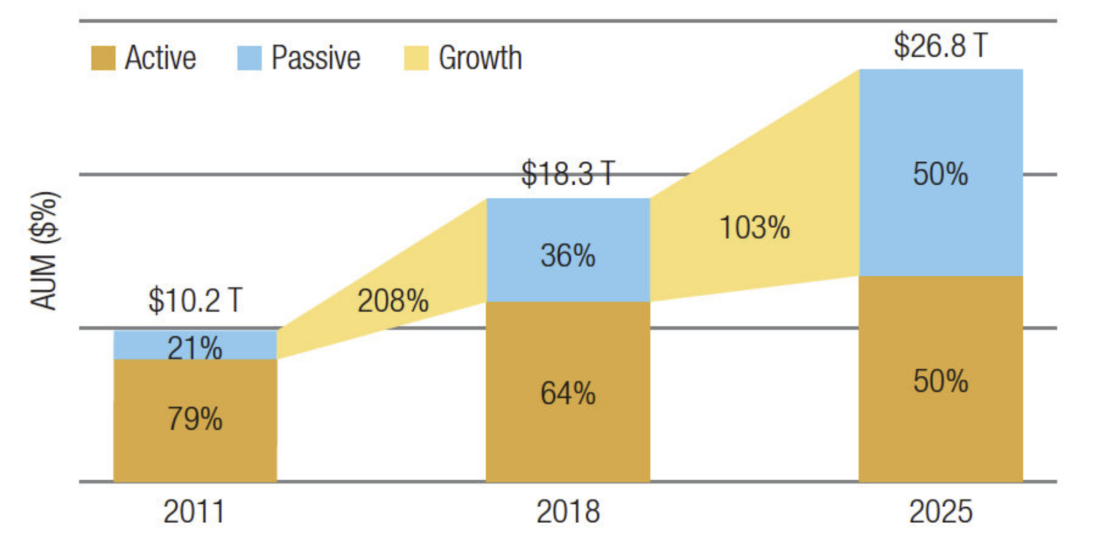

The trend towards passive management is expected to grow further:

Exhibit 4: US Mutual Fund industry assets: Actual and projected active/passive split7

c, Some implications of the rise of passive investing

Imagine if every publically listed company were 100% owned by truly passive investors! There would be nobody to exercise shareholders’ rights and provide corporate governance. In this respect, you might say that passive investors are ‘free riders’ of the financial system.

However, there is some evidence that passive managers are becoming more active in environmental, social, and governance decisions within their holdings8.

Nevertheless, when the “Big Three” (BlackRock, Vanguard, and State Street) are the largest shareholders in 88 percent of S&P 500 firms9, it raises systemic questions as to whether these entities are “too big to fail”. One also has to wonder how effectively they can exercise corporate governance, each being invested in many hundred of entities.

d, Concluding Comments

Every investor has to decide on the optimal mix between passive and active investing, depending on knowledge of finance and markets, time available, etc. Practically speaking, it is a relief for most individuals that relatively good returns may be reached (e.g. outperforming most active investors!) by investing in passive funds that (i) save time compared to active stock picking and (ii) save money compared to investing in active funds. However, if your objective is to beat the market, make your own investment decisions or seek out the best possible active manager, and take your chances.

a, Defining Terms

Passive investing first became part of the American investors’ portfolio in 1976, when John Bogle, then CEO of Vanguard, enabled retail investors to buy a basket of stocks that represented the market—without buying every single stock. A revolutionary idea at the time!

While active investing is the art of picking stock in the hope of beating the market, passive investing is a long-term strategy that removes the investor from the need to pick stocks. Instead, he or she can buy a fund (e.g. an Exchange Traded Fund, commonly referred to as an ETF or a mutual fund). For example, there are ETF’s that reflect the performance of the S&P 5000, or the Russell 2000, emerging market indices, Junior Gold Miners, etc. Sometimes the weightings are tied to the weightings of the stocks within the index, sometimes the fund manager decides on weightings. The investor must still decide what asset class he or she wishes to purchase, and then buy into a passive investment vehicle. The managers of the vehicle purchase and sell the individual securities, to make sure they conform to the policy of the fund. The investor still has a large responsibility here, because choosing an asset class (e.g. commodities, emerging markets, precious metals, etc. ) may have more effect on returns than stock picks.

While active investing is the art of picking stocks in the hope of beating the market, passive investing is an “investment strategy that aims to maximize returns by minimizing buying and selling. Index investing is a common passive investing strategy whereby investors purchase a representative benchmark, such as the S&P 500 index, and hold it over a long time horizon”1.

b, Relevant Statistics

In September 2019, passive equity funds overtook active funds in the United States for the first time.

Exhibit 1: U.S Equity Funds Active vs Passive Assets from 1998 to mid-2019

Even activist hedge funds managers, allocated som $50 billion to index funds in 20172–typically where an ETF may play a niche role within an activist strategy.

Even activist hedge funds managers, allocated som $50 billion to index funds in 20172–typically where an ETF may play a niche role within an activist strategy.In today’s low yield world, paying even a percentage point or two of assets deployed on management fees may have an enormous effect on net portfolio returns. This is the main reason why passive investing outperforms active investing more often than not. According to Morningstar, in 2019 investors saved $6 billion in fees by investing passively.3 Only 23% of active funds topped the average of their passive rivals over a 10-year period ending in June 2019. As the chart below shows, if you invest in the best activist fund, you outperform passive investing by a country mile, but if you are invested in an average activist fund, passive investment vehicles will outperform.

Exhibit 2: 20-year return comparison of active and passive fund in different areas4

The passive asset management industry is largely dominated by Blackrock and the Vanguard Group which had a combined asset under management of about $13.6 trillion in 2019. In March 2021, BlackRock hit an all-time high with $9.01 trillion in Assets Under Management (AUN)5:

The passive asset management industry is largely dominated by Blackrock and the Vanguard Group which had a combined asset under management of about $13.6 trillion in 2019. In March 2021, BlackRock hit an all-time high with $9.01 trillion in Assets Under Management (AUN)5:Exhibit 3: Largest asset management companies worldwide in 2019, by managed assets (in trillion USD)6

The trend towards passive management is expected to grow further:

The trend towards passive management is expected to grow further:Exhibit 4: US Mutual Fund industry assets: Actual and projected active/passive split7

c, Some implications of the rise of passive investing

Imagine if every publically listed company were 100% owned by truly passive investors! There would be nobody to exercise shareholders’ rights and provide corporate governance. In this respect, you might say that passive investors are ‘free riders’ of the financial system.

However, there is some evidence that passive managers are becoming more active in environmental, social, and governance decisions within their holdings8.

Nevertheless, when the “Big Three” (BlackRock, Vanguard, and State Street) are the largest shareholders in 88 percent of S&P 500 firms9, it raises systemic questions as to whether these entities are “too big to fail”. One also has to wonder how effectively they can exercise corporate governance, each being invested in many hundred of entities.

d, Concluding Comments

Every investor has to decide on the optimal mix between passive and active investing, depending on knowledge of finance and markets, time available, etc. Practically speaking, it is a relief for most individuals that relatively good returns may be reached (e.g. outperforming most active investors!) by investing in passive funds that (i) save time compared to active stock picking and (ii) save money compared to investing in active funds. However, if your objective is to beat the market, make your own investment decisions or seek out the best possible active manager, and take your chances.

1https://www.investopedia.com/terms/p/passiveinvesting.asp

2https://www.investopedia.com/news/active-vs-passive-investing/#:~:text=Passive%20Investing%3A%20An%20Overview&text=Active%20investing%20requires%20a%20hands,funds%20or%20other%20mutual%20funds

3https://www.morningstar.com/lp/annual-us-fund-fee-study?utm_source=corp_comm&utm_medium=referral

4https://www.trustnet.com/news/5053845/five-key-trends-in-passive-investing-that-bmos-watching

5https://www.pionline.com/money-management/blackrock-tops-9-trillion-record-inflows

6https://www.statista.com/statistics/431790/leading-asset-management-companies-worldwide-by-assets/

7https://www.scienceofinvestment.com/editorial/news-review/

8https://www.morningstar.com/content/dam/marketing/shared/pdfs/Research/Morningstar-Passive-Active-Stewardship.pdf

9« Hidden power of the Big Three? Passive index funds, re-concentration of corporate ownership, and new financial risk » by Cambridge University Press: 25 April 2017

2https://www.investopedia.com/news/active-vs-passive-investing/#:~:text=Passive%20Investing%3A%20An%20Overview&text=Active%20investing%20requires%20a%20hands,funds%20or%20other%20mutual%20funds

3https://www.morningstar.com/lp/annual-us-fund-fee-study?utm_source=corp_comm&utm_medium=referral

4https://www.trustnet.com/news/5053845/five-key-trends-in-passive-investing-that-bmos-watching

5https://www.pionline.com/money-management/blackrock-tops-9-trillion-record-inflows

6https://www.statista.com/statistics/431790/leading-asset-management-companies-worldwide-by-assets/

7https://www.scienceofinvestment.com/editorial/news-review/

8https://www.morningstar.com/content/dam/marketing/shared/pdfs/Research/Morningstar-Passive-Active-Stewardship.pdf

9« Hidden power of the Big Three? Passive index funds, re-concentration of corporate ownership, and new financial risk » by Cambridge University Press: 25 April 2017