M&A activity, both globally and in Central Europe, declined dramatically in Q1 2020

:

Exhibit 1. – Total global volume of announced and closed transactions1(USD Billion)

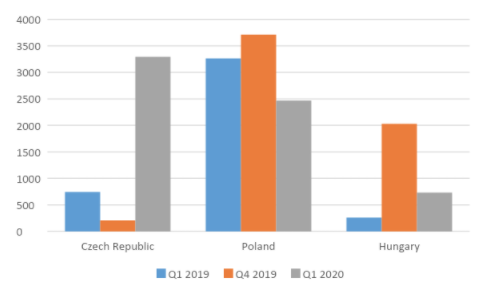

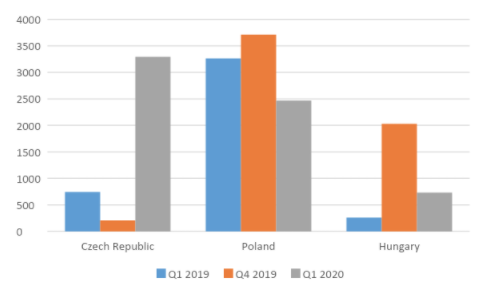

Exhibit 2. – M&A Activity in selected CEE countries, million USD 2

Exhibit 2. – M&A Activity in selected CEE countries, million USD 2

While the above data is reported quarterly, most of the downdraft was experienced in March. In other words, Covid-19 is causing a dramatic decline in M&A activity.

This article will (a) first analyze reasons for the dramatic decline; (b) attempt to deal with the issue of when there might be a recovery in M&A transactions; and (c) make some predictions as to how a partial mid-term recovery of M&A activity may occur.

Let’s analyze this uncertainty around M&A. Even if Covid-19 were to miraculously disappear tomorrow, there would still be enormous uncertainly surrounding the economic effects of the virus: would it be a fast V-shaped recovery, a slow U-shaped recovery, or an L-shaped stagnation? How fast will unemployment recover? What stresses will be there on the banking system? How many countries will go into default? Will the globalization process continue forward or in reverse? What will happen to supply chains? There will likely be entirely unforeseeable domino effects. We are only scratching the surface here in terms of the massive uncertainty, even under a scenario of Covid-19 stopping immediately. But we know that Covid-19 will continue for many more months to come. It is only now beginning to hit high-density low-income emerging economies like Brazil, Indonesia, India, etc. New hotspots are emerging in developed countries. There is the possibility of re-infection, mutations, etc., uncertainty as to when a vaccine will emerge, and how effective it will be against Covid-19, as well as possible mutations.

An M&A transaction requires a buyer and a seller. Sellers always tend to look at the value of their company optimistically, sellers take a much more cautious approach. So with the uncertainty around Covid-19and the economic outlook, the expectations gap between buyer and seller is perhaps wider than ever before. Most would-be sellers have no intention of accepting distress-type valuation, and would rather wait for markets to recover, while in most cases buyers would insist on valuations approaching distressed levels. Hence the main reason for the dramatic decline in M&A.

There are at least two other major reasons for virtual cessation of M&A activity. First, lack of liquidity. Most potential acquirors are themselves facing reduced cashflow, and need to keep powder dry to provision for the uncertainty. Second, bank financing has become much more challenging to arrange. Issuance of new bank debt, particularly for SME’s and in Central Europe, is also greatly diminished.

So where is this money likely to go?

Exhibit 2. – M&A Activity in selected CEE countries, million USD 2

Exhibit 2. – M&A Activity in selected CEE countries, million USD 2

While the above data is reported quarterly, most of the downdraft was experienced in March. In other words, Covid-19 is causing a dramatic decline in M&A activity.

This article will (a) first analyze reasons for the dramatic decline; (b) attempt to deal with the issue of when there might be a recovery in M&A transactions; and (c) make some predictions as to how a partial mid-term recovery of M&A activity may occur.

- (a) Reasons for the Dramatic Decline in M&A Activity

Let’s analyze this uncertainty around M&A. Even if Covid-19 were to miraculously disappear tomorrow, there would still be enormous uncertainly surrounding the economic effects of the virus: would it be a fast V-shaped recovery, a slow U-shaped recovery, or an L-shaped stagnation? How fast will unemployment recover? What stresses will be there on the banking system? How many countries will go into default? Will the globalization process continue forward or in reverse? What will happen to supply chains? There will likely be entirely unforeseeable domino effects. We are only scratching the surface here in terms of the massive uncertainty, even under a scenario of Covid-19 stopping immediately. But we know that Covid-19 will continue for many more months to come. It is only now beginning to hit high-density low-income emerging economies like Brazil, Indonesia, India, etc. New hotspots are emerging in developed countries. There is the possibility of re-infection, mutations, etc., uncertainty as to when a vaccine will emerge, and how effective it will be against Covid-19, as well as possible mutations.

An M&A transaction requires a buyer and a seller. Sellers always tend to look at the value of their company optimistically, sellers take a much more cautious approach. So with the uncertainty around Covid-19and the economic outlook, the expectations gap between buyer and seller is perhaps wider than ever before. Most would-be sellers have no intention of accepting distress-type valuation, and would rather wait for markets to recover, while in most cases buyers would insist on valuations approaching distressed levels. Hence the main reason for the dramatic decline in M&A.

There are at least two other major reasons for virtual cessation of M&A activity. First, lack of liquidity. Most potential acquirors are themselves facing reduced cashflow, and need to keep powder dry to provision for the uncertainty. Second, bank financing has become much more challenging to arrange. Issuance of new bank debt, particularly for SME’s and in Central Europe, is also greatly diminished.

- (b) When might there by a Recovery in M&A Transactions

- (c) Where might there be a Partial Recovery in M&A Activity in the Medium-term?

So where is this money likely to go?

- 1. Distressed assets. Typically, it usually takes a number of months for the “penny to fall”, for owners of distressed enterprises to realize that there is perhaps no way out, other than a distress sale, or for banks to foreclose and then begin disposing of assets. The number of assets and companies sold under distress is beginning with a trickle, and will end up a flood.

- 2. Winners from Covid-19. There may be more winners than the reader may realize; just to list a few potential winners:

- a. The most obvious winner may be Amazon, which have announced plans to hire some 175,000 employees since the start of Covid 19. Amazon is not alone. There is a massive shift from physical retail stores to online retailing.

- b. Other internet-based technologies, from online education to telemedicine will benefit.

- c. Certain pharmaceutical companies and health-related companies are also likely to do extremely well.

- 3. Technology. Google and other technology majors continue to announce deals even during the virus.

1CapitalIQ

2Global M&A Review Q1 2020 by Bureau van Dijk For the Czech Republic, surge in 1Q 2020 is mainly attributed to several mega deals. For instance, Swedish real estate company Heimstaden acquired a residential property portfolio in the Czech Republic owned and operated by Residomo for a total purchase price of $1.4 billion.

3Global Private Equity Report 2020 by Bain https://www.bain.com/globalassets/noindex/2020/bain_report_private_equity_report_2020.pdf

4Cross-border M&A activity expected to pick up, http://www.chinadaily.com.cn/a/202004/22/WS5e9fa5a9a3105d50a3d17f0e.html

2Global M&A Review Q1 2020 by Bureau van Dijk For the Czech Republic, surge in 1Q 2020 is mainly attributed to several mega deals. For instance, Swedish real estate company Heimstaden acquired a residential property portfolio in the Czech Republic owned and operated by Residomo for a total purchase price of $1.4 billion.

3Global Private Equity Report 2020 by Bain https://www.bain.com/globalassets/noindex/2020/bain_report_private_equity_report_2020.pdf

4Cross-border M&A activity expected to pick up, http://www.chinadaily.com.cn/a/202004/22/WS5e9fa5a9a3105d50a3d17f0e.html