It is clear that Covid-19 is creating winners and losers in the world today, although there seem to be more losers than winners.

In certain sectors, like the retail sector, online retailers are massively gaining market share at the expense of physical stores. Shopping plaza stores and main street retailers are dropping like flies, while Amazon hires hundreds of thousands of workers.

What about the proposition that Covid-19 has given an advantage to large companies and technology companies, and that these have taken market share from smaller enterprises? While there are obviously large companies that have suffered (e.g. Carnival Cruise Lines), might the general proposition of larger companies taking market share hold true?

It seems that this kind of trend towards large companies was already the case before Covid-19: in the US, between 1995 and 2013, the percentage of employees working for firms with 10,000 or more employees increased from 24% to 28%1. In Europe, between 2011 and 2017, the share of employment in firms with 250 or more employees rose from 32,8% to 34,8%2. Might Covid-19 further accelerate this trend?

This article looks at the evidence, cutting transversally across all sectors, whether large companies are doing better or squeezing out smaller and mid-sized companies (SME’s). First, we will look at the macro evidence. Second, we will look at the possible reasons for this. Finally, we will discuss what small companies might do to augment their own market share.

(1) The Macro Evidence

In the US, it is evident that the Nasdaq – NDX (representing large corporations), the DOW Jones – DJI (consisting of the largest 200 publically listed companies), the S&P 500 – SPX (increasingly dominated by five high tech stocks) have performed vastly better than the Russell 2000 – RUT, which represents the smaller publically listed companies across America:

Exhibit 1: Comparison of Stock Indices in the US3 In Europe, fortunately for smaller companies, there has be less of a divergence (see Stoxx indeces below). This may, however, have more to do more with sector mix of companies in the index).

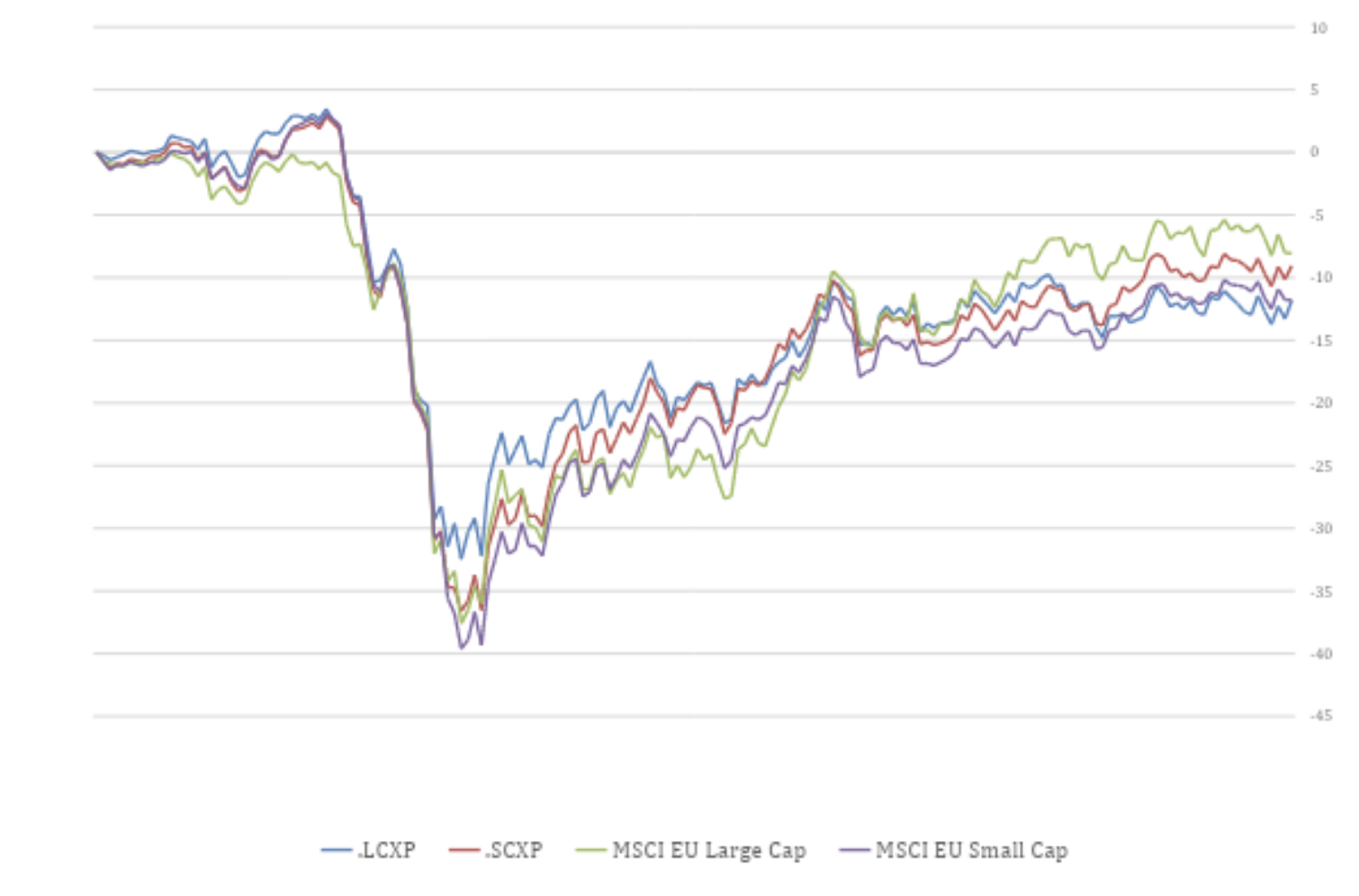

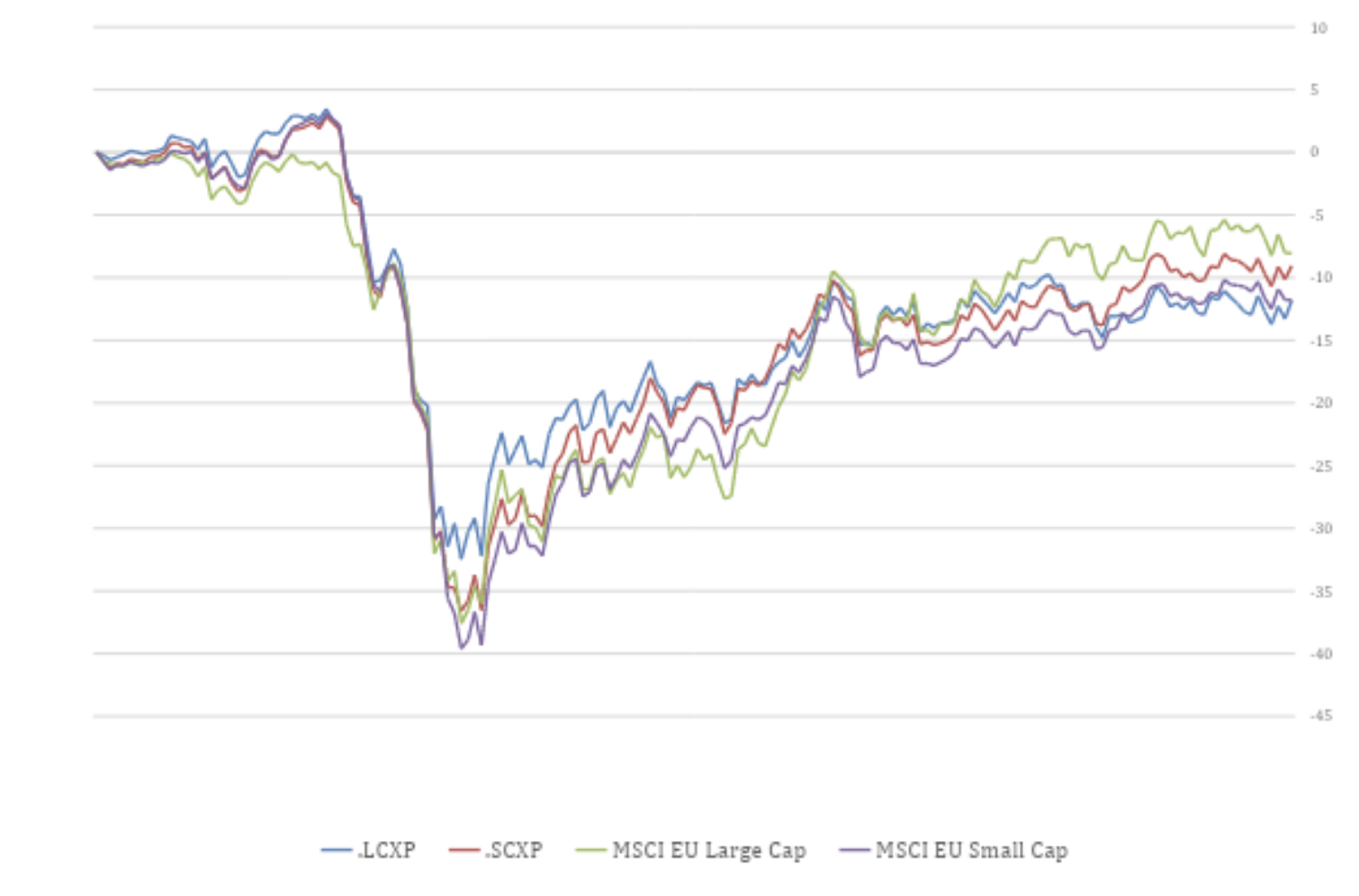

In Europe, fortunately for smaller companies, there has be less of a divergence (see Stoxx indeces below). This may, however, have more to do more with sector mix of companies in the index).

Exhibit 2: Comparison of Stock Indices in Europe4

(2) Reasons why large companies may be at an advantage

According to marketing experts, market share among competitors tends to be much more stable in good economic times, when the economy is growing5. A shrinking economy or an economy in crisis is where the sheep tend to be separated from the goats. Stronger companies steal a lead on weaker companies. Market shares tend to change much more rapidly.

So what might be some of the advantages that larger companies might have over smaller companies? Several possible advantages are listed below, not necessarily in order of importance:

A small company is like a motorboat, compared to a large multinational, which might be compared to an aircraft carrier. The advantage of the motorboat is that it can turn on a dime, an aircraft carrier might be stable, but is much more difficult to maneuver. In theory, small corporations should take advantage of their ability to be more flexible, creative and responsive. They are in closer touch with local conditions. Many restaurants survived the pandemic by expanding into food delivery, for example, while many of those who failed to evolve went bankrupt. Those small corporations will survive and prosper which can identify new opportunities appropriate to the environment, and take advantage of them.

Smaller companies would also be well advised to consider examining their capital structure. Is it optimized to respond to the risk of a prolonged pandemic? Is there enough capital for the company to reinvent itself, take advantage of new opportunities, or simply to survive the pandemic? The pandemic, in many ways, accelerates the rate of change in the business world.

What about the proposition that Covid-19 has given an advantage to large companies and technology companies, and that these have taken market share from smaller enterprises? While there are obviously large companies that have suffered (e.g. Carnival Cruise Lines), might the general proposition of larger companies taking market share hold true?

It seems that this kind of trend towards large companies was already the case before Covid-19: in the US, between 1995 and 2013, the percentage of employees working for firms with 10,000 or more employees increased from 24% to 28%1. In Europe, between 2011 and 2017, the share of employment in firms with 250 or more employees rose from 32,8% to 34,8%2. Might Covid-19 further accelerate this trend?

This article looks at the evidence, cutting transversally across all sectors, whether large companies are doing better or squeezing out smaller and mid-sized companies (SME’s). First, we will look at the macro evidence. Second, we will look at the possible reasons for this. Finally, we will discuss what small companies might do to augment their own market share.

(1) The Macro Evidence

In the US, it is evident that the Nasdaq – NDX (representing large corporations), the DOW Jones – DJI (consisting of the largest 200 publically listed companies), the S&P 500 – SPX (increasingly dominated by five high tech stocks) have performed vastly better than the Russell 2000 – RUT, which represents the smaller publically listed companies across America:

Exhibit 1: Comparison of Stock Indices in the US3

In Europe, fortunately for smaller companies, there has be less of a divergence (see Stoxx indeces below). This may, however, have more to do more with sector mix of companies in the index).

In Europe, fortunately for smaller companies, there has be less of a divergence (see Stoxx indeces below). This may, however, have more to do more with sector mix of companies in the index).

Exhibit 2: Comparison of Stock Indices in Europe4

(2) Reasons why large companies may be at an advantage

According to marketing experts, market share among competitors tends to be much more stable in good economic times, when the economy is growing5. A shrinking economy or an economy in crisis is where the sheep tend to be separated from the goats. Stronger companies steal a lead on weaker companies. Market shares tend to change much more rapidly.

So what might be some of the advantages that larger companies might have over smaller companies? Several possible advantages are listed below, not necessarily in order of importance:

- Larger companies have greater access to capital and technology. The mountains of cash at companies like Apple and Microsoft is legendary. They have also resorted to far more raising of fresh debt and equity, hence are in a much more liquid position. Please see my recent blog on this subject (https://europhoenix.com/blog/corporate-debt-market-during-covid-19-pandemicby-les-nemethy-and-sergey-glekov/)

- There are usually more diversified, both in terms of products/services as well as geography; should Covid-19 hit a segment particularly hard, large companies may still derive cash flow from other segments.

- Large companies have usually invested more in branding than smaller companies, hence typically tend to engender trust. Trust seems to be at a premium during the pandemic. A higher degree of trust may also play a role in helping larger companies hire the best employees.

- As a response to Covid-19, supply chains have a tendency to become flatter. Larger companies are cutting back on outsourcing, reducing the number of links in the supply chain, which tends to affect smaller firms.

- It is often possible to do more online with larger companies, and they often have more automated internal processes, allowing them to attract more clients and serve them with more resilience.6

- There seems to be evidence that larger corporations are better able to obtain state assistance.78

A small company is like a motorboat, compared to a large multinational, which might be compared to an aircraft carrier. The advantage of the motorboat is that it can turn on a dime, an aircraft carrier might be stable, but is much more difficult to maneuver. In theory, small corporations should take advantage of their ability to be more flexible, creative and responsive. They are in closer touch with local conditions. Many restaurants survived the pandemic by expanding into food delivery, for example, while many of those who failed to evolve went bankrupt. Those small corporations will survive and prosper which can identify new opportunities appropriate to the environment, and take advantage of them.

Smaller companies would also be well advised to consider examining their capital structure. Is it optimized to respond to the risk of a prolonged pandemic? Is there enough capital for the company to reinvent itself, take advantage of new opportunities, or simply to survive the pandemic? The pandemic, in many ways, accelerates the rate of change in the business world.

1https://www.bloomberg.com/opinion/articles/2020-04-27/covid-19-will-make-big-companies-more-dominant-than-ever

2https://appsso.eurostat.ec.europa.eu/nui/submitViewTableAction.do

3https://eikon.thomsonreuters.com/index.html

4https://eikon.thomsonreuters.com/index.html

5https://salesbenchmarkindex.com/insights/market-share-gain-the-most-viable-growth-play-during-a-downturn/

6https://www.nytimes.com/2020/04/28/business/coronavirus-stocks.html

7https://on.ft.com/3gkrGvP

8https://www.ft.com/content/f33e5b29-c666-4a72-a0a1-a54cea2a7b1f?accessToken=zwAAAXRyLHfYkdPzPlspxmZKctOgoaVM6ip7Hw.MEUCIQDUSBhkHqFsal7ZwtmEz3yVDzmdfqzsipOIlCUqlvXIggIgNt_hwsf5AWeJzC_mXKKNwYD3h82Ryh5K0nb-QjYkiBU&sharetype=gift?token=f9622502-98b7-4782-8527-d336aa4c5b19

2https://appsso.eurostat.ec.europa.eu/nui/submitViewTableAction.do

3https://eikon.thomsonreuters.com/index.html

4https://eikon.thomsonreuters.com/index.html

5https://salesbenchmarkindex.com/insights/market-share-gain-the-most-viable-growth-play-during-a-downturn/

6https://www.nytimes.com/2020/04/28/business/coronavirus-stocks.html

7https://on.ft.com/3gkrGvP

8https://www.ft.com/content/f33e5b29-c666-4a72-a0a1-a54cea2a7b1f?accessToken=zwAAAXRyLHfYkdPzPlspxmZKctOgoaVM6ip7Hw.MEUCIQDUSBhkHqFsal7ZwtmEz3yVDzmdfqzsipOIlCUqlvXIggIgNt_hwsf5AWeJzC_mXKKNwYD3h82Ryh5K0nb-QjYkiBU&sharetype=gift?token=f9622502-98b7-4782-8527-d336aa4c5b19