The recent sanctions against Russia catalyzed a sudden fall of the Ruble from 81 Rubles to the Dollar to 150 Rubles to the Dollar.

Although the invasion of Ukraine went badly for the Russians, and the sanctions continued to take their toll, between March 7 to April 3, 2022, the Ruble miraculously recovered to 85 Rubles to the Dollar. What happened?

Very simply: Russia declared that from April 1, gas deliveries to “unfriendly” countries must be paid in Rubles or gold. The Russian central bank also agreed to buy gold at 5,000 rubles per gram, effectively linking the Ruble to both gold and oil.

The Russians were able to strengthen their currency by (a) increasing demand for Rubles (e.g. gas importers had to buy Rubles to buy gas) and (b) tying it to gold. Russia just announced that this will be the prototype for other commodities in future (e.g. wheat, fertilizer, etc.) Terms of trade also shifted massively to Russia’s advantage, (i.e. the prices of energy and food-related commodities, Russia’s main exports, soared).

In this financial war, each side played to its strength—the US to its control of the US dollar payment system, the Russians to their strength in energy (being the world’s largest gas exporter and third largest oil exporter).

Zoltan Pozsar, a well-known Credit Suisse analyst and former US Treasury official, stated that we are entering a new monetary order, which he calls Bretton Woods III: “Commodities are real resources … and resource inequality cannot be addressed by QE…you can print money, buy not oil to heat or wheat to eat.”

For Pozsar, Bretton Woods I was the post-World War II agreement that established a gold-backed US Dollar as global reserve currency. Bretton Woods II began in 1971 when Nixon “temporarily” suspended the gold backing of the US dollar. “We are [now] witnessing the birth of Bretton Woods III – a new world (monetary) order centered on commodity-based currencies in the East that will probably weaken the Eurodollar system and contribute to inflationary forces in the West…It used to be as simple as ‘our currency, your problem’. Now it’s ‘our commodity, your problem’.”

Pozsar believes that the Bretton Woods III era will be characterized by higher inflation and higher interest rates. Governments will substitute foreign currency reserves for commodity reserves. Demand for Dollars will be lower, as fewer Dollars will be held in reserves, and more trade will be done in other currencies.

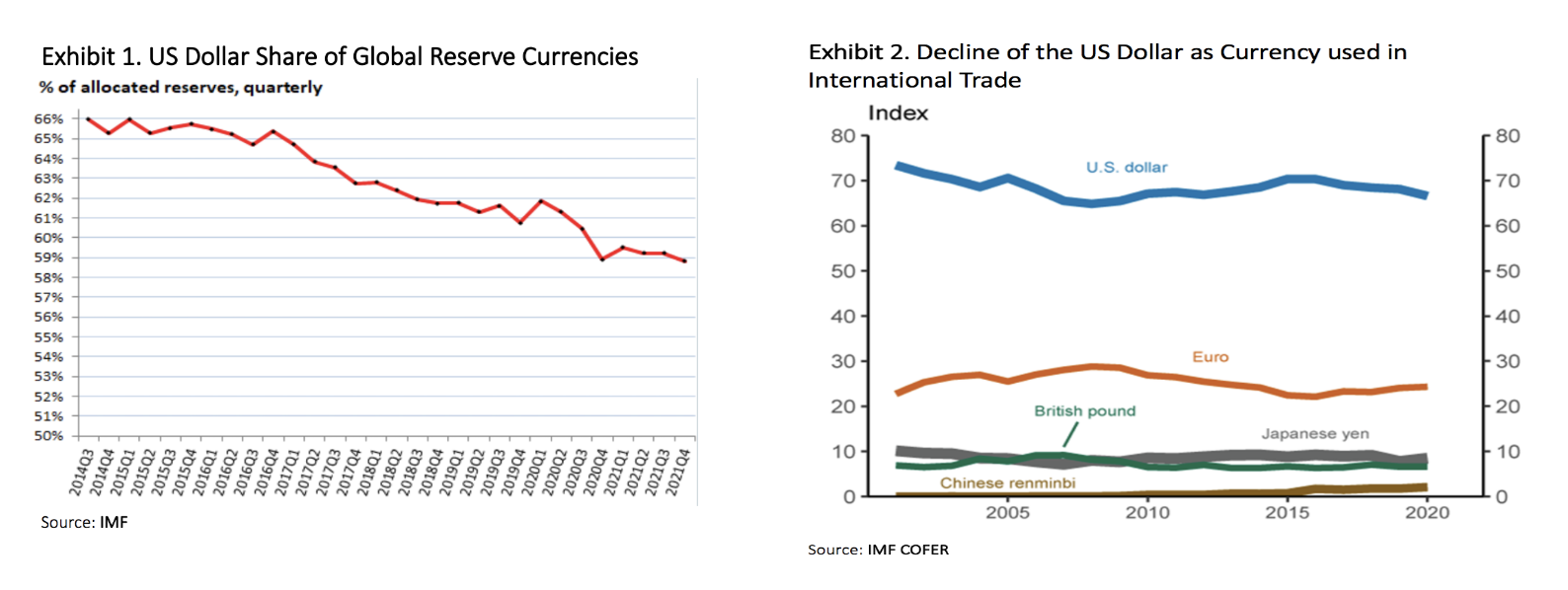

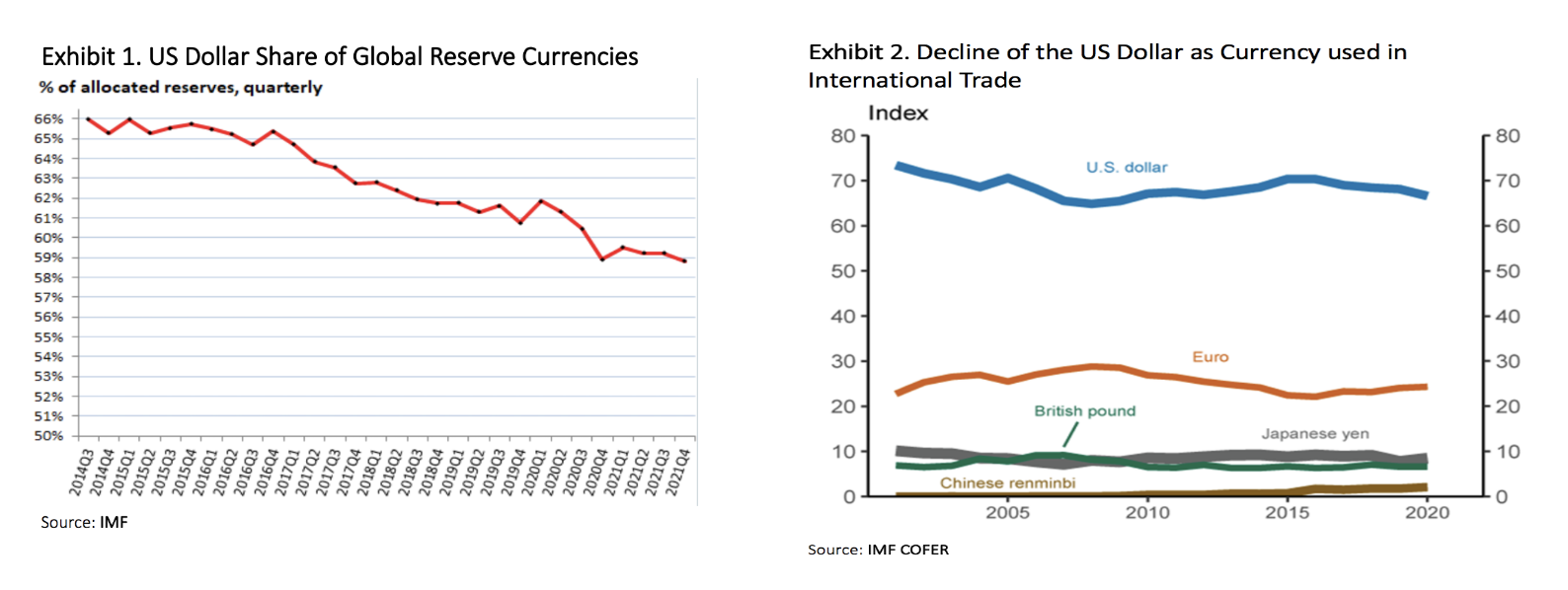

The two charts below illustrate the decline in past years the use of US Dollar, both as a share of Global Reserve Currencies and share as currency used in international trade:

According to a very recent IMF Working Paper, The Stealth Erosion of Dollar Dominance, “reserve managers have moved out of dollars in two directions, with one quarter headed into the renminbi and three quarters into currencies of smaller countries that have traditionally played a limited role as reserve assets.”

There is a fear that the seizure of Russian reserve assets may accelerate the trend.

According to a very recent IMF Working Paper, The Stealth Erosion of Dollar Dominance, “reserve managers have moved out of dollars in two directions, with one quarter headed into the renminbi and three quarters into currencies of smaller countries that have traditionally played a limited role as reserve assets.”

There is a fear that the seizure of Russian reserve assets may accelerate the trend.

According to Pozsar, “When this crisis (and war) is over, the U.S. dollar should be much weaker and, on the flipside, the renminbi much stronger, backed by a basket of commodities.”

In my opinion, the Chinese are much more natural allies with Russia in this form of monetary/commodity warfare than allies in the military sense. You may recall that in February, 2022, Putin and Xi signed a joined statement calling for a new world order. The Chinese have made no secret of their desire to carve out a global role for the yuan.

If Bretton Woods III were to emerge over time , it would undermine the exorbitant privilege of the US dollar’s current status as the world’s reserve currency. Furthermore, if Pozsar is right, the deflationary impulse of Bretton Woods II (globalization, free trade, etc.) will turn into an inflationary impulse (autarky, duplication of supply chains, etc.)

In no way should this article be interpreted as predicting sudden collapse of the US Dollar in the short- to medium-term. The US Dollar remains extremely dominant, both in trade and reserve currency functions; a more likely scenario is long-term erosion. Currently the Chinese and Russians seem to be playing the currency game more creatively than the Americans. The Fed has painted itself into a corner on inflation. We are still in early stages of a long-term decline of the US Dollar. While the trend is inescapable, it is not irreversible: an economic implosion in Russia or real estate crisis in China, for example, could slow or reverse the trend.

Think of the world monetary order today as a game, where the rules are changing all the time—not suddenly –but gradually—there is no referee. You have to figure out how the rules evolve as you go along, adding to the challenge of the game.

Very simply: Russia declared that from April 1, gas deliveries to “unfriendly” countries must be paid in Rubles or gold. The Russian central bank also agreed to buy gold at 5,000 rubles per gram, effectively linking the Ruble to both gold and oil.

The Russians were able to strengthen their currency by (a) increasing demand for Rubles (e.g. gas importers had to buy Rubles to buy gas) and (b) tying it to gold. Russia just announced that this will be the prototype for other commodities in future (e.g. wheat, fertilizer, etc.) Terms of trade also shifted massively to Russia’s advantage, (i.e. the prices of energy and food-related commodities, Russia’s main exports, soared).

In this financial war, each side played to its strength—the US to its control of the US dollar payment system, the Russians to their strength in energy (being the world’s largest gas exporter and third largest oil exporter).

Zoltan Pozsar, a well-known Credit Suisse analyst and former US Treasury official, stated that we are entering a new monetary order, which he calls Bretton Woods III: “Commodities are real resources … and resource inequality cannot be addressed by QE…you can print money, buy not oil to heat or wheat to eat.”

For Pozsar, Bretton Woods I was the post-World War II agreement that established a gold-backed US Dollar as global reserve currency. Bretton Woods II began in 1971 when Nixon “temporarily” suspended the gold backing of the US dollar. “We are [now] witnessing the birth of Bretton Woods III – a new world (monetary) order centered on commodity-based currencies in the East that will probably weaken the Eurodollar system and contribute to inflationary forces in the West…It used to be as simple as ‘our currency, your problem’. Now it’s ‘our commodity, your problem’.”

Pozsar believes that the Bretton Woods III era will be characterized by higher inflation and higher interest rates. Governments will substitute foreign currency reserves for commodity reserves. Demand for Dollars will be lower, as fewer Dollars will be held in reserves, and more trade will be done in other currencies.

The two charts below illustrate the decline in past years the use of US Dollar, both as a share of Global Reserve Currencies and share as currency used in international trade:

According to a very recent IMF Working Paper, The Stealth Erosion of Dollar Dominance, “reserve managers have moved out of dollars in two directions, with one quarter headed into the renminbi and three quarters into currencies of smaller countries that have traditionally played a limited role as reserve assets.”

There is a fear that the seizure of Russian reserve assets may accelerate the trend.

According to a very recent IMF Working Paper, The Stealth Erosion of Dollar Dominance, “reserve managers have moved out of dollars in two directions, with one quarter headed into the renminbi and three quarters into currencies of smaller countries that have traditionally played a limited role as reserve assets.”

There is a fear that the seizure of Russian reserve assets may accelerate the trend.

According to Pozsar, “When this crisis (and war) is over, the U.S. dollar should be much weaker and, on the flipside, the renminbi much stronger, backed by a basket of commodities.”

In my opinion, the Chinese are much more natural allies with Russia in this form of monetary/commodity warfare than allies in the military sense. You may recall that in February, 2022, Putin and Xi signed a joined statement calling for a new world order. The Chinese have made no secret of their desire to carve out a global role for the yuan.

If Bretton Woods III were to emerge over time , it would undermine the exorbitant privilege of the US dollar’s current status as the world’s reserve currency. Furthermore, if Pozsar is right, the deflationary impulse of Bretton Woods II (globalization, free trade, etc.) will turn into an inflationary impulse (autarky, duplication of supply chains, etc.)

In no way should this article be interpreted as predicting sudden collapse of the US Dollar in the short- to medium-term. The US Dollar remains extremely dominant, both in trade and reserve currency functions; a more likely scenario is long-term erosion. Currently the Chinese and Russians seem to be playing the currency game more creatively than the Americans. The Fed has painted itself into a corner on inflation. We are still in early stages of a long-term decline of the US Dollar. While the trend is inescapable, it is not irreversible: an economic implosion in Russia or real estate crisis in China, for example, could slow or reverse the trend.

Think of the world monetary order today as a game, where the rules are changing all the time—not suddenly –but gradually—there is no referee. You have to figure out how the rules evolve as you go along, adding to the challenge of the game.