Impact investing, as the word “impact” implies, is all about investing to make a positive impact on the world, not only generating a financial return1.

One may define impact investments as investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return.

This is not the same as charitable donations, where one the donor typically expects nothing in return (except for perhaps a tax deduction). They each have their own separate and crucial roles. Impact investing is growing exponentially all over the world recently, even partially displacing traditional charitable donations. Charities are important and effective in meeting immediate needs, such as food, shelter, and sanitation. Social impact investments can be more effective in stimulating long-term sustainability through job creation and entrepreneurship.

Impact investment may appeal to a wide variety of individual and institutional investors, including:

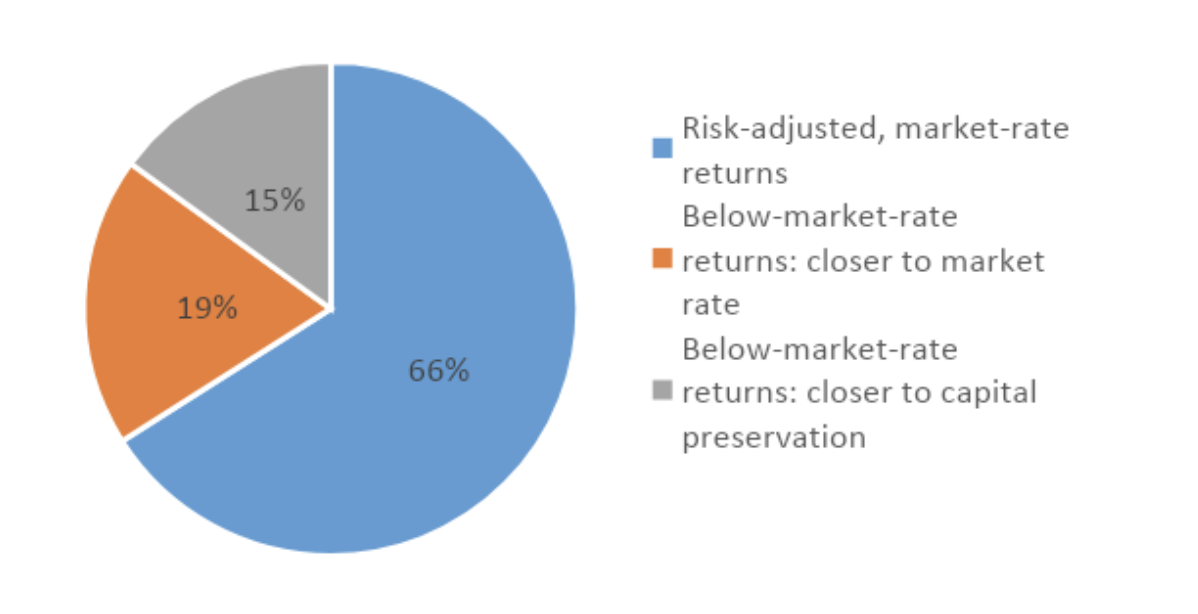

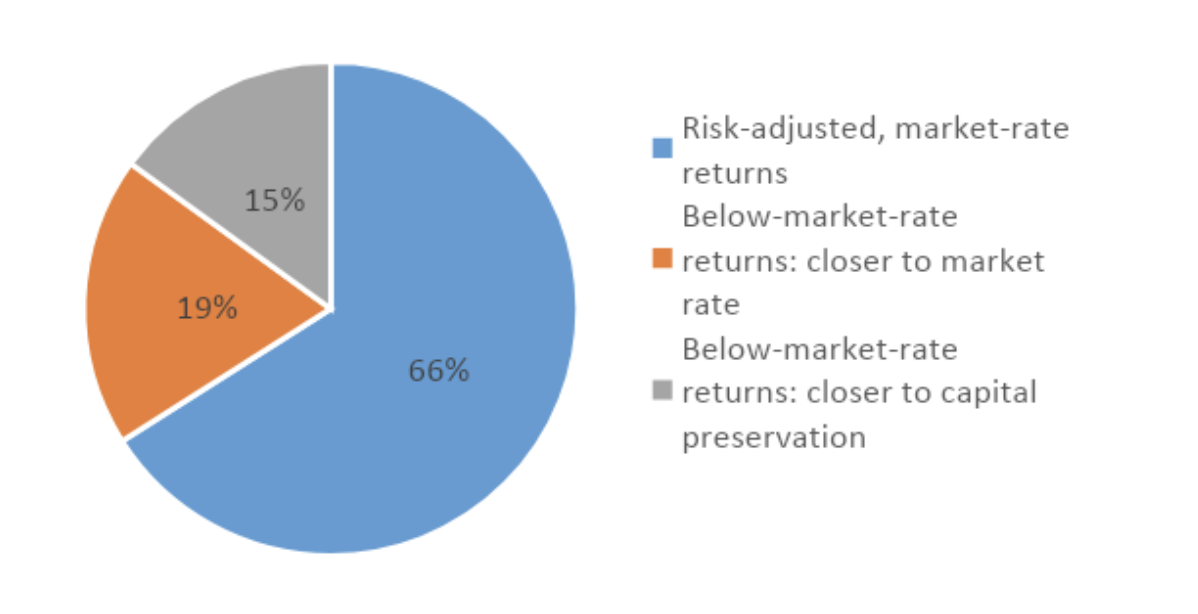

2. Positive financial returns. The target range of returns for impact investments may range from below market to market, depending on investors’ strategic goals. Based on a 2019 survey of social impact investors throughout the world, a majority of impact investors still choose to pursue competitive, market-rate returns. But this is not always the case.

Exhibit 1: Target financial returns sought by impact investors2 3. The third and most challenging aspect of impact investment is measurement of the impact on the world. The Global Impact Investing Network (GIIN) establishes criteria for measuring impact3:

3. The third and most challenging aspect of impact investment is measurement of the impact on the world. The Global Impact Investing Network (GIIN) establishes criteria for measuring impact3:

A majority of impact investing organizations is headquartered in developed markets, mainly in the U.S. and Canada. However, impact investing is a global phenomenon, also with strong roots in Central Europe. The impact investment ecosystem in the Visegrad countries is relatively well-developed, despite still being in its early stage. A lack of concise national-level strategies and gaps in cooperation between entities need to be addressed in order for the region to ensure the impact investment ecosystem develops to its full potential5.

For many years, numerous investors have been avoiding investments in the so called “sin” industries like alcohol, tobacco, armaments, etc. Impact investment might be viewed as an extension of that trend, to actively seek out investments that will make the world a better place. One might also view investing in certain high-tech firms as a form of impact investing, if the technology (e.g. med-tech or drug research) makes the world a better place.

There is a perception in society in general that money is often a source of evil. Impact investing is proof positive that money can also be a source for good.

This is not the same as charitable donations, where one the donor typically expects nothing in return (except for perhaps a tax deduction). They each have their own separate and crucial roles. Impact investing is growing exponentially all over the world recently, even partially displacing traditional charitable donations. Charities are important and effective in meeting immediate needs, such as food, shelter, and sanitation. Social impact investments can be more effective in stimulating long-term sustainability through job creation and entrepreneurship.

Impact investment may appeal to a wide variety of individual and institutional investors, including:

- Fund Managers

- Development finance institutions

- Diversified financial institutions/banks

- Private foundations

- Pension funds and insurance companies

- Family Offices

- Individual investors

- NGOs

- Religious institutions

2. Positive financial returns. The target range of returns for impact investments may range from below market to market, depending on investors’ strategic goals. Based on a 2019 survey of social impact investors throughout the world, a majority of impact investors still choose to pursue competitive, market-rate returns. But this is not always the case.

Exhibit 1: Target financial returns sought by impact investors2

3. The third and most challenging aspect of impact investment is measurement of the impact on the world. The Global Impact Investing Network (GIIN) establishes criteria for measuring impact3:

3. The third and most challenging aspect of impact investment is measurement of the impact on the world. The Global Impact Investing Network (GIIN) establishes criteria for measuring impact3:

- Declaring the social or environmental objectives that an investment is attempting to accomplish.

- Using standardized metrics to set performance targets for these objectives.

- Utilizing Key Performance Indicators (KPI’s) to measure performance and optimizing specific parts of a business model.

- Reporting social and environmental performance in the context of the standardized metrics that were previously set.

A majority of impact investing organizations is headquartered in developed markets, mainly in the U.S. and Canada. However, impact investing is a global phenomenon, also with strong roots in Central Europe. The impact investment ecosystem in the Visegrad countries is relatively well-developed, despite still being in its early stage. A lack of concise national-level strategies and gaps in cooperation between entities need to be addressed in order for the region to ensure the impact investment ecosystem develops to its full potential5.

For many years, numerous investors have been avoiding investments in the so called “sin” industries like alcohol, tobacco, armaments, etc. Impact investment might be viewed as an extension of that trend, to actively seek out investments that will make the world a better place. One might also view investing in certain high-tech firms as a form of impact investing, if the technology (e.g. med-tech or drug research) makes the world a better place.

There is a perception in society in general that money is often a source of evil. Impact investing is proof positive that money can also be a source for good.

1 Global Impact Investing Network, https://thegiin.org/

2 2019 Annual Impact Investor Survey by Global Impact Investing Network

3 Global Impact Investing Network

4 Sizing the Impact Investing Market by GIIN

5Social Investment Leveraging Index, Investing for Impact in Central and Eastern Europe by Deloitte

2 2019 Annual Impact Investor Survey by Global Impact Investing Network

3 Global Impact Investing Network

4 Sizing the Impact Investing Market by GIIN

5Social Investment Leveraging Index, Investing for Impact in Central and Eastern Europe by Deloitte