“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion or later as the final and total collapse of the currency itself.”– Ludwig von Mises, Founder of the Austrian School of Economics

In other words, according to von Mises, Governments can turn off the lending spiggots and prick the debt bubble, causing a recession or depression, but if they pass a certain point of no return, a currency collapse becomes inevitable.

This may sound a little dramatic. Is there any possibility that we are heading towards a crack-up boom?

Numerous indicators point towards the most serious debt balloon faced simultaneously by virtually all economies of the modern world :

- Global debt has skyrocketed to over $280 trillion, some 355% of global GDP

- US Debt has surpassed $80 trillion, some 400% of GDP (of which Government debt has reached $30 trillion).

- Government debt in Japan exceeds 220% of GDP

- In the US, there is also over $100 trillion of unfunded pension and medical liabilities of the Government.

- The fiscal deficit of the US Government is entering into double digit percentages of GDP.

- The US Government plans another $4 trillion infrastructure stimulus program, in addition the trillions it has already spent on stimulus.

- Commodity prices (metals, agriculture, etc.) are rising dramatically (lumber up 400% in a year).

- Real estate prices in the US, Canada and other major economies are seeing double digit percentage annual price rises.

- Capacity shortages—from computer chips to shipping services—are driving up prices.

- It is only a matter of time before all of the above start feeding into the Consumer Price Index.

- Global stock markets have reached a new high—their capitalization has surpassed 200% of global GDP.

- Cryptocurrencies are going crazy.

The US Fed has admitted that we will experience some inflation—but insists that this will be of a temporary nature only. The majority of the world seems to believe this assertion today, because it is on the good authority of the Fed.

But then again, in 2008 the Fed adopted the unorthodox monetary policy of Quantitative Easing (QE), and to allay market concerns, told the world that QE was of a purely temporary nature. A subsequent brief attempt by the Fed to reverse QE in 2013 resulted in a “taper tantrum. Today QE is going stronger than ever. The US Fed and the European Central Bank have each accumulated over $7 trillion of assets on their balance sheet, still growing strong.

My opinion, for what it’s worth: this upcoming bout of ”temporary” inflation will be about as temporary as QE.

Inflation is very much a function of market psychology. Once people expect inflation, velocity of money goes increases because people want to buy or invest their cash before it loses purchasing power. At that point the genie is out of the bottle, there is a natural tendency towards inflation accelerating.

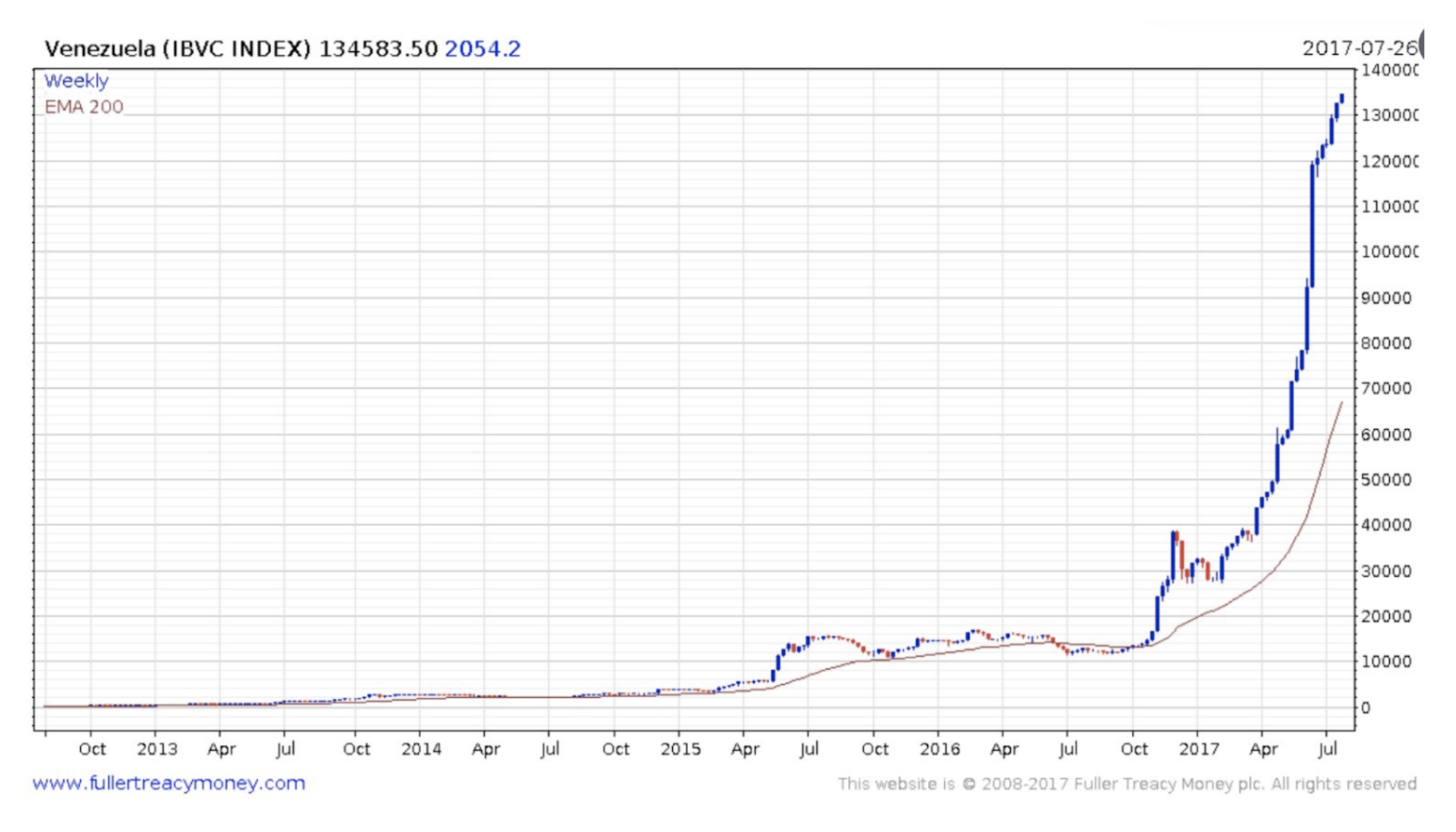

We all know that for years the Venezuelan economy has been heading towards disaster and hyperinflation—notice in the graph below how the Venezuelan stock exchange index is going vertical:

Exhibit 1: Venezuelan Stock Exchange Index

I can’t think of a graph that better illustrates a crack-up boom.

I can’t think of a graph that better illustrates a crack-up boom.

By the end of 2020, the exchange ended up with a market capitalization of 1,270,229,028,210,000 bolivars—due to inflation, a mere $1.3 billion1.

Based on historical example, Austrian economists tell us that the first phases of the crack up boom can actually feel quite good—assets are going up, people who have assets are feeling richer—until the currency collapses. (Some say it’s like sex—it feels best just before the end). The currency collapse drives home the real value of assets. (At times of currency collapse, it is typically gold that best holds its value—in 1923, at the height of hyperinflation during the Weimar Republic—you could buy a large bungalow in ta luxurious suburb of Berlin for 8 ounces of gold).

It seems we are already in the early phases of a crack-up boom. That is not to say the crack up is inevitable, We will move to mid-stage once a majority conclude that inflation is not temporary, at which point inflation will tend to accelerate. As momentum picks up towards indebtedness and inflation, it will prove ever more difficult for Governments to step off the path to currency collapse.

Many of us share a sense that while markets are booming, they are also increasingly volatile and dangerous—which is why the concept of “crack-up boom” has merit, and provides a cautionary message.

1https://www.ft.com/content/281bf4f9-e2b3-413d-8d3a-39de32bf8809