Forecasts for GDP decrease within the European Union in 2020 run as high as 13%, even after taking into account massive stimulation by Governments1.This is likely to trigger many bankruptcies and even more Non-Performing Loans (an “NPL” is a loan where a borrower has a high probability of default or is actually in default).

NPL’s lead to the question: will Covid-19 lead to failure of one or more European banks? In this article we will talk about (a) capital adequacy of the European banking sector; (b) non-performing loans in the European banking sector; (c) brief analysis of several weaker European banks; (d) and some concluding comments as to the likelihood of bank failure or default.

(a) Capital Adequacy of the European Banking Sector.

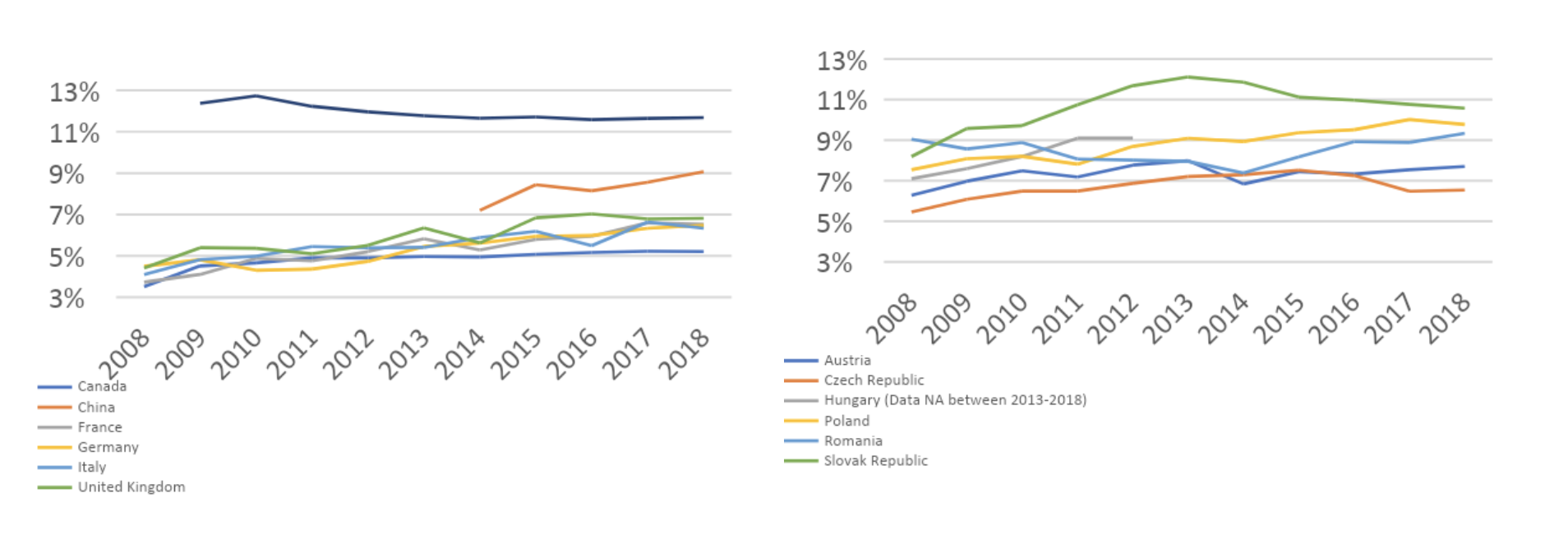

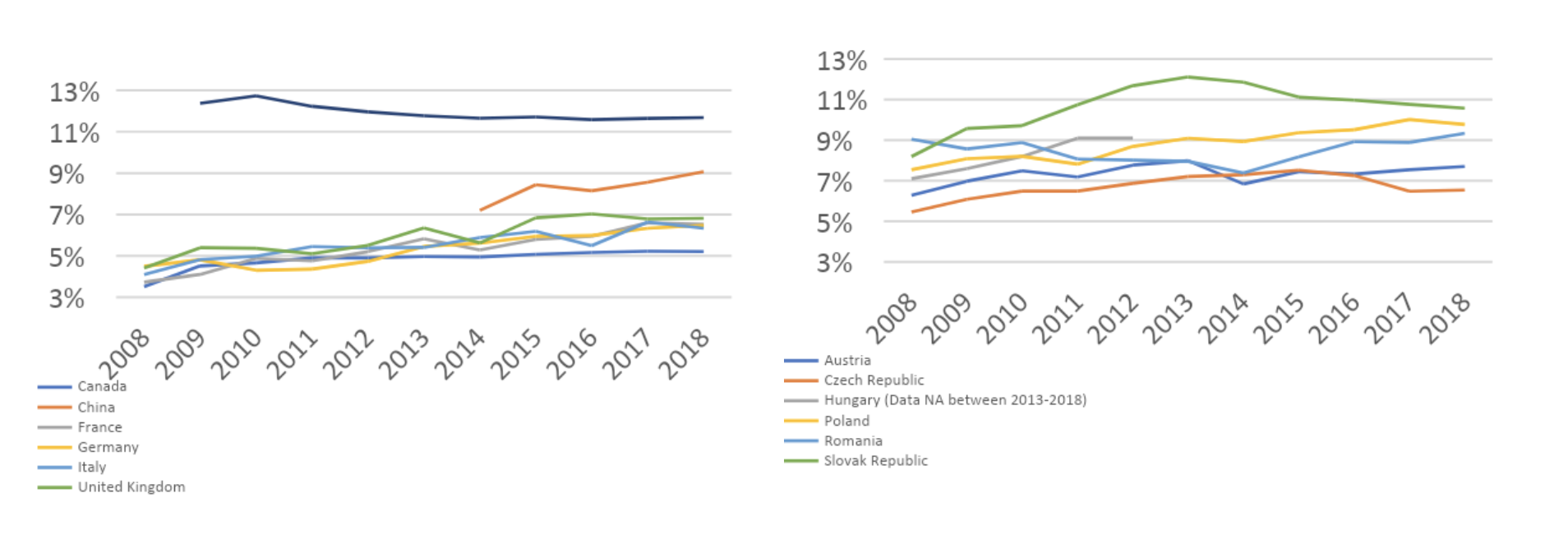

The European banking system has considerably improved capital to asset ratios since the Lehman crisis, with a six percent annual growth rate over the past 10 years: Exhibit 1: Total Capital to Asset Ratio Evolution 2008-2018 (%) in Selected Countries2,3 This growth in capitalization was driven by the application of Basel II and III rules, which impose requirements for capital, liquidity and ability to absorb shocks. Some of these requirements include:

This growth in capitalization was driven by the application of Basel II and III rules, which impose requirements for capital, liquidity and ability to absorb shocks. Some of these requirements include:

(b) Non-performing loans in the European Banking Sector;

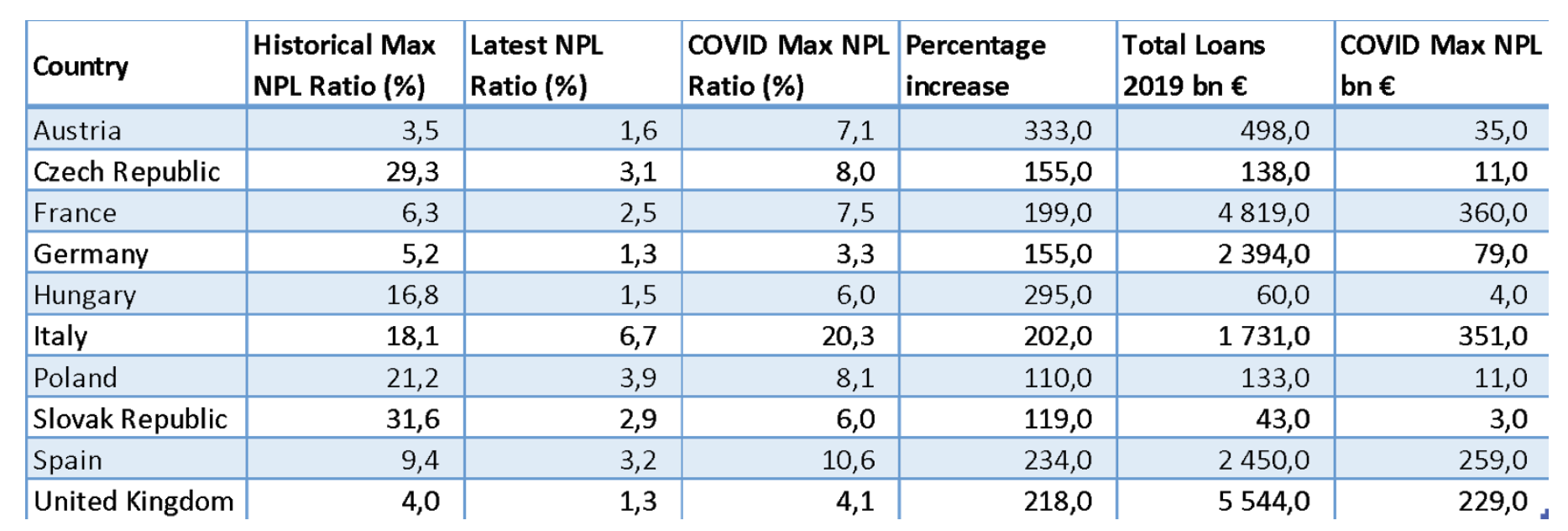

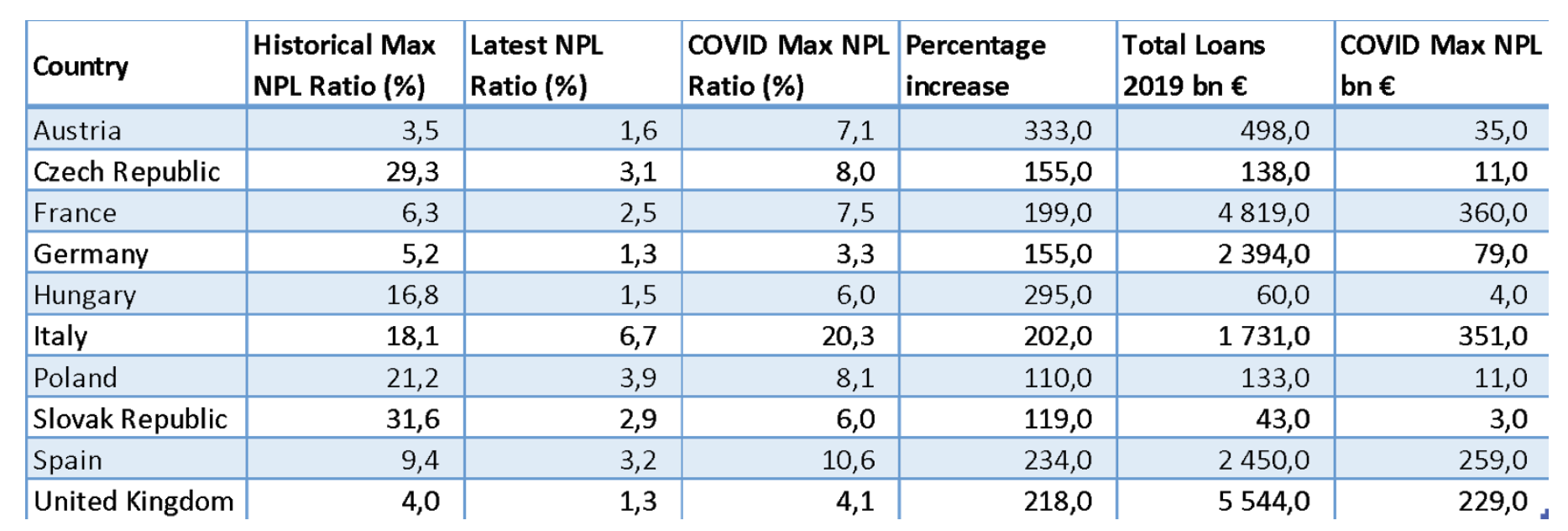

The following exhibit provides an overview of historic and most recent NPL ratios in the European Union, as well as a so-called “worst case” forecast taking into account Covid-19.

Exhibit 2: Worst-case projections on NPL for selected European Countries5 The “Latest NPL Ratio” is the last one available (typically the 2019 ratio).

The “Latest NPL Ratio” is the last one available (typically the 2019 ratio).

Covid-19 will have massive effect on NPL’s, particularly in Italy and Spain, where the NPL ratio could exceed 20% and 10% respectively.

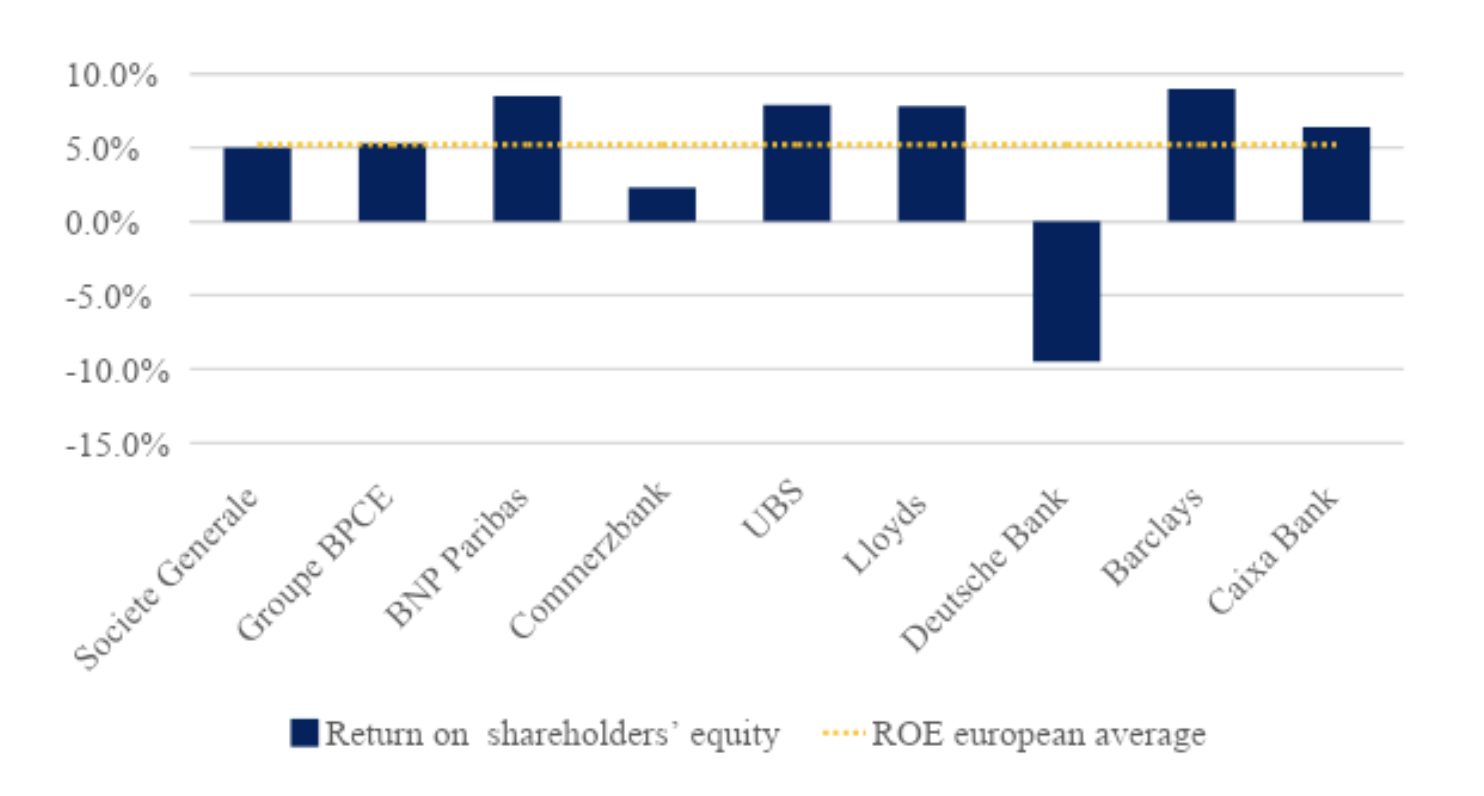

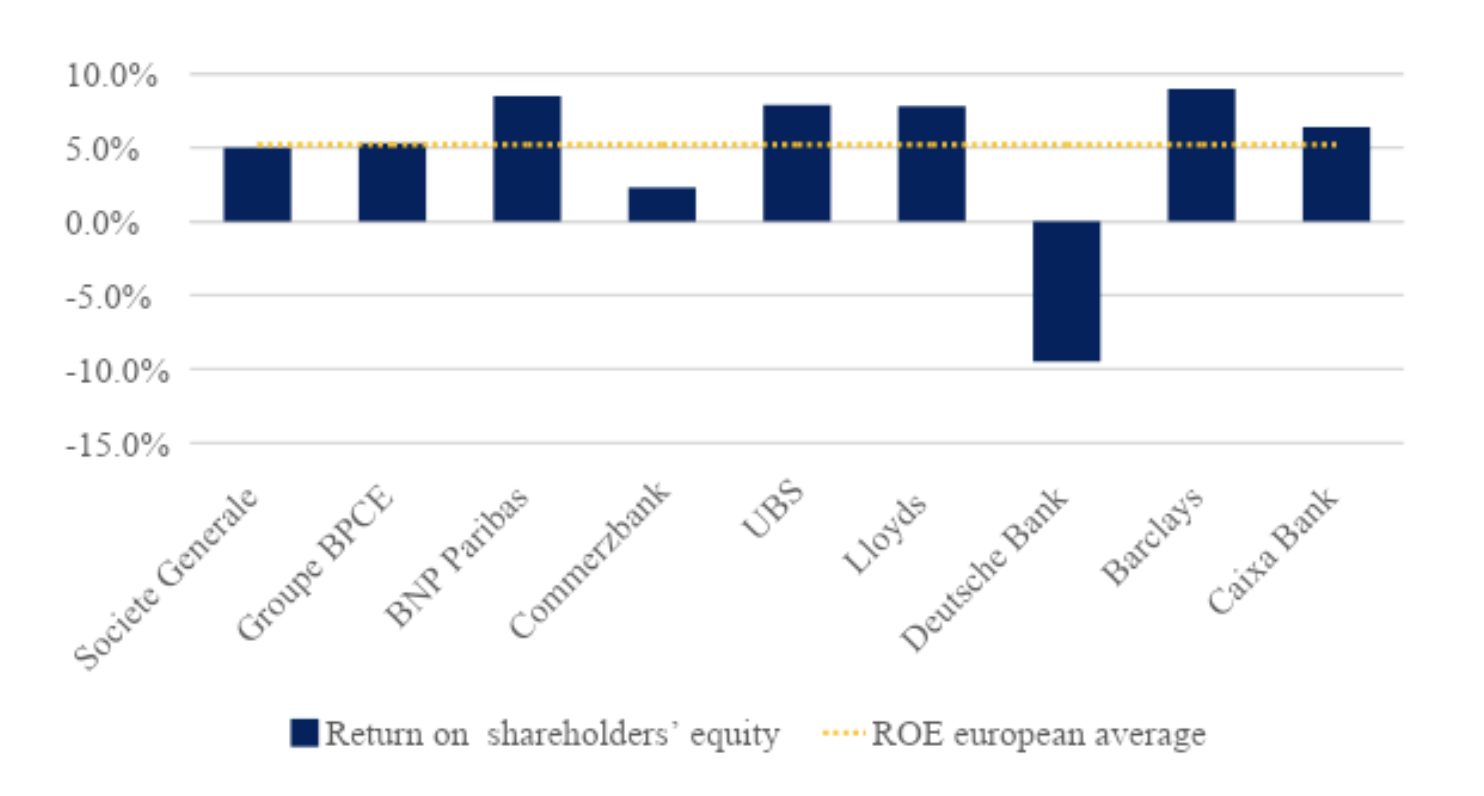

The following chart shows Return on Equity for some of the weaker European banks: Exhibit 3: Top 10 European weakest banks: 2019 Return on Equity6 Deutsche Bank has been on the regulators’ watch list for many years. While capitalization has come into line with Basel requirements, its profitability remains a concern. In 2019 it clocked a whopping -9.5% return on equity, albeit in the context of a restructuring exercise. A continued negative or low return could jeopardize financial stability.

Deutsche Bank has been on the regulators’ watch list for many years. While capitalization has come into line with Basel requirements, its profitability remains a concern. In 2019 it clocked a whopping -9.5% return on equity, albeit in the context of a restructuring exercise. A continued negative or low return could jeopardize financial stability.

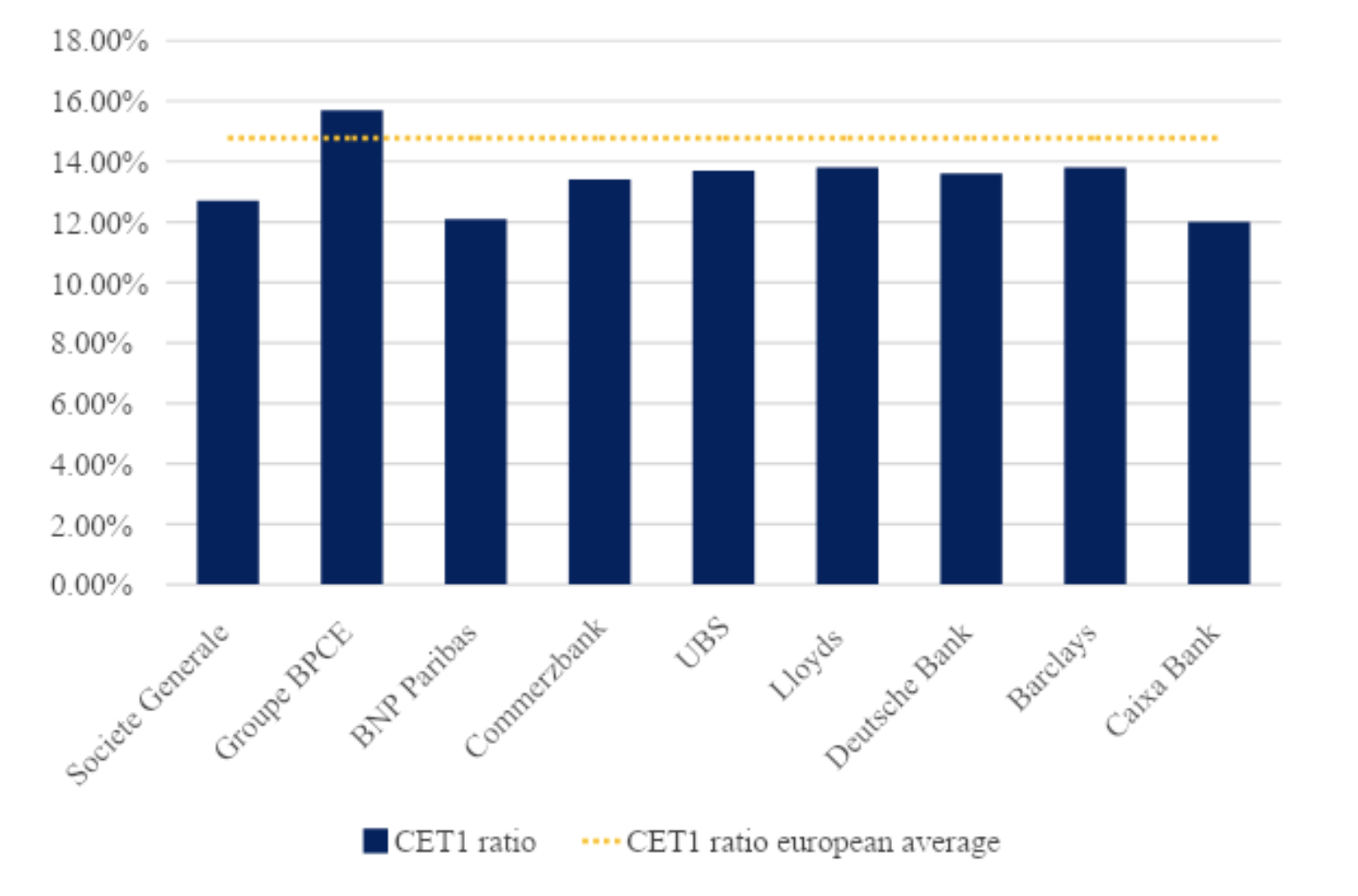

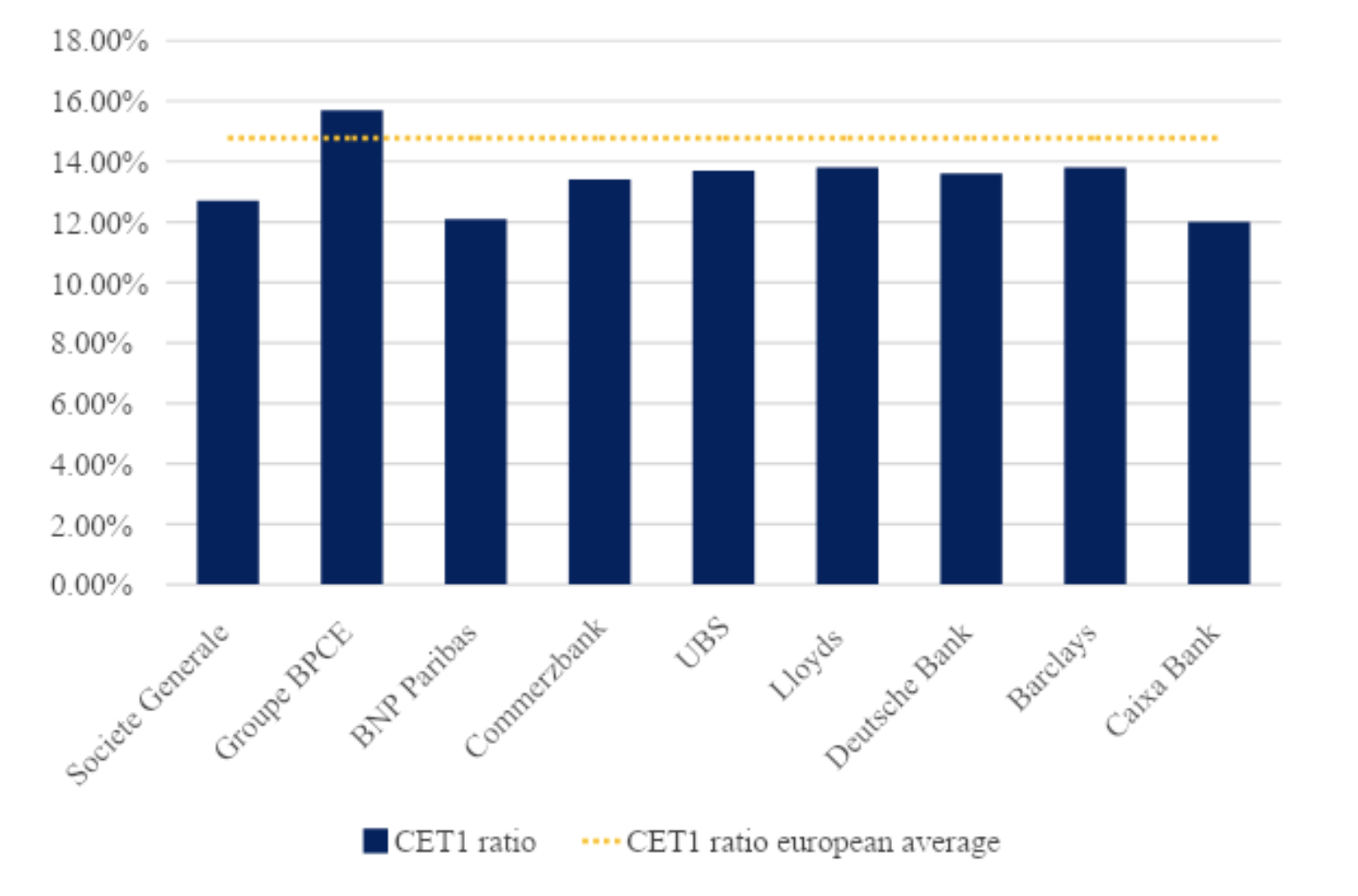

On April 23, 2020, S&P lowered its outlook for Deutsche Bank to negative from stable and cut Commerzbank’s credit rating by a notch.. S&P expects that bank earnings, asset quality, and in some cases, capitalization, to weaken meaningfully through year-end 2020 and into 2021.7 Exhibit 4: 2019 CET1 ratio of Selected Weaker European Banks 8

(d) Some concluding Comments as to the Likelihood of Bank Default in Europe

We can breathe a sigh of relief that European banks met their Basel III requirements on schedule in 2019, just in time for Covid-19. Even credit ratings weaker banks, as mentioned above, seem to be within the range of acceptability. Much stress has also been taken off the banking sector by massive Government bailouts and guarantees. For example, in Italy, both the Italian government’s and the European Commission have provided guarantees on emergency loans given by Italian banks.

However, NPL projections in Exhibit 2 above are based on IMF calculations which assume a one quarter shock, and the virus will subside in the second half of 20209. But what if there are subsequent waves of virus, or worse, a severe mutation? What if no vaccine is found? What about the current crisis triggering as-of-yet unforeseen domino effects, which may range from supply chain breakdowns to war? Some pundits are suggesting that Covid-19 may even trigger the dissolution of the European Union. In the end, runs on banks are seldom triggered by capitalization levels, but by depositor panics.

We should count our blessings that Basel III has been implemented, that we do not seem to be facing an immediate crisis; but we are far from being out of the woods.

NPL’s lead to the question: will Covid-19 lead to failure of one or more European banks? In this article we will talk about (a) capital adequacy of the European banking sector; (b) non-performing loans in the European banking sector; (c) brief analysis of several weaker European banks; (d) and some concluding comments as to the likelihood of bank failure or default.

(a) Capital Adequacy of the European Banking Sector.

The European banking system has considerably improved capital to asset ratios since the Lehman crisis, with a six percent annual growth rate over the past 10 years: Exhibit 1: Total Capital to Asset Ratio Evolution 2008-2018 (%) in Selected Countries2,3

This growth in capitalization was driven by the application of Basel II and III rules, which impose requirements for capital, liquidity and ability to absorb shocks. Some of these requirements include:

This growth in capitalization was driven by the application of Basel II and III rules, which impose requirements for capital, liquidity and ability to absorb shocks. Some of these requirements include:

- Common Equity Tier 1 ratio (CET1) refers to the most basic and liquid core equity capital of a bank. Basel III has decreed that since 2019 CET1 must exceed 4.5% for European banks; no dividends or employee bonuses may be paid in the event of losses unless CET1 has been topped up.

- Minimum Tier 1 capital must be minimum 10.5% (e.g. capital requirement that must be met in order for a bank to stay in business);

- Minimum Tier 2 capital at 2% (e.g. additional capital that must be available to satisfy liquidation).

(b) Non-performing loans in the European Banking Sector;

The following exhibit provides an overview of historic and most recent NPL ratios in the European Union, as well as a so-called “worst case” forecast taking into account Covid-19.

Exhibit 2: Worst-case projections on NPL for selected European Countries5

The “Latest NPL Ratio” is the last one available (typically the 2019 ratio).

The “Latest NPL Ratio” is the last one available (typically the 2019 ratio).

Covid-19 will have massive effect on NPL’s, particularly in Italy and Spain, where the NPL ratio could exceed 20% and 10% respectively.

- c) An Analysis of Selected Weak European Banks

The following chart shows Return on Equity for some of the weaker European banks: Exhibit 3: Top 10 European weakest banks: 2019 Return on Equity6

Deutsche Bank has been on the regulators’ watch list for many years. While capitalization has come into line with Basel requirements, its profitability remains a concern. In 2019 it clocked a whopping -9.5% return on equity, albeit in the context of a restructuring exercise. A continued negative or low return could jeopardize financial stability.

Deutsche Bank has been on the regulators’ watch list for many years. While capitalization has come into line with Basel requirements, its profitability remains a concern. In 2019 it clocked a whopping -9.5% return on equity, albeit in the context of a restructuring exercise. A continued negative or low return could jeopardize financial stability.

On April 23, 2020, S&P lowered its outlook for Deutsche Bank to negative from stable and cut Commerzbank’s credit rating by a notch.. S&P expects that bank earnings, asset quality, and in some cases, capitalization, to weaken meaningfully through year-end 2020 and into 2021.7 Exhibit 4: 2019 CET1 ratio of Selected Weaker European Banks 8

(d) Some concluding Comments as to the Likelihood of Bank Default in Europe

We can breathe a sigh of relief that European banks met their Basel III requirements on schedule in 2019, just in time for Covid-19. Even credit ratings weaker banks, as mentioned above, seem to be within the range of acceptability. Much stress has also been taken off the banking sector by massive Government bailouts and guarantees. For example, in Italy, both the Italian government’s and the European Commission have provided guarantees on emergency loans given by Italian banks.

However, NPL projections in Exhibit 2 above are based on IMF calculations which assume a one quarter shock, and the virus will subside in the second half of 20209. But what if there are subsequent waves of virus, or worse, a severe mutation? What if no vaccine is found? What about the current crisis triggering as-of-yet unforeseen domino effects, which may range from supply chain breakdowns to war? Some pundits are suggesting that Covid-19 may even trigger the dissolution of the European Union. In the end, runs on banks are seldom triggered by capitalization levels, but by depositor panics.

We should count our blessings that Basel III has been implemented, that we do not seem to be facing an immediate crisis; but we are far from being out of the woods.

1NPL Markets, Forecasting NPL Ratios after Covid-19, May 6, 2020, https://go.aws/3dzMnll

2World bank Database, https://bit.ly/2y659kE

3FRED St Louis FED Economic Data, https://bit.ly/2WpsozU

4ECB Supervisory statistics, https://bit.ly/2Lud5j7

5NPL Markets, Forecasting NPL Ratios after Covid-19, May 6, 2020, https://go.aws/3dzMnll

6European Banks 2019 financial results’ reports

7REUTERS – S&P cuts Commerzbank rating, revises outlook for Deutsche Bank to negative https://reut.rs/35IJ88v

8European Banks 2019 financial results’ reports

9 IMF, World Economic Outlook, April 2020: The Great Lockdown, https://bit.ly/2zw37v2

2World bank Database, https://bit.ly/2y659kE

3FRED St Louis FED Economic Data, https://bit.ly/2WpsozU

4ECB Supervisory statistics, https://bit.ly/2Lud5j7

5NPL Markets, Forecasting NPL Ratios after Covid-19, May 6, 2020, https://go.aws/3dzMnll

6European Banks 2019 financial results’ reports

7REUTERS – S&P cuts Commerzbank rating, revises outlook for Deutsche Bank to negative https://reut.rs/35IJ88v

8European Banks 2019 financial results’ reports

9 IMF, World Economic Outlook, April 2020: The Great Lockdown, https://bit.ly/2zw37v2