We often hear comments about how little interest banks pay, or the low yield on certain treasuries. In our business of Mergers & Acquisitions, we have seen quite a few business owners who want to sell their businesses, but hesitate to do so

, because they do not know how to generate a decent return on their proceeds.

The good news is that through a diversified medium-risk bond portfolio, it should be possible to generate a return of 6-8% per annum. Rather than you working, let your money work for you!

Part I of this series provided an overview of asset classes; Part II dealt with the size and liquidity of the various public markets in which these asset classes trade. This article zeroes in on bonds, one of the most important asset classes.

On US Bond Market, Treasury Securities (government debt instrument issued by the United States Department of the Treasury) and Corporate Bonds account for 57% of the whole market, with mortgage related securities, municipal bonds, and other more exotic bonds accounting for the balance. Hence, we will focus on treasuries and corporates for the remainder of this article.

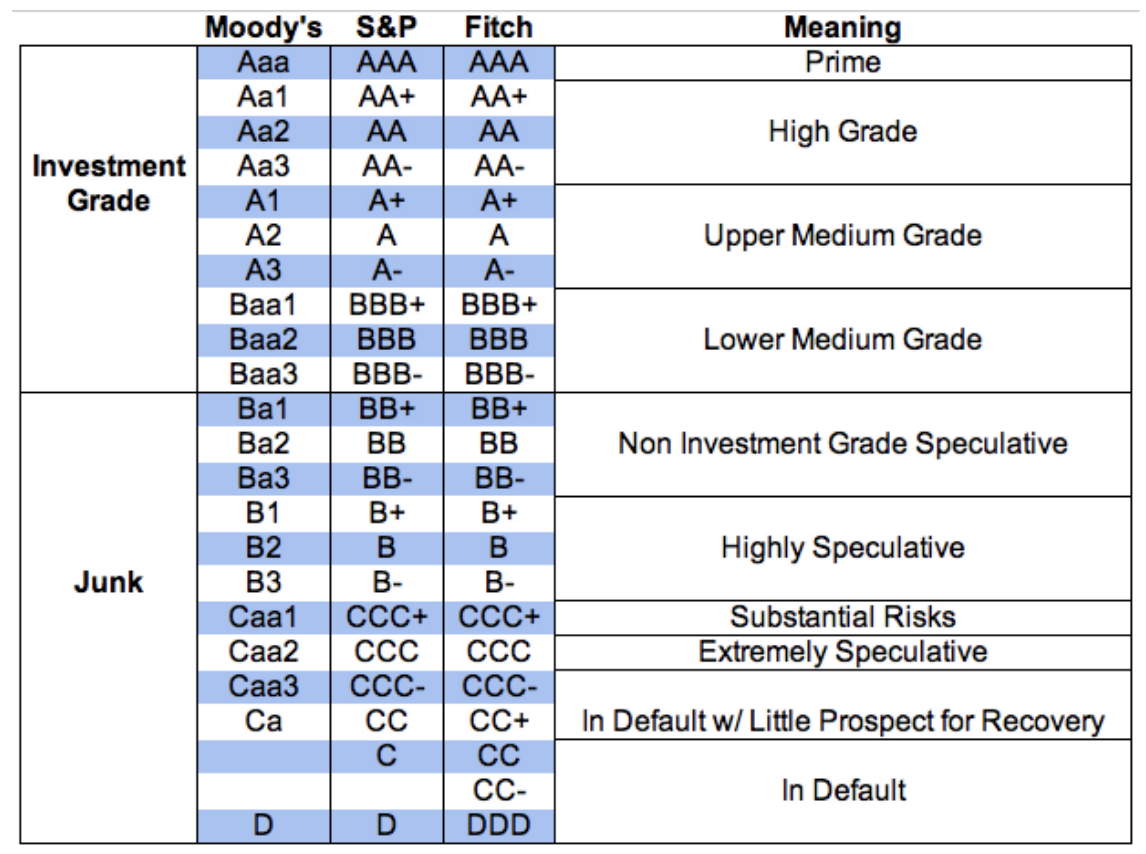

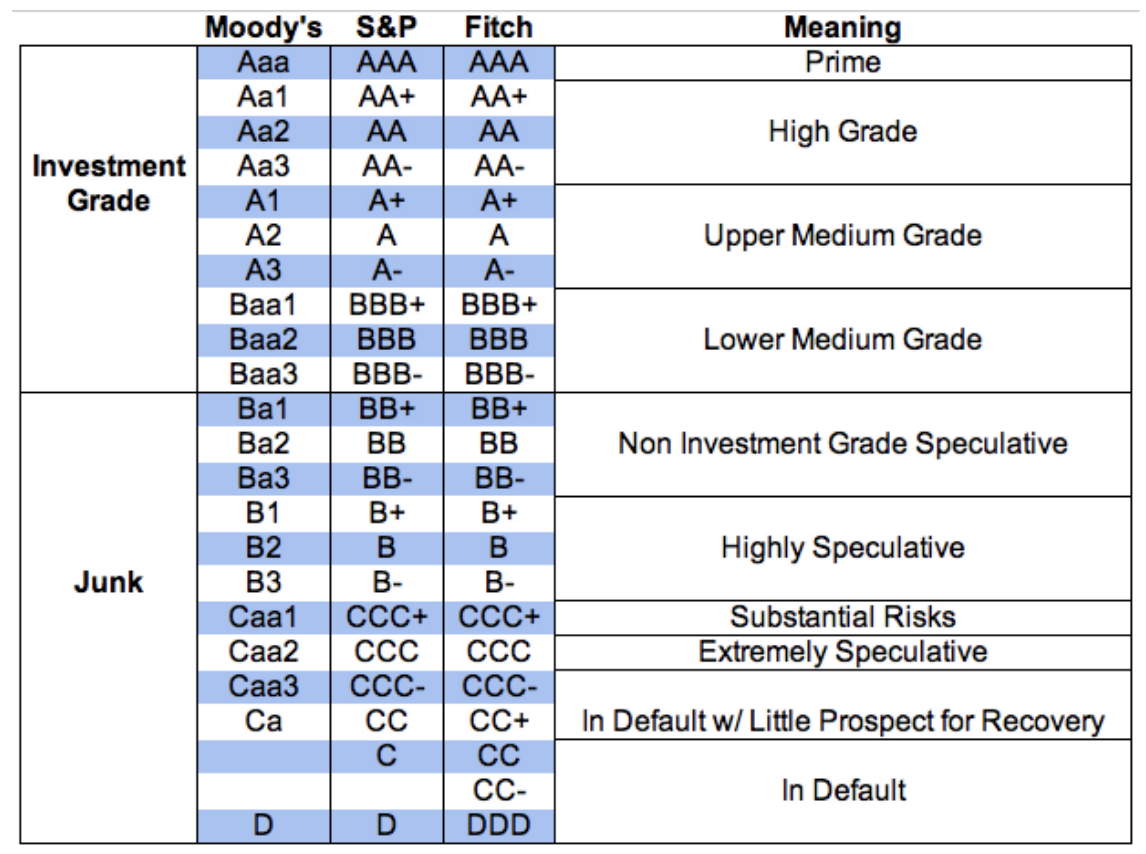

A useful tool for determining the likelihood of Government or corporate default is a credit rating. The three major rating agencies are Moody’s, Standard and Poor’s, and Fitch: Exhibit 1: Credit ratings scale1 Each investor who decides to invest in bonds as an asset class should construct his or her own bond portfolio, with the appropriate degree of risk/return relationship. (Usually this would be in conjunction with investing in other asset classes as well).

The next two charts provide (a) a sample of 10-year Government bonds; and (b) a sample various maturities of corporate bonds, just to provide illustrate available of risk/ return relationships. Note that the least risky bonds have a negative yield!

Exhibit 2: 10-year government bond yields for the selected countries as at April 17, 20192

Each investor who decides to invest in bonds as an asset class should construct his or her own bond portfolio, with the appropriate degree of risk/return relationship. (Usually this would be in conjunction with investing in other asset classes as well).

The next two charts provide (a) a sample of 10-year Government bonds; and (b) a sample various maturities of corporate bonds, just to provide illustrate available of risk/ return relationships. Note that the least risky bonds have a negative yield!

Exhibit 2: 10-year government bond yields for the selected countries as at April 17, 20192

Exhibit 3: Selected corporate bond yields as at April 17, 20194

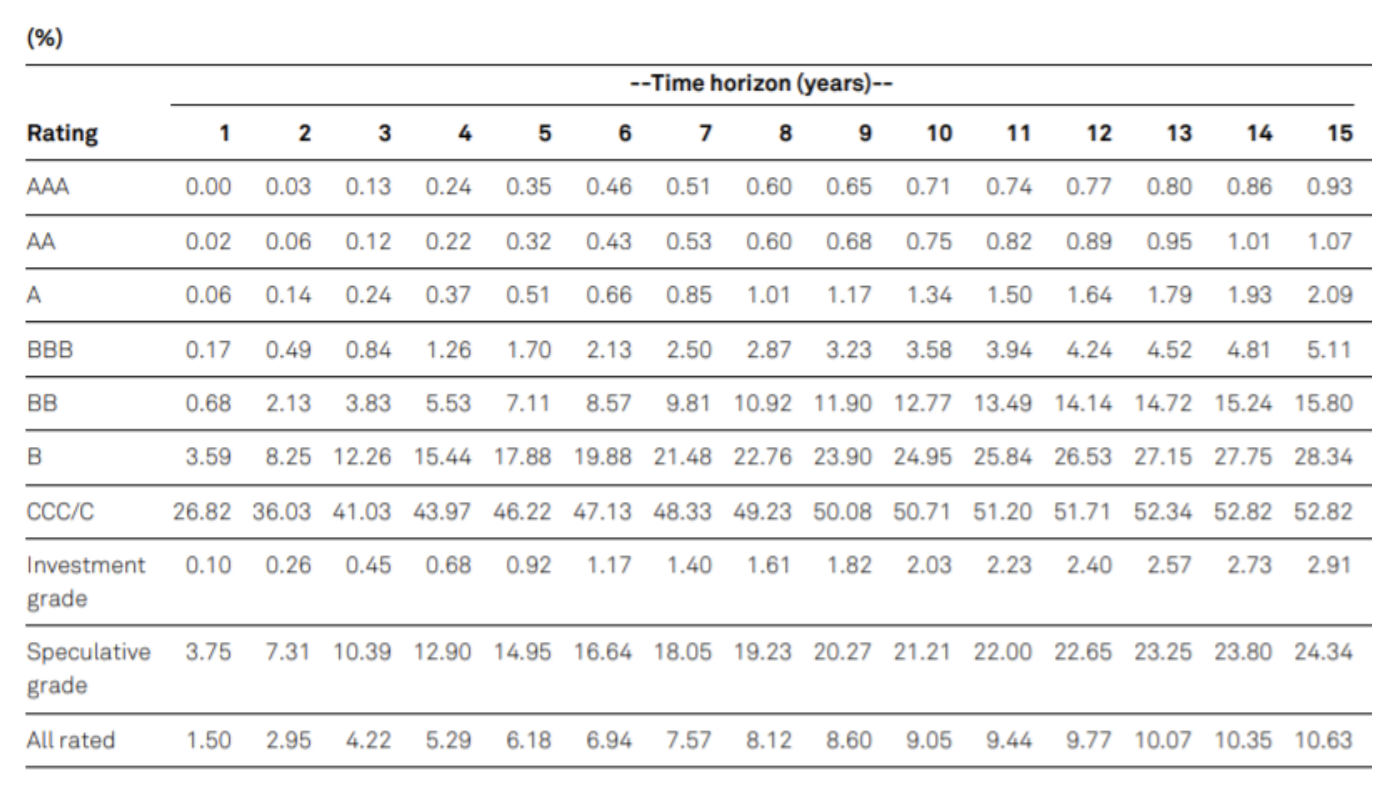

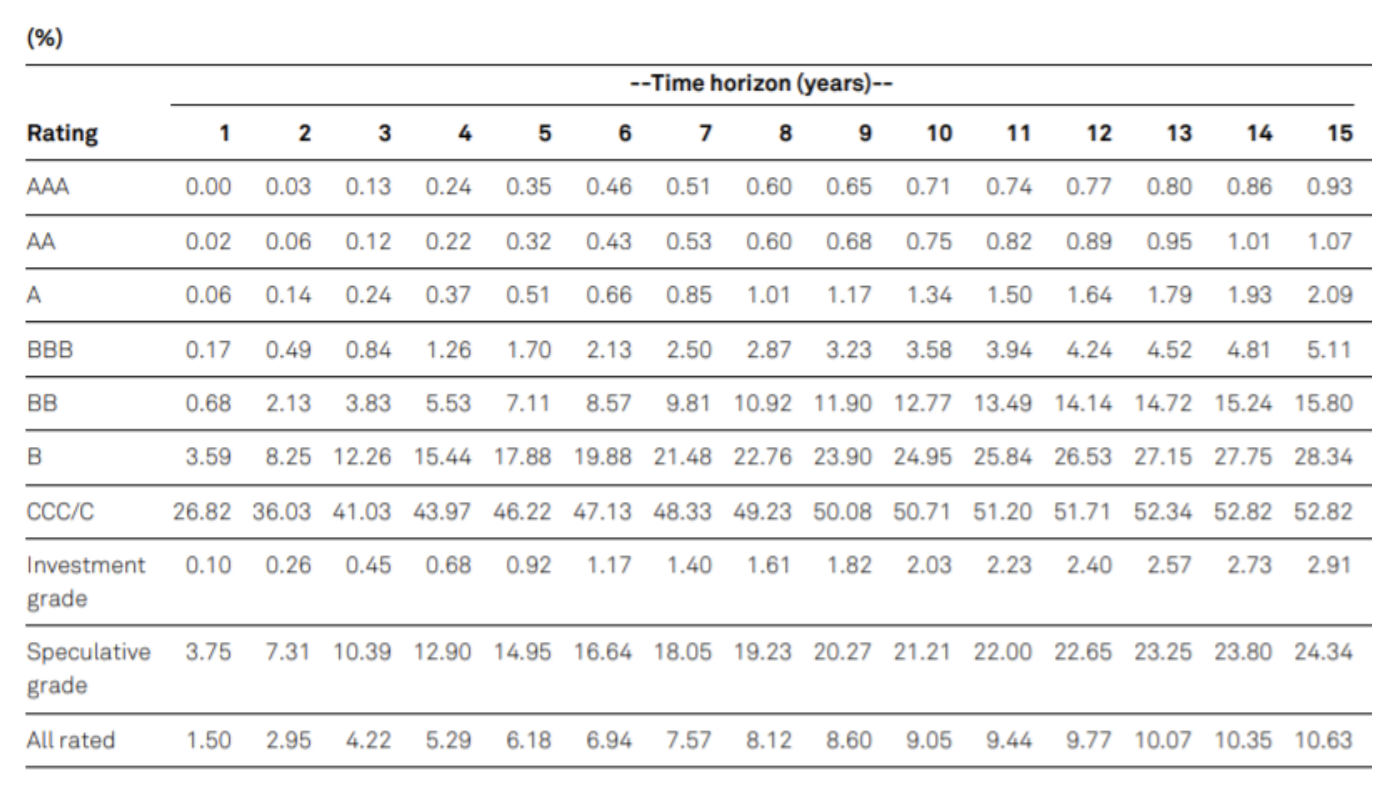

So how often do bonds default? A summary overview is provided by the following chart:

Exhibit 4: Global Average Cumulative Default Rates5

In other words, higher grade and shorter-term bonds default quite seldom. Only 2% of investment grade bonds (e.g. credit rating of Baa3/BBB- and higher) are expected to default under a 10 year time horizon.

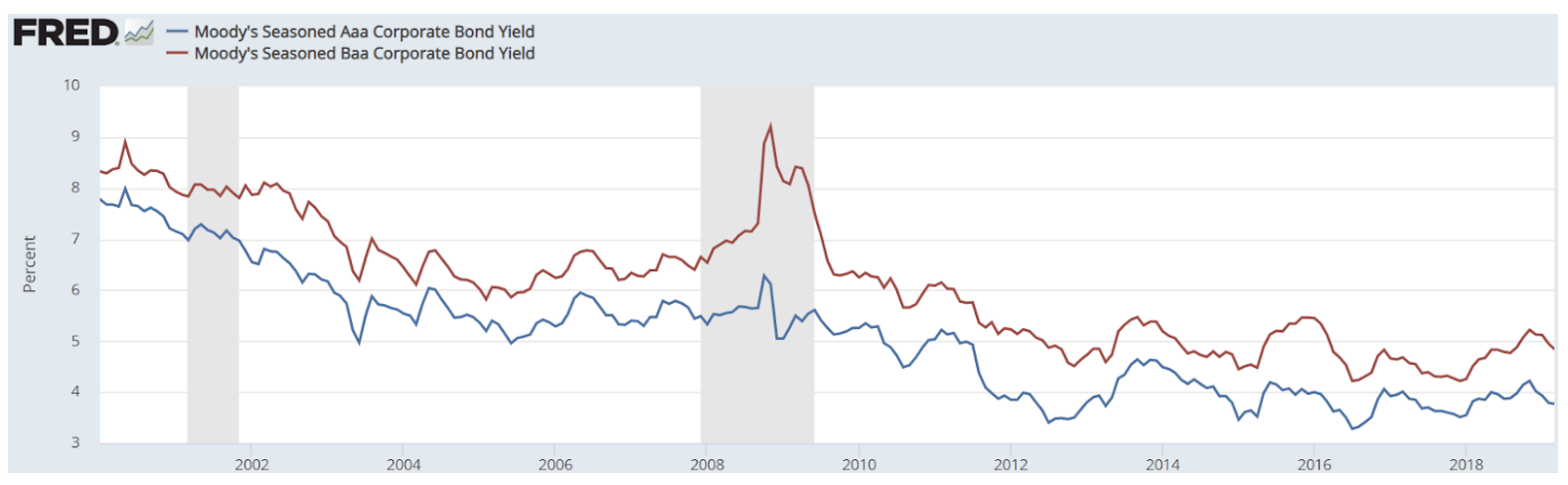

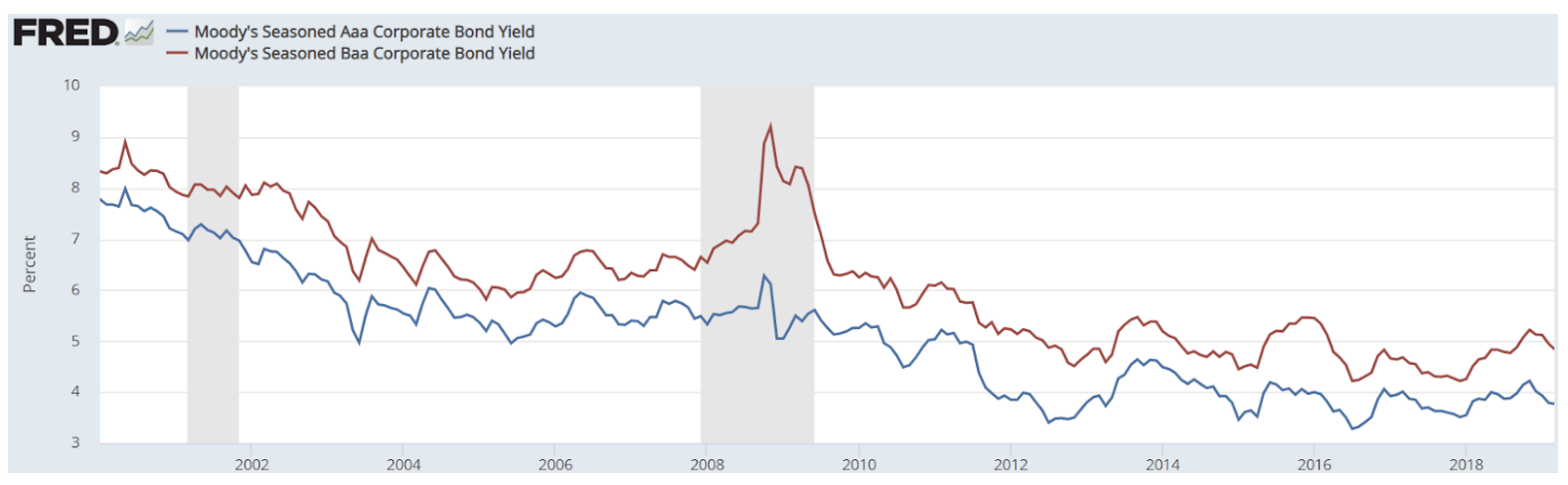

As the following chart indicates, yields fluctuate over time:

Exhibit 5: Moody’s Seasoned Aaa and Baa Corporate Bond Yields6

In other words, higher grade and shorter-term bonds default quite seldom. Only 2% of investment grade bonds (e.g. credit rating of Baa3/BBB- and higher) are expected to default under a 10 year time horizon.

As the following chart indicates, yields fluctuate over time:

Exhibit 5: Moody’s Seasoned Aaa and Baa Corporate Bond Yields6

Since the end of the last financial crises, yields on Aaa bonds have fluctuated between 3-5% and Baa bonds between 4-7%.

We are not suggesting an investment in bonds is for everyone. (For example, it takes a fair amount of resources to build a balanced portfolio when bonds are typically sold in denominations of USD 100,000). However, we trust we have illustrated the principle that a 6-7% overall yield even in today’s low yield market should be achievable with relatively modest risk, and that bonds of various types should be seriously considered by most investors.

This article is for informational purposes only, not to be construed as investment advice. It is very important to do your own investigation and analysis before making any investments based on your own personal circumstances.

Since the end of the last financial crises, yields on Aaa bonds have fluctuated between 3-5% and Baa bonds between 4-7%.

We are not suggesting an investment in bonds is for everyone. (For example, it takes a fair amount of resources to build a balanced portfolio when bonds are typically sold in denominations of USD 100,000). However, we trust we have illustrated the principle that a 6-7% overall yield even in today’s low yield market should be achievable with relatively modest risk, and that bonds of various types should be seriously considered by most investors.

This article is for informational purposes only, not to be construed as investment advice. It is very important to do your own investigation and analysis before making any investments based on your own personal circumstances.

The good news is that through a diversified medium-risk bond portfolio, it should be possible to generate a return of 6-8% per annum. Rather than you working, let your money work for you!

Part I of this series provided an overview of asset classes; Part II dealt with the size and liquidity of the various public markets in which these asset classes trade. This article zeroes in on bonds, one of the most important asset classes.

On US Bond Market, Treasury Securities (government debt instrument issued by the United States Department of the Treasury) and Corporate Bonds account for 57% of the whole market, with mortgage related securities, municipal bonds, and other more exotic bonds accounting for the balance. Hence, we will focus on treasuries and corporates for the remainder of this article.

A useful tool for determining the likelihood of Government or corporate default is a credit rating. The three major rating agencies are Moody’s, Standard and Poor’s, and Fitch: Exhibit 1: Credit ratings scale1

Each investor who decides to invest in bonds as an asset class should construct his or her own bond portfolio, with the appropriate degree of risk/return relationship. (Usually this would be in conjunction with investing in other asset classes as well).

The next two charts provide (a) a sample of 10-year Government bonds; and (b) a sample various maturities of corporate bonds, just to provide illustrate available of risk/ return relationships. Note that the least risky bonds have a negative yield!

Exhibit 2: 10-year government bond yields for the selected countries as at April 17, 20192

Each investor who decides to invest in bonds as an asset class should construct his or her own bond portfolio, with the appropriate degree of risk/return relationship. (Usually this would be in conjunction with investing in other asset classes as well).

The next two charts provide (a) a sample of 10-year Government bonds; and (b) a sample various maturities of corporate bonds, just to provide illustrate available of risk/ return relationships. Note that the least risky bonds have a negative yield!

Exhibit 2: 10-year government bond yields for the selected countries as at April 17, 20192

| Country | S&P Rating | 10Y Yield | Spread vs Germany Bund | Spread vs Treasury Note |

| Australia | AAA | 1.960% | 189.2 bp | -63.8 bp |

| Austria | AA+ | 0.361% | 29.3 bp | -223.7 bp |

| Canada | AAA | 1.783% | 171.5 bp | -81.5 bp |

| Chile | A+ | 4.130% | 406.2 bp | 153.2 bp |

| China | A+ | 3.429% | 336.1 bp | 83.1 bp |

| Czech Republic | AA- | 1.854% | 178.6 bp | -74.4 bp |

| Egypt | B | 16.330% | 1626.2 bp | 1373.2 bp |

| France | AA | 0.420% | 35.2 bp | -217.8 bp |

| Germany | AAA | 0.068% | 0.0 bp | -253.0 bp |

| Greece | B+ | 3.362% | 329.4 bp | 76.4 bp |

| Hungary | BBB | 3.290% | 322.2 bp | 69.2 bp |

| India | BBB- | 7.390% | 732.2 bp | 479.2 bp |

| Indonesia | BBB- | 7.629% | 756.1 bp | 503.1 bp |

| Italy | BBB | 2.592% | 252.4 bp | -0.6 bp |

| Japan | A+ | -0.019% | -8.7 bp | -261.7 bp |

| Nigeria | B | 14.347% | 1427.9 bp | 1174.9 bp |

| Poland | A- | 2.873% | 280.5 bp | 27.5 bp |

| Russia | BBB- | 8.250% | 818.2 bp | 565.2 bp |

| South Africa | BB | 8.500% | 843.2 bp | 590.2 bp |

| Spain | A- | 1.086% | 101.8 bp | -151.2 bp |

| Switzerland | AAA | -0.252% | -32.0 bp | -285.0 bp |

| Turkey | B+ | 17.590% | 1752.2 bp | 1499.2 bp |

| United Kingdom | AA | 1.222% | 115.4 bp | -137.6 bp |

| United States | AA+ | 2.598% | 253.0 bp | 0.0 bp |

| Issuer | Symbol | Coupon | Maturity | S&P Rating | Yield | Category |

| Microsoft Corp | MSFT4451226 | 4.500 | 02/06/2057 | AAA | 3.853 | Prime |

| Berkshire Hathaway Fin Corp | BRK3677309 | 5.750 | 01/15/2040 | AA | 4.065 | High Grade |

| Apple Inc | AAPL4336433 | 4.650 | 02/23/2046 | AA+ | 3.943 | High Grade |

| Cargill Inc | CARG.HY | 6.125 | 04/19/2034 | A | 4.651 | Upper Medium Grade |

| Boeing Company | BA.IS | 7.875 | 04/15/2043 | A | 4.520 | Upper Medium Grade |

| AT&T Inc | T4621935 | 5.300 | 08/15/2058 | BBB | 5.942 | Lower Medium Grade |

| Delta Air Lines Inc | DAL4277696 | 4.250 | 01/30/2025 | BBB+ | 3.835 | Lower Medium Grade |

| Dell Inc | DELL.GR | 6.500 | 04/15/2038 | BB- | 6.414 | Speculative |

| Netflix Inc | NFLX4556816 | 4.875 | 04/15/2028 | BB- | 5.756 | Speculative |

| Frontier Communications Corp | FTR4609188 | 8.500 | 04/01/2026 | B | 9.784 | Highly Speculative |

| Mattel Inc | MAT.HG | 5.450 | 11/01/2041 | B+ | 7.978 | Highly Speculative |

| Tesla Inc | TSLA4530906 | 5.300 | 08/15/2025 | – (Moody’s Caa1) | 8.318 | Substantial Risk |

| Bombardier | BDRB3705506 | 7.450 | 05/01/2034 | – (Moody’s Caa1) | 7.088 | Substantial Risk |

In other words, higher grade and shorter-term bonds default quite seldom. Only 2% of investment grade bonds (e.g. credit rating of Baa3/BBB- and higher) are expected to default under a 10 year time horizon.

As the following chart indicates, yields fluctuate over time:

Exhibit 5: Moody’s Seasoned Aaa and Baa Corporate Bond Yields6

In other words, higher grade and shorter-term bonds default quite seldom. Only 2% of investment grade bonds (e.g. credit rating of Baa3/BBB- and higher) are expected to default under a 10 year time horizon.

As the following chart indicates, yields fluctuate over time:

Exhibit 5: Moody’s Seasoned Aaa and Baa Corporate Bond Yields6

Since the end of the last financial crises, yields on Aaa bonds have fluctuated between 3-5% and Baa bonds between 4-7%.

We are not suggesting an investment in bonds is for everyone. (For example, it takes a fair amount of resources to build a balanced portfolio when bonds are typically sold in denominations of USD 100,000). However, we trust we have illustrated the principle that a 6-7% overall yield even in today’s low yield market should be achievable with relatively modest risk, and that bonds of various types should be seriously considered by most investors.

This article is for informational purposes only, not to be construed as investment advice. It is very important to do your own investigation and analysis before making any investments based on your own personal circumstances.

Since the end of the last financial crises, yields on Aaa bonds have fluctuated between 3-5% and Baa bonds between 4-7%.

We are not suggesting an investment in bonds is for everyone. (For example, it takes a fair amount of resources to build a balanced portfolio when bonds are typically sold in denominations of USD 100,000). However, we trust we have illustrated the principle that a 6-7% overall yield even in today’s low yield market should be achievable with relatively modest risk, and that bonds of various types should be seriously considered by most investors.

This article is for informational purposes only, not to be construed as investment advice. It is very important to do your own investigation and analysis before making any investments based on your own personal circumstances.

1Learn Bonds, https://learnbonds.com/6891/bond-credit-ratings-table/

2World Government Bonds, http://www.worldgovernmentbonds.com/

3 Basis point. One basis point is equal to 1/100th of 1%, or 0.01% 4Finra – Bonds, http://finra-markets.morningstar.com/BondCenter/Default.jsp

5S&P, 2017 Annual Global Corporate Default Study

6Fred Economic Data

2World Government Bonds, http://www.worldgovernmentbonds.com/

3 Basis point. One basis point is equal to 1/100th of 1%, or 0.01% 4Finra – Bonds, http://finra-markets.morningstar.com/BondCenter/Default.jsp

5S&P, 2017 Annual Global Corporate Default Study

6Fred Economic Data