In my opinion, the macro environment is riskier than before the Dotcom Bubble and before the Great Financial Bubble. Why? A nasty cocktail of factors which may reinforce each other:

The trillion dollar question is when the US Fed will pivot from Quantitative Tightening (QT) to Quantitative Easing (QE). It is the high levels of debt that could make the next crash the most dramatic of this century.

Powell seems to think that there is a feedback loop, whereby high interest rates are enough to drive down inflation. But what if other things (increased money supply, supply bottlenecks, inflation expectations, etc.) keep inflation from responding? The economy may crash before inflation comes down.

Think of a dry forest with an accumulation of flammable undergrowth. There may never be a forest fire; but one tiny spark has the potential to cause a conflagration.

- Jerome Powell declared he wants to see a trend of lower consumer price index (CPI) data before the Fed takes the foot off the monetary tightening pedal. The Fed calling itself “data dependent” is like driving using the rear view mirror. The Fed intends to continue to raise interest rates until data, which is by definition lagged, shows a favorable CPI trend.

- What if raising interest rates kills demand, but not inflation? Then the Fed continues to tighten, literally until something breaks.

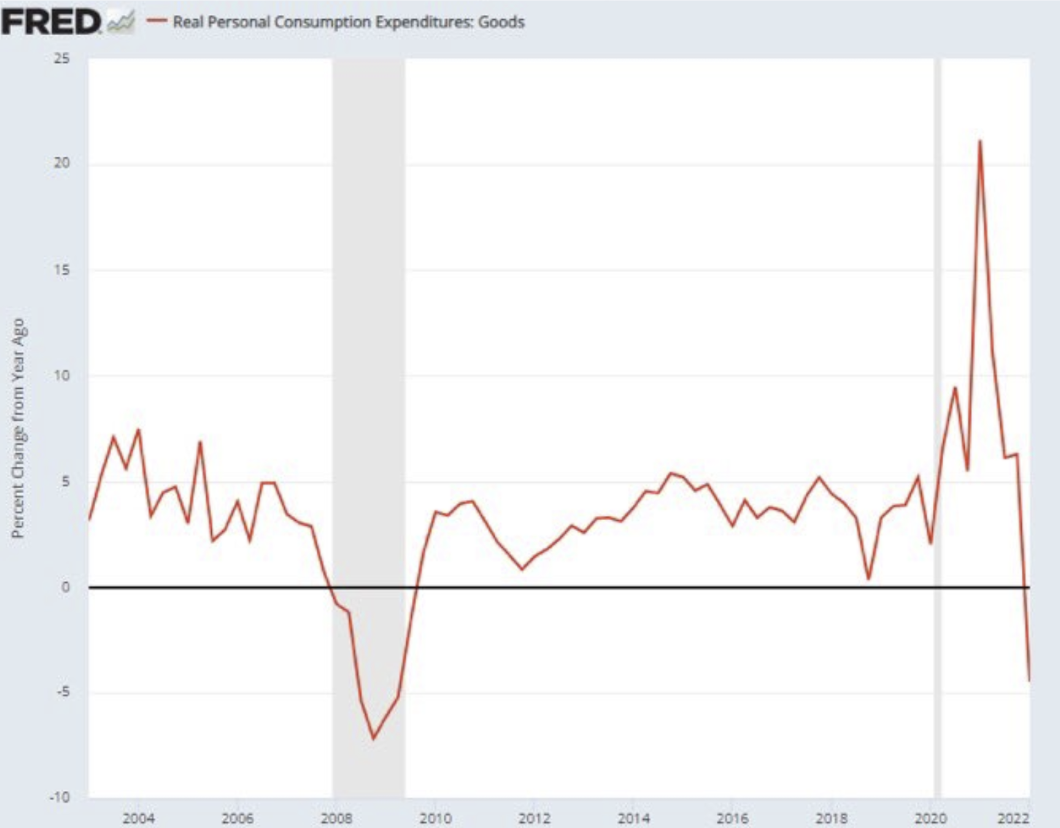

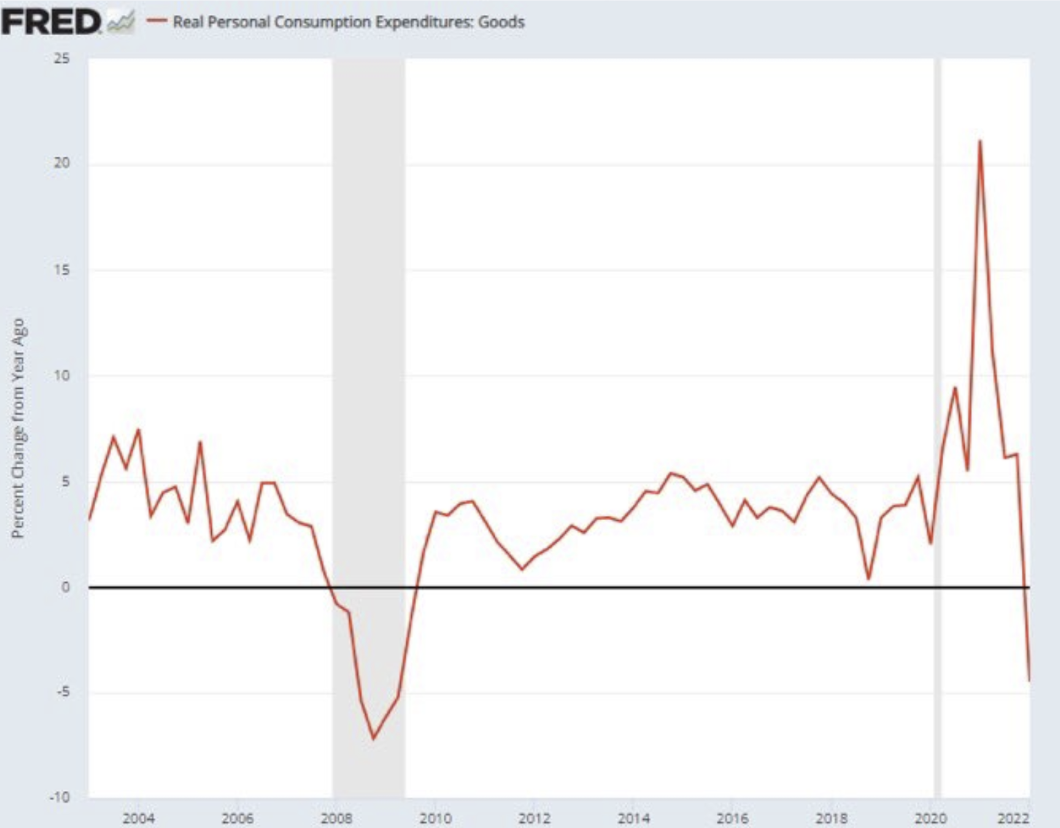

- Consumer expenditures are falling off a cliff.

- Both bond and equity markets have had their worst half year since the Great Depression.

- Jerome Powell seems to think he can “do a Volcker” and tame inflation. But the world is very different place than under Volcker: US Government debt is at 120% of GDP, compared to 40% under Volcker, making the US Government far less able to withstand high interest rates. Individual, corporate and government debt have seen similar increases the world over, making the world ever-so-fragile.

- The number of emerging market countries experiencing crisis is increasing by the month. High US interest rates are sucking moneys out of emerging markets into the US. This is because much of the emerging market debt is denominated in USD, making it harder to service given higher US interest rates and a higher US dollar.

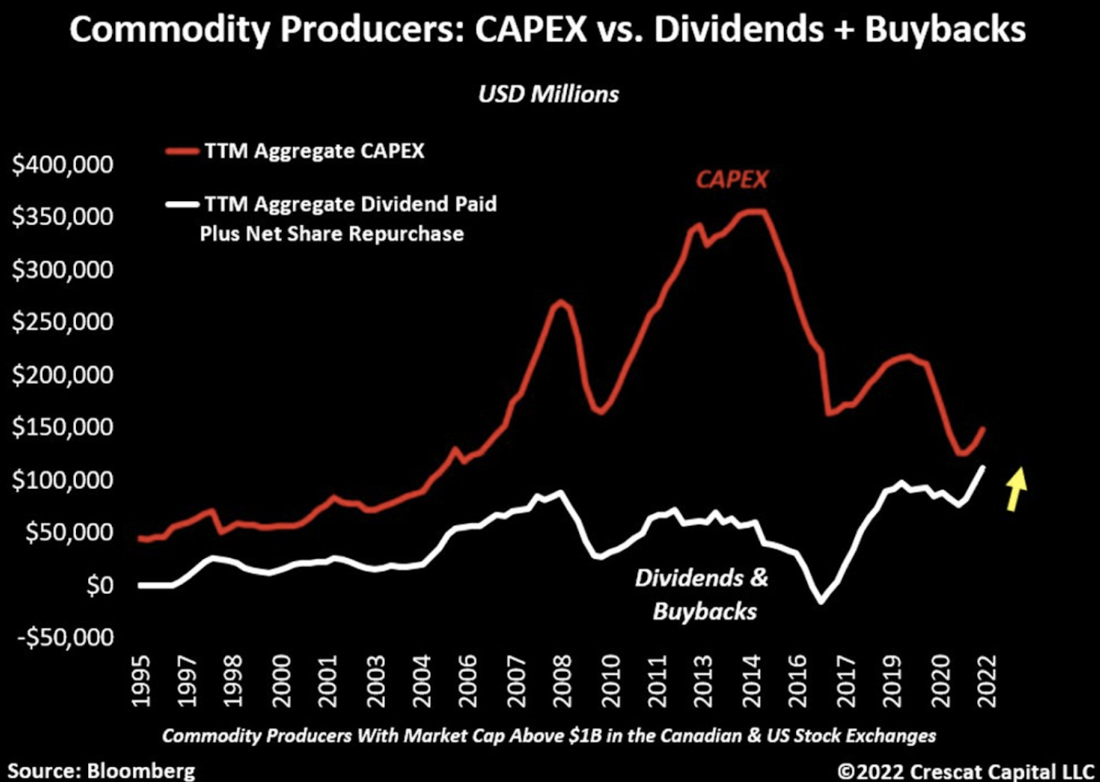

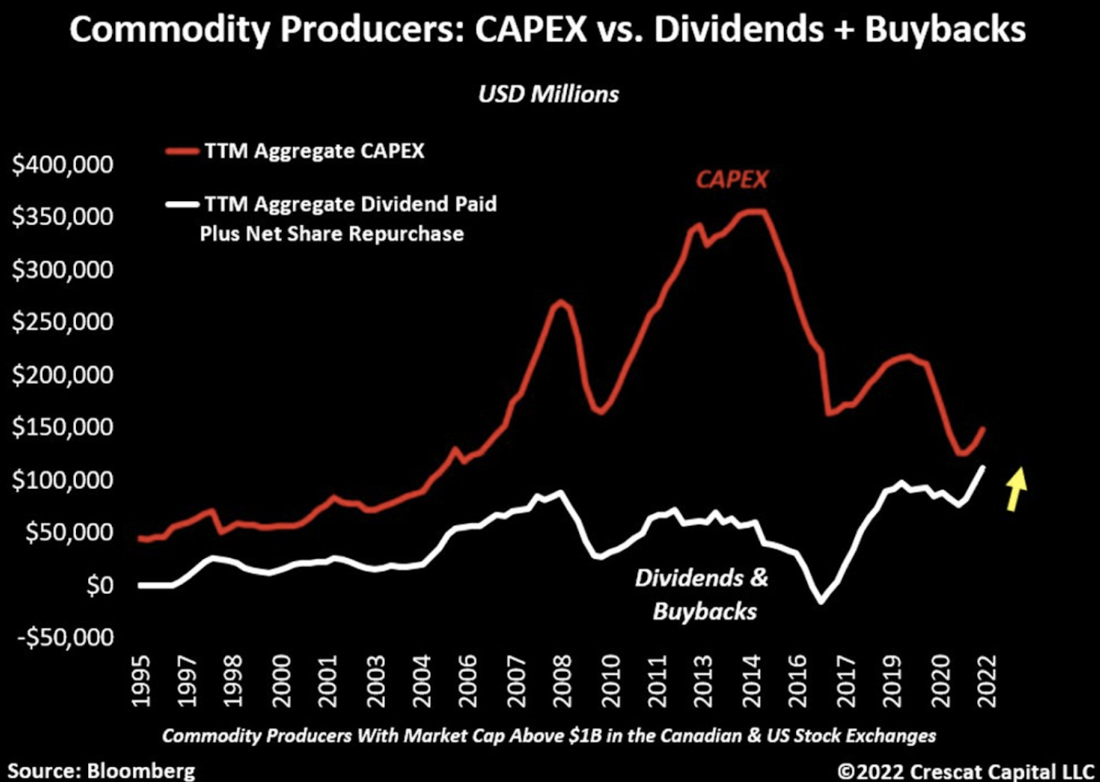

- While oil and many other commodity prices have dipped a bit, prices remain very high by historic standards. In addition, underinvestment in energy and commodities has been so severe that it has created capacity constraints.

- It will take many years to bring on new supplies. Tight supply conditions will continue to buoy prices, with the potential for price surges upon disruption.

- Wholesale electricity prices in Europe are going through the roof.

- High electricity prices (above) and gas prices (at quadruple the US prices) due to the war in Ukraine, are contributing to Germany’s loss of competitiveness, which cannot fuel its export machine. Indeed, for the first time in over 30 years, Germany had a trade deficit. The German economic model is based on cheap Russian energy. Germany willingly threw away the option of nuclear diversification, shutting its nuclear plants.

- A total disruption of Russian hydrocarbon supplies to Europe is now a very real scenario, and would make matters worse.

- Inventory shortages and supply side disruptions in the fertilizer and food sectors risk creating famine, further price spirals, and political unrest. Inventories of key commodities like wheat are extremely low.

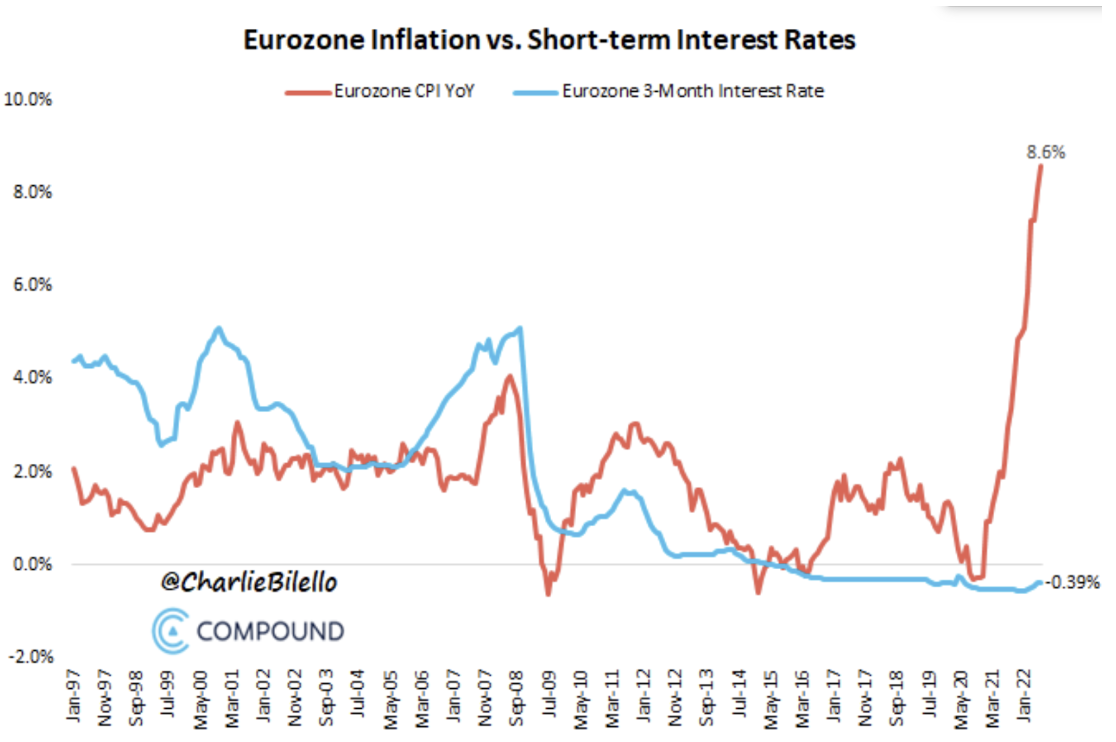

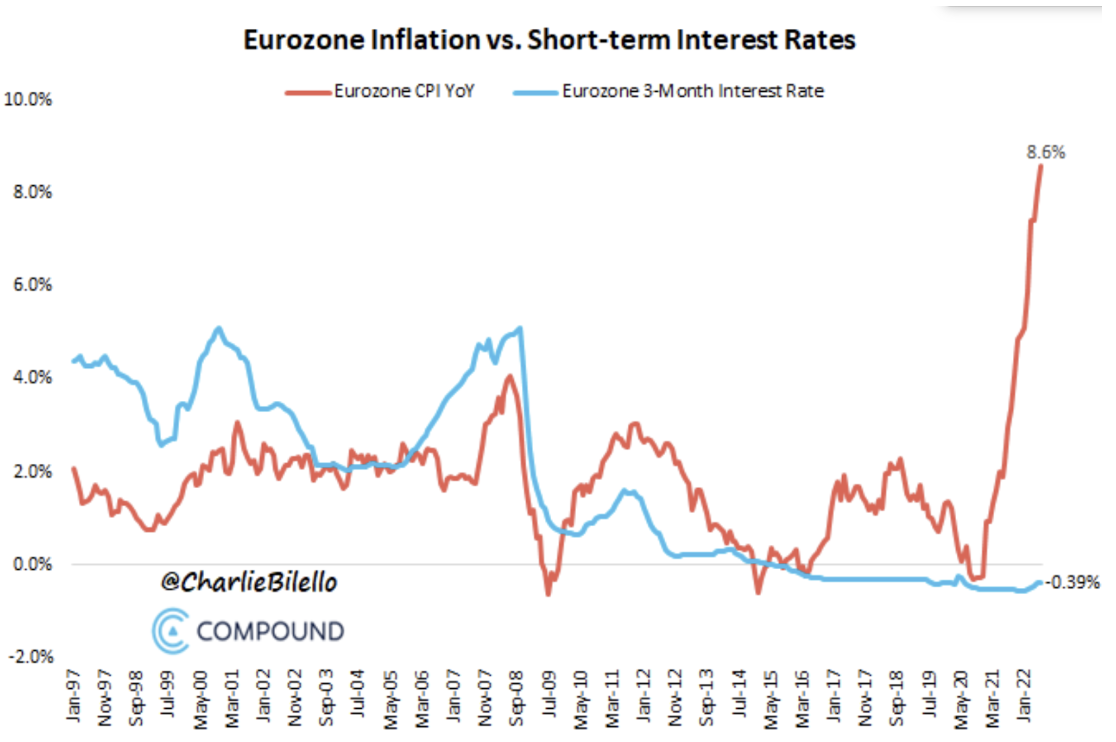

- Despite Quantitative Tightening (QT) in the US already having caused so much pain, real interest rates in the US and Europe remain high, and in the case of Europe, the trend is frightening.

- The European Central Bank is in a “damned if you do, damned if you don’t” dilemma. It desperately needs to raise interest rates. However, raising interest rates would put strain on the periphery (e.g. Italy) and further dampen GDP growth.

- On top of all this, we have the consequences and uncertainties from the Covid-19 pandemic and the Ukraine War. Epidemiologists are again raising concerns about the newest variants, while Putin just keeps escalating.

- The above list is far from exhaustive. There are many other vulnerabilities. Certain European banks have equity to asset ratios below 3%. Demonstrations are going on by deposit holders in China who cannot withdraw deposits since April. Meanwhile, Evergrande’s default on over $300 billion of debt continues to work its way through the system.

The trillion dollar question is when the US Fed will pivot from Quantitative Tightening (QT) to Quantitative Easing (QE). It is the high levels of debt that could make the next crash the most dramatic of this century.

Powell seems to think that there is a feedback loop, whereby high interest rates are enough to drive down inflation. But what if other things (increased money supply, supply bottlenecks, inflation expectations, etc.) keep inflation from responding? The economy may crash before inflation comes down.

Think of a dry forest with an accumulation of flammable undergrowth. There may never be a forest fire; but one tiny spark has the potential to cause a conflagration.