Over the past month, I have travelled within North America and Western Europe, met quite a few people, including senior bankers, and have been generally surprised by the feeling of ‘business as usual’.

Very little sense of impending doom or recession. Reasons given include:

After stating that inflation was not a threat, then calling it “transitory”, Secretary Yellen admitted that she was wrong in her assessment of inflation (a welcome step), but went on to state: “I do not expect inflation to remain high, although I very much HOPE that it will be coming down now”. Since when is hope a strategy?

After stating that inflation was not a threat, then calling it “transitory”, Secretary Yellen admitted that she was wrong in her assessment of inflation (a welcome step), but went on to state: “I do not expect inflation to remain high, although I very much HOPE that it will be coming down now”. Since when is hope a strategy?

As explained in a previous article, I expect the Fed to tighten until something breaks (e.g. major market crash or credit markets freeze up, etc.) and then to begin their fifth Quantitative Easing (QE) program.

As Peter Schiff stated: “The most important mistake investors [and I might add: Central Banks] are making is thinking that a recession will solve the inflation problem. In reality, it will make it worse. When the Fed pivots and launches QE5 to stimulate the economy, the dollar will tank, accelerating the increase in consumer prices.”

As macro strategist Lyn Alden recently stated, there are two major supply side factors redefining the world economy today:

Of course globally high debt levels (Government, corporations individuals—for a grand total of over USD $350 trillion) add to global economic fragility, and less ability to tolerate higher interest rates.

This article is for educational purposes only and must not be construed as investment advice. Investors should obtain their own investment advice.

- strength in the US job market;

- High aggregate savings and bank deposit levels of US consumers.

- US Federal deficit has decreased to $1.1 trillion in May 2022, down from a peak of $4.3 trillion in March 2021 (measured on a 12 months trailing basis).

- The Michigan consumer confidence index at its lowest since 1980.

- The distribution of those savings is skewed. 60% of Americans have little or no savings.

- Jobs reporting is with a lag, and the number of unemployed is already starting to notch upwards.

- Q1 nominal growth in the US was already -1.5%.

- The S&P is down 18.2% in the first 111 trading days of 2022, the fourth worth performance since 1932–diminishing consumer and investor confidence.

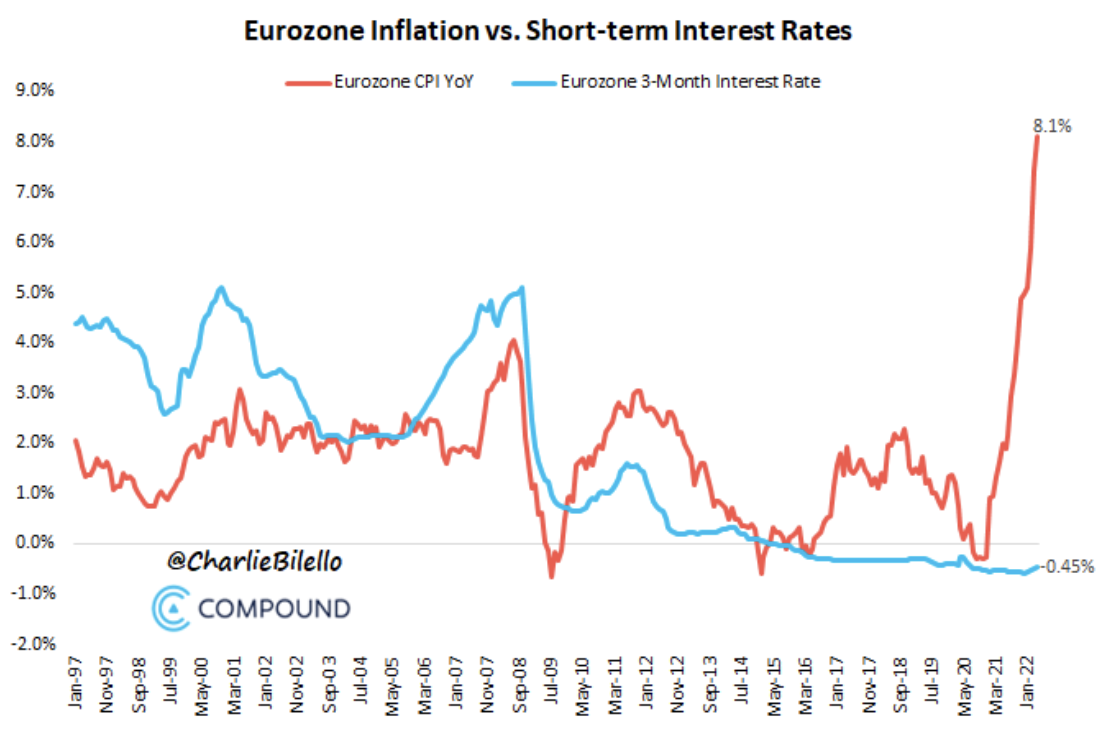

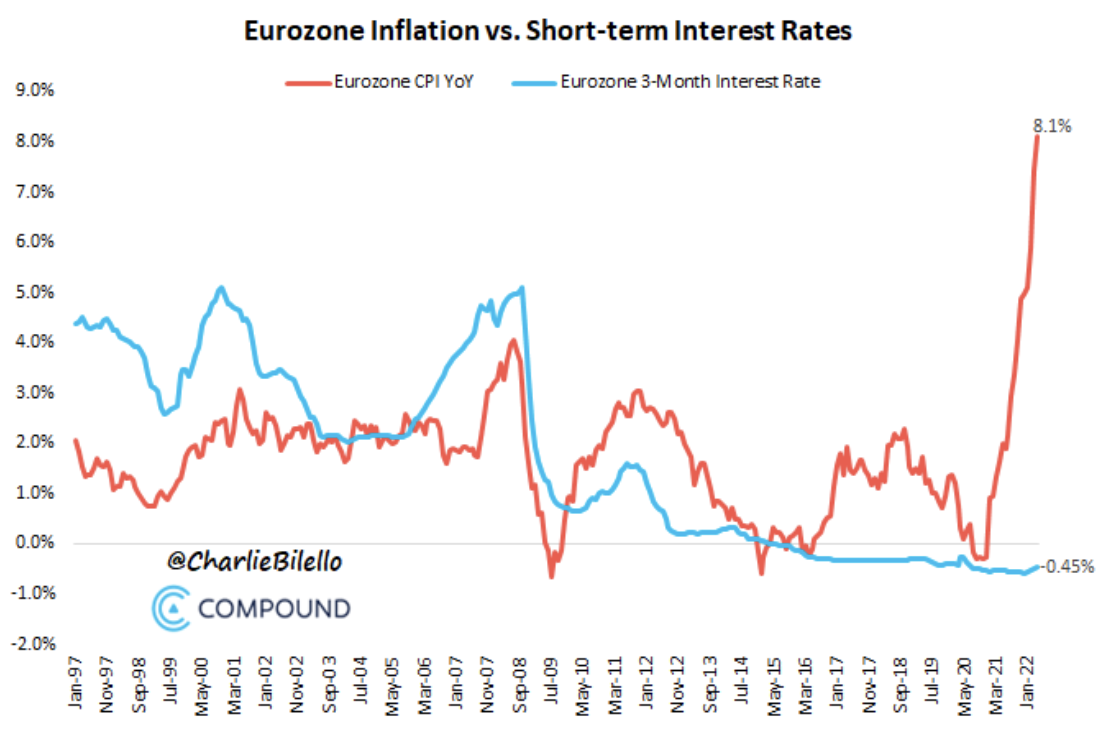

- Inflation continues to increase in most countries in the world, raising the likelihood of further rate increases and the specter of further economic slowdown and decline in stock market indices.

- Bond yields are generally increasing rapidly worldwide (e.g. in Germany from negative a year ago to over 1.5% on June 10), with yields on the EU periphery rising even faster (e.g. a year ago 10 year Italian bonds yields were about a percent higher than German bonds, today they are over two percent higher). 10 Year Italian bond yield have risen from 1% at the beginning of 2022 to 3,86% on June 1, despite massive bond buying from the ECB. While most believe the ECB will do “whatever it takes to save the euro” (as Mario Draghi famously said in 2012, turning the tide on the then euro crisis), the magnitude and speed of movement in Italian bond rates is cause for worry.

After stating that inflation was not a threat, then calling it “transitory”, Secretary Yellen admitted that she was wrong in her assessment of inflation (a welcome step), but went on to state: “I do not expect inflation to remain high, although I very much HOPE that it will be coming down now”. Since when is hope a strategy?

After stating that inflation was not a threat, then calling it “transitory”, Secretary Yellen admitted that she was wrong in her assessment of inflation (a welcome step), but went on to state: “I do not expect inflation to remain high, although I very much HOPE that it will be coming down now”. Since when is hope a strategy?As explained in a previous article, I expect the Fed to tighten until something breaks (e.g. major market crash or credit markets freeze up, etc.) and then to begin their fifth Quantitative Easing (QE) program.

As Peter Schiff stated: “The most important mistake investors [and I might add: Central Banks] are making is thinking that a recession will solve the inflation problem. In reality, it will make it worse. When the Fed pivots and launches QE5 to stimulate the economy, the dollar will tank, accelerating the increase in consumer prices.”

As macro strategist Lyn Alden recently stated, there are two major supply side factors redefining the world economy today:

- For at least the past decade, there has been massive underinvestment in energy. Hydrocarbon drilling has plummeted. The Keystone pipeline was cancelled. Uranium programs have been shuttered (e.g. Germany); no new uranium mining capacity developed since Fukushima. Meanwhile, insufficient supply of minerals required for alternative energy development (nickel, lithium, copper, etc.) constrains capacity.

- For decades, the global value chain was optimized for efficiency. Since the Ukraine war, priorities have changed, and the priority suddenly became security of supply. Manufacturing closer to home, holding more inventory, etc. requires massive investment, and contributes to considerable price increases.

Of course globally high debt levels (Government, corporations individuals—for a grand total of over USD $350 trillion) add to global economic fragility, and less ability to tolerate higher interest rates.

This article is for educational purposes only and must not be construed as investment advice. Investors should obtain their own investment advice.