Even if you do not own Treasuries, rising Treasury rates is arguably the most important event in financial markets this year so far.

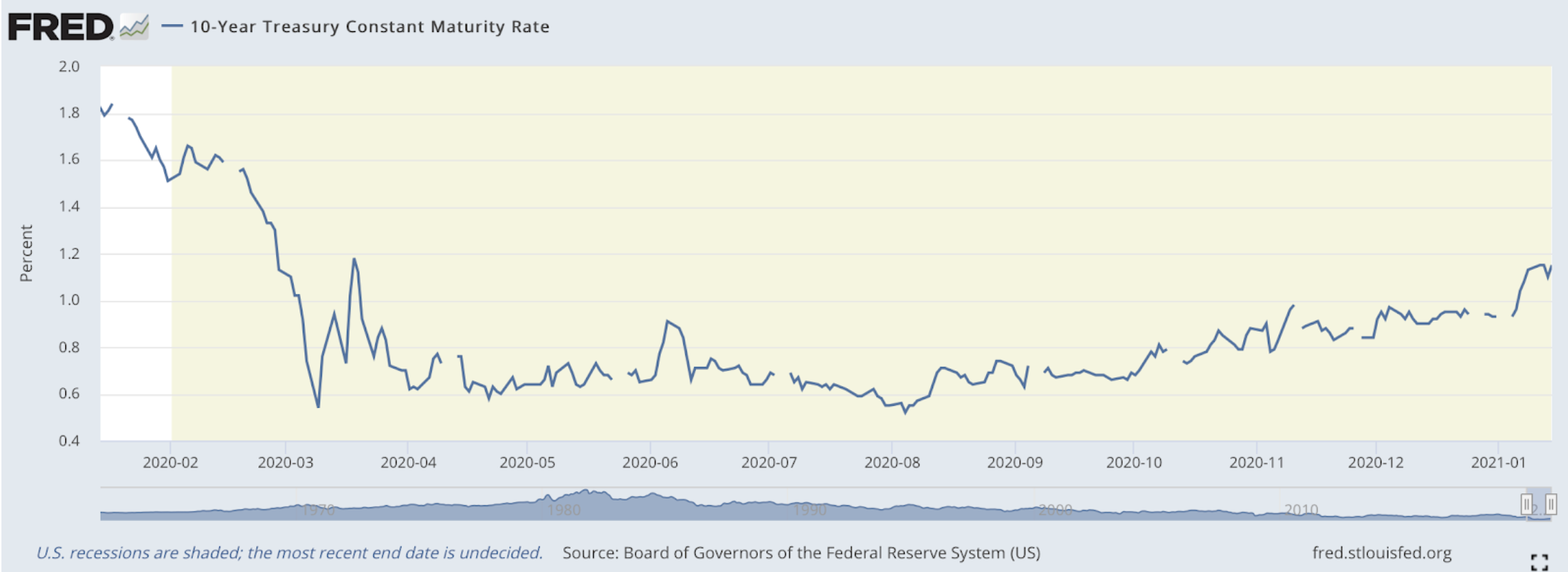

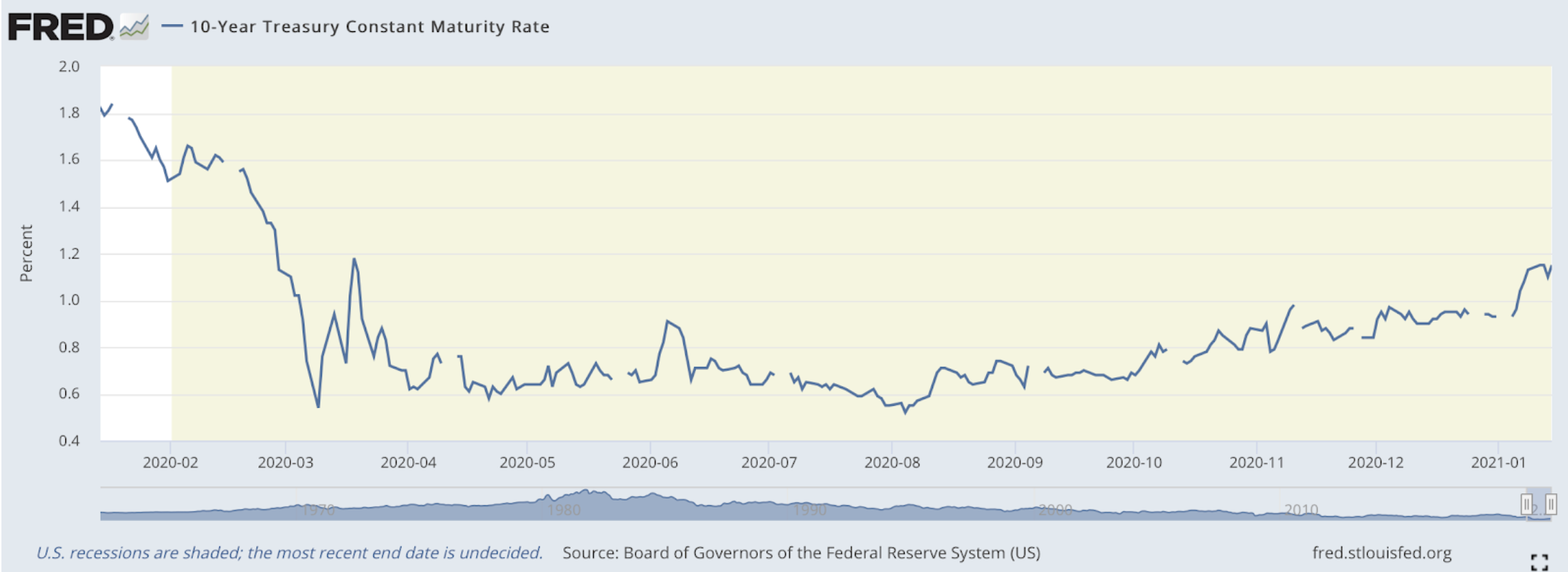

10Y Treasuries bounced from a low of 0.52% on August 5, 2020, to 1.15% on January 15, 2021:

US 10 Year Treasury Rates:

So why is this so significant?

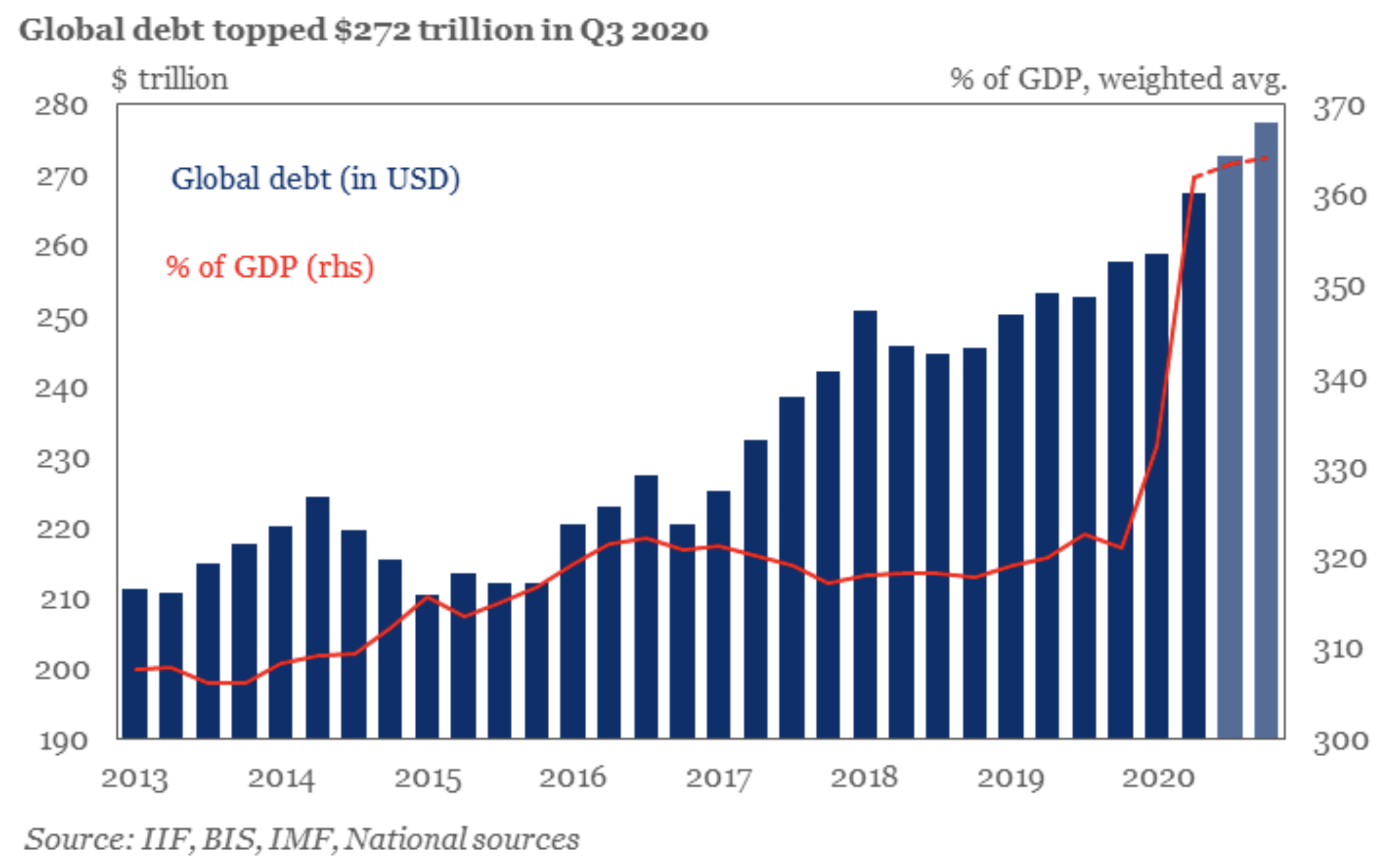

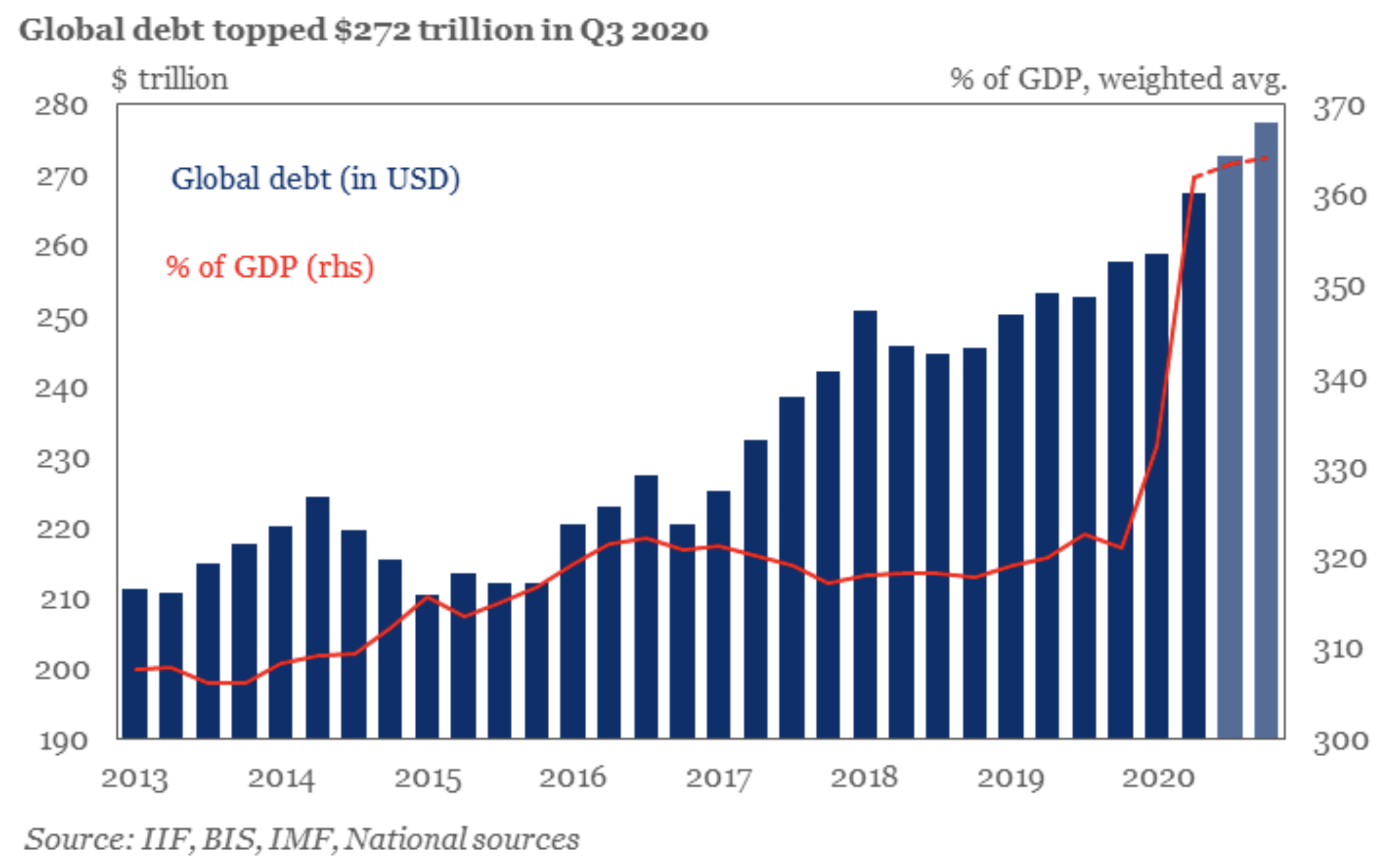

First, it signals an increase in financing costs, not just of Government debt, but for housing, corporations, mortgages, etc. When there are such massive amounts of Government, corporate and individual debt, both in the US and worldwide, any increase in financing costs sucks oxygen from the economy. Just to put this into perspective, US Government revenues are USD 3.3 trillion per annum, and the US has some USD 27 trillion of debt and potentially USD 100 trillion plus of off balance sheet liabilities (pensions, etc.)1. Global debt has surpassed USD 270 trillion, some 370% of global GDP:

So why is this so significant?

First, it signals an increase in financing costs, not just of Government debt, but for housing, corporations, mortgages, etc. When there are such massive amounts of Government, corporate and individual debt, both in the US and worldwide, any increase in financing costs sucks oxygen from the economy. Just to put this into perspective, US Government revenues are USD 3.3 trillion per annum, and the US has some USD 27 trillion of debt and potentially USD 100 trillion plus of off balance sheet liabilities (pensions, etc.)1. Global debt has surpassed USD 270 trillion, some 370% of global GDP:

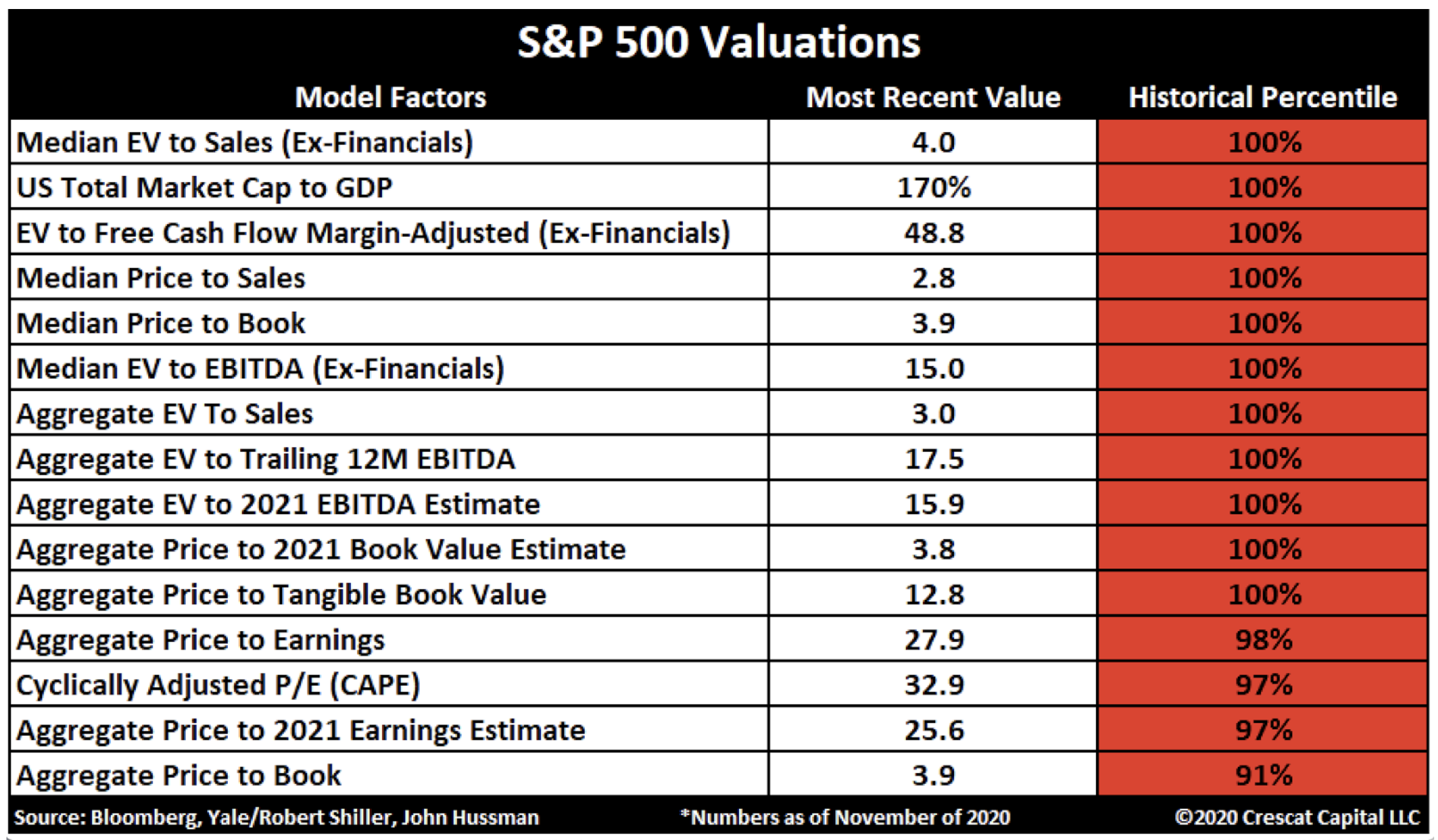

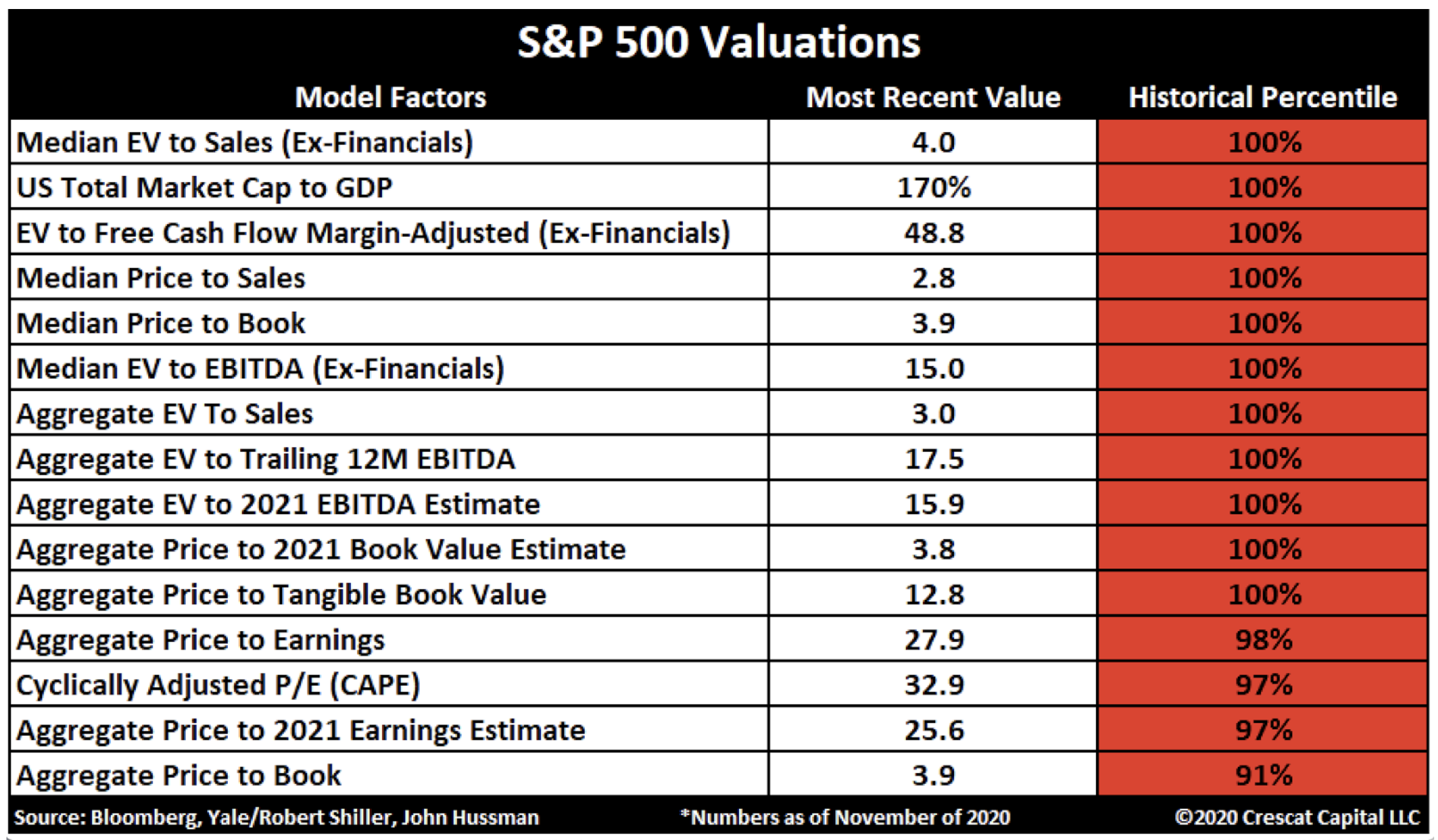

The second reason is that rising interest rates would affect asset valuations—which are exploding in the current market. The following chart shows how the S&P index is in record territory, by just about any metric:

The second reason is that rising interest rates would affect asset valuations—which are exploding in the current market. The following chart shows how the S&P index is in record territory, by just about any metric:

Other stock exchanges, both in the US and globally, are heading into similar record territory, as are various commodities, real estate in several markets, etc. The only possible justification for such valuations are the record low interest rates. As interest rates rise, valuations will become ever so more fragile. Markets may experience what I call a “road runner” moment: as the cartoon character runs over the cliff, he treads on thin air for a while; when he looks down, crashes.

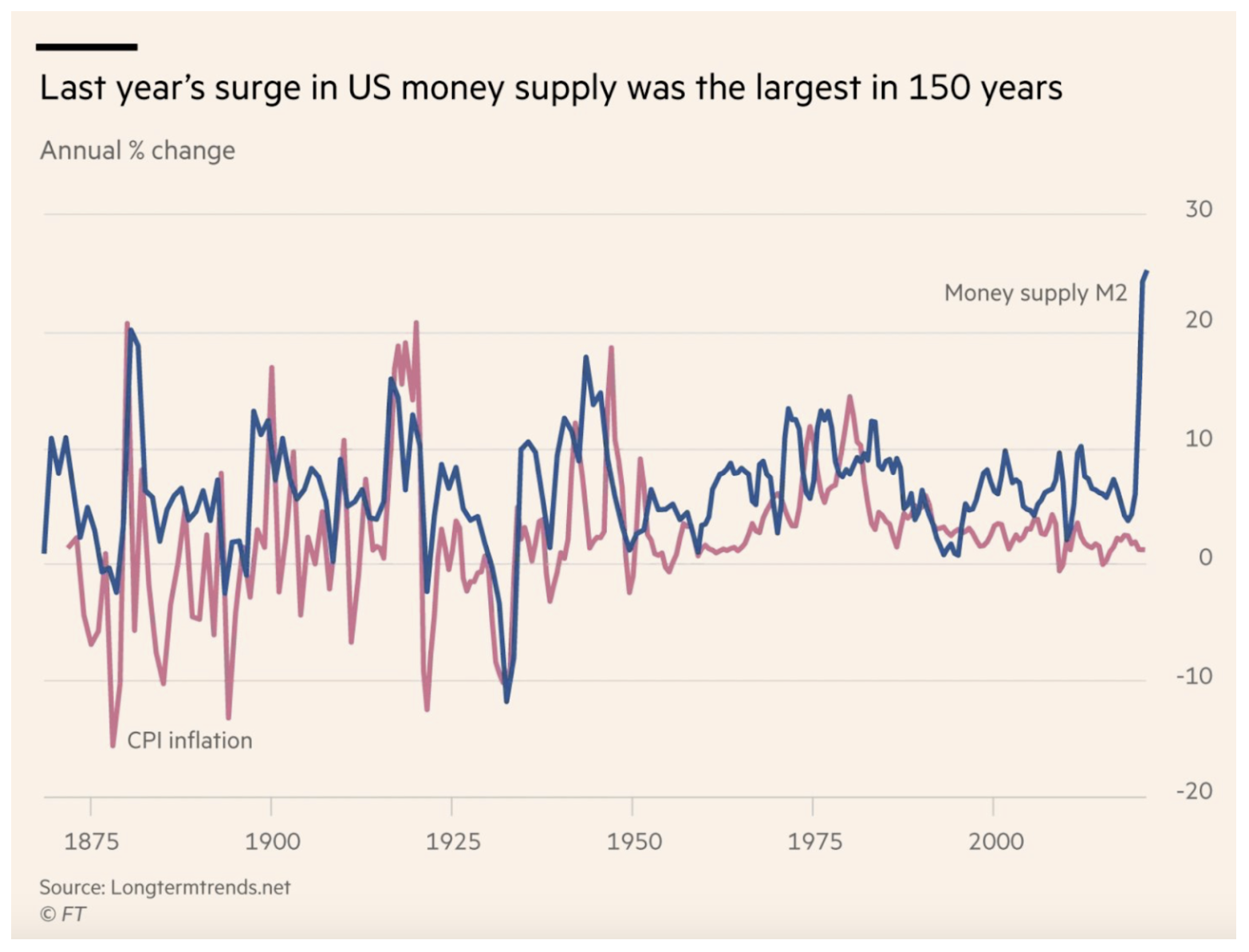

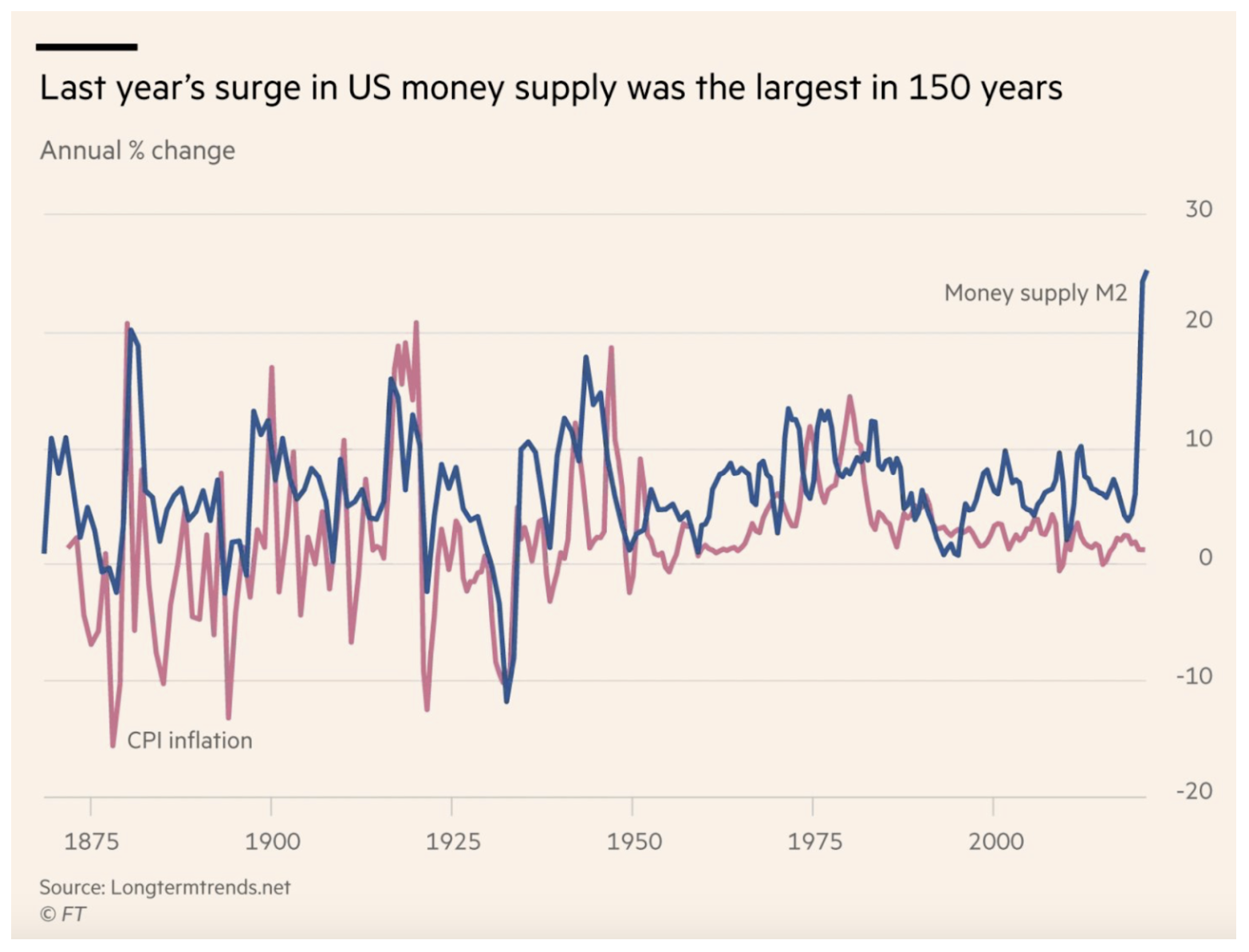

Third, one should look at the reason for the increase: increase in inflation expectations driven by a massive double whammy of record monetary and fiscal stimulus:

Other stock exchanges, both in the US and globally, are heading into similar record territory, as are various commodities, real estate in several markets, etc. The only possible justification for such valuations are the record low interest rates. As interest rates rise, valuations will become ever so more fragile. Markets may experience what I call a “road runner” moment: as the cartoon character runs over the cliff, he treads on thin air for a while; when he looks down, crashes.

Third, one should look at the reason for the increase: increase in inflation expectations driven by a massive double whammy of record monetary and fiscal stimulus:

Monetary stimulus will likely be even larger in 2021. The Fed needs to refinance some USD 7 trillion in maturing debt this year, and will need to fund the USD 2 trillion stimulus program announced by Biden as well as many other new programs. Many market watchers (including one of my former blogs) have discussed how this is likely to feed inflation in the mid- to long-term, once we have the deflationary forces of covid behind us.

Monetary stimulus will likely be even larger in 2021. The Fed needs to refinance some USD 7 trillion in maturing debt this year, and will need to fund the USD 2 trillion stimulus program announced by Biden as well as many other new programs. Many market watchers (including one of my former blogs) have discussed how this is likely to feed inflation in the mid- to long-term, once we have the deflationary forces of covid behind us.

Should inflationary expectations, and hence Treasury rates, rise further, the US Fed will have one of two choices: crush the economy, or crush the dollar (and hence ignite US inflation). Let me explain.

So which is likelier—crushing the economy or crushing the dollar? Given that politicians have little tolerance for recession and want to be re-elected —probably crushing the dollar (although the Fed will probably want to defend the dollar while it can).

So what might investors do? I would suggest four things:

Note: do your own due diligence and discuss any investment decisions with your financial advisor before making any investments.

So why is this so significant?

First, it signals an increase in financing costs, not just of Government debt, but for housing, corporations, mortgages, etc. When there are such massive amounts of Government, corporate and individual debt, both in the US and worldwide, any increase in financing costs sucks oxygen from the economy. Just to put this into perspective, US Government revenues are USD 3.3 trillion per annum, and the US has some USD 27 trillion of debt and potentially USD 100 trillion plus of off balance sheet liabilities (pensions, etc.)1. Global debt has surpassed USD 270 trillion, some 370% of global GDP:

So why is this so significant?

First, it signals an increase in financing costs, not just of Government debt, but for housing, corporations, mortgages, etc. When there are such massive amounts of Government, corporate and individual debt, both in the US and worldwide, any increase in financing costs sucks oxygen from the economy. Just to put this into perspective, US Government revenues are USD 3.3 trillion per annum, and the US has some USD 27 trillion of debt and potentially USD 100 trillion plus of off balance sheet liabilities (pensions, etc.)1. Global debt has surpassed USD 270 trillion, some 370% of global GDP:

The second reason is that rising interest rates would affect asset valuations—which are exploding in the current market. The following chart shows how the S&P index is in record territory, by just about any metric:

The second reason is that rising interest rates would affect asset valuations—which are exploding in the current market. The following chart shows how the S&P index is in record territory, by just about any metric:

Other stock exchanges, both in the US and globally, are heading into similar record territory, as are various commodities, real estate in several markets, etc. The only possible justification for such valuations are the record low interest rates. As interest rates rise, valuations will become ever so more fragile. Markets may experience what I call a “road runner” moment: as the cartoon character runs over the cliff, he treads on thin air for a while; when he looks down, crashes.

Third, one should look at the reason for the increase: increase in inflation expectations driven by a massive double whammy of record monetary and fiscal stimulus:

Other stock exchanges, both in the US and globally, are heading into similar record territory, as are various commodities, real estate in several markets, etc. The only possible justification for such valuations are the record low interest rates. As interest rates rise, valuations will become ever so more fragile. Markets may experience what I call a “road runner” moment: as the cartoon character runs over the cliff, he treads on thin air for a while; when he looks down, crashes.

Third, one should look at the reason for the increase: increase in inflation expectations driven by a massive double whammy of record monetary and fiscal stimulus:

Monetary stimulus will likely be even larger in 2021. The Fed needs to refinance some USD 7 trillion in maturing debt this year, and will need to fund the USD 2 trillion stimulus program announced by Biden as well as many other new programs. Many market watchers (including one of my former blogs) have discussed how this is likely to feed inflation in the mid- to long-term, once we have the deflationary forces of covid behind us.

Monetary stimulus will likely be even larger in 2021. The Fed needs to refinance some USD 7 trillion in maturing debt this year, and will need to fund the USD 2 trillion stimulus program announced by Biden as well as many other new programs. Many market watchers (including one of my former blogs) have discussed how this is likely to feed inflation in the mid- to long-term, once we have the deflationary forces of covid behind us.

Should inflationary expectations, and hence Treasury rates, rise further, the US Fed will have one of two choices: crush the economy, or crush the dollar (and hence ignite US inflation). Let me explain.

- Crush the economy: If interest rates continue to climb, enormous pain will be felt throughout the economy—individuals, corporates and even government will strive to make interest payments, driving out other types of spending (or in the case of government, creating an even steeper debt spiral), thereby crushing the economy.

- Crush the dollar: To save the economy from tanking, the Fed may engages in yield curve suppression (e.g. keeping yields low by buying bonds, thereby driving bond prices up and yields down), likely to crash the US dollar, This will have numerous knock-on effects, such as importing inflation into the US.

So which is likelier—crushing the economy or crushing the dollar? Given that politicians have little tolerance for recession and want to be re-elected —probably crushing the dollar (although the Fed will probably want to defend the dollar while it can).

So what might investors do? I would suggest four things:

- 1, Avoid not only Treasuries, but also government bonds in all countries where national debt is high and spiraling higher. There is every likelihood that financial repression (real interest rates below below interest rates) will reduce purchasing power of your investment). Unfortunately, eliminating or reducing Government bond exposure in your portfolio also reduces your ability to mitigate risk.

- 2, Create or maintain an appropriate degree of liquidity (cash, short-term bonds).

- 3, Consider hedging up to 5% of your portfolio in physical gold. Gold is an excellent hedge, a form of insurance, in case the wheels come off, with thousands of years of history. (Consider: at the height of hyperinflation in the Weimar Republic, you could buy a large villa in suburban Berlin, for just five ounces of gold). The USD has lost 98% of its value since going off the gold standard in 1971.

- 4, Also invest a portion of your portfolio into stocks or other assets that produce yield. This is the most challenging part of the investment equation—how do you generate decent yields at acceptable risk levels? Markets today are in a relentless quest for yield. No easy answers here; the decision is very personal.

Note: do your own due diligence and discuss any investment decisions with your financial advisor before making any investments.

1https://www.macrovoices.com/guest-content/list-guest-transcripts/4017-2021-01-14-transcript-of-the-podcast-interview-between-erik-townsend-and-luke-gromen/file

1Ibid

1Ibid