This article will explore two reasons why you should carefully observe commodities over the coming months:

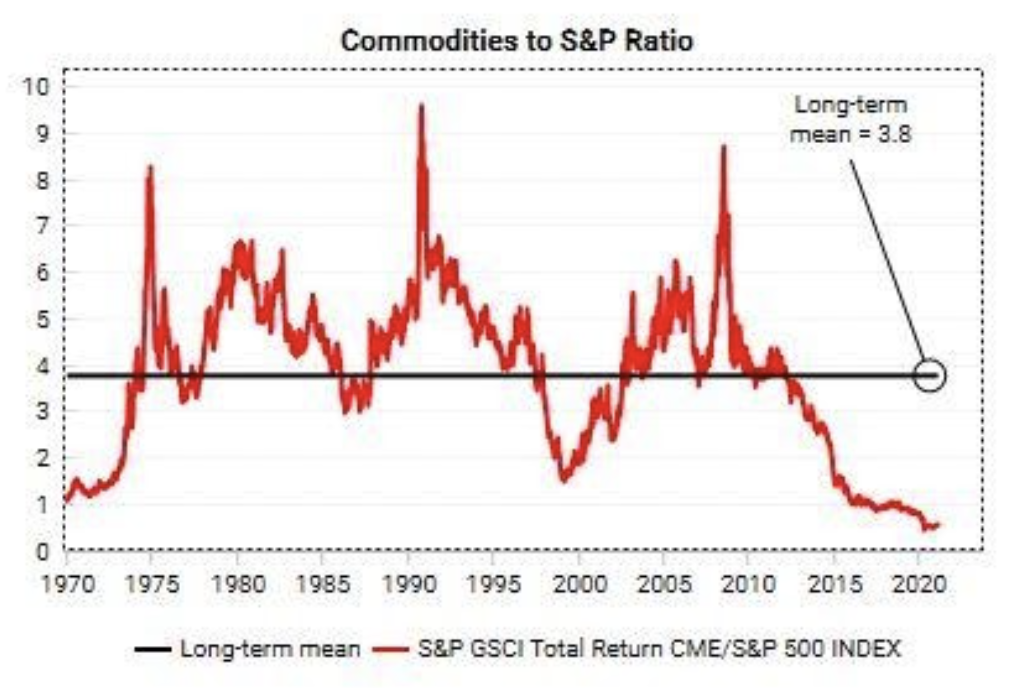

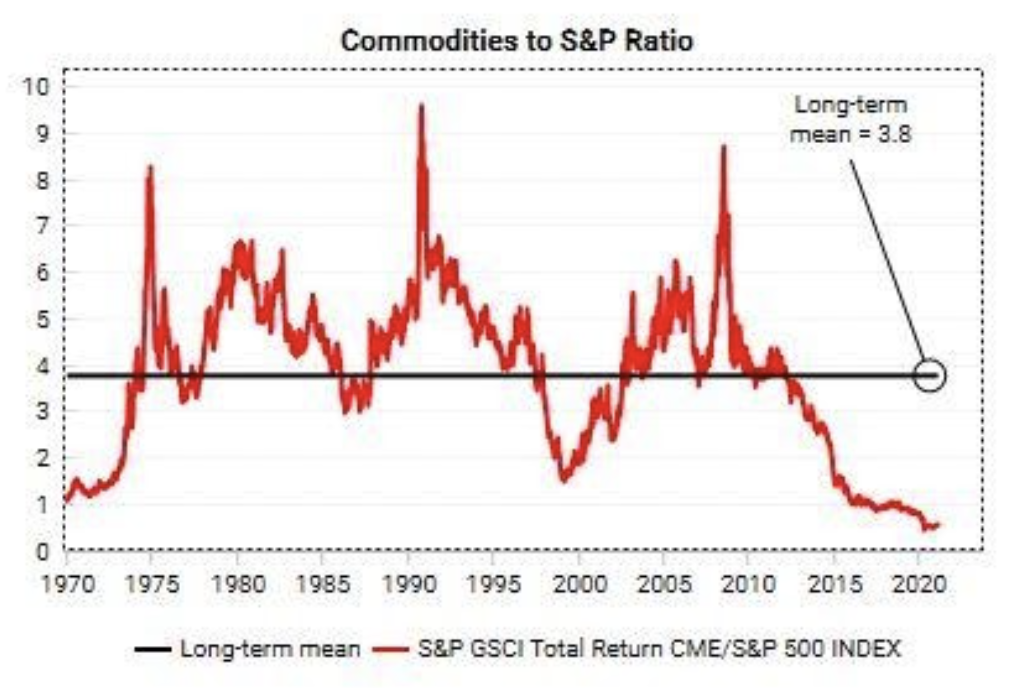

The majority of asset classes are overvalued, including most equities and bonds. Commodities, however, reached a cyclical low relative to equities in 2020:

Exhibit 1: GSCI Commodity Index vs. S&P500 Chart Source: Bloomberg, Macrobond

Chart Source: Bloomberg, Macrobond

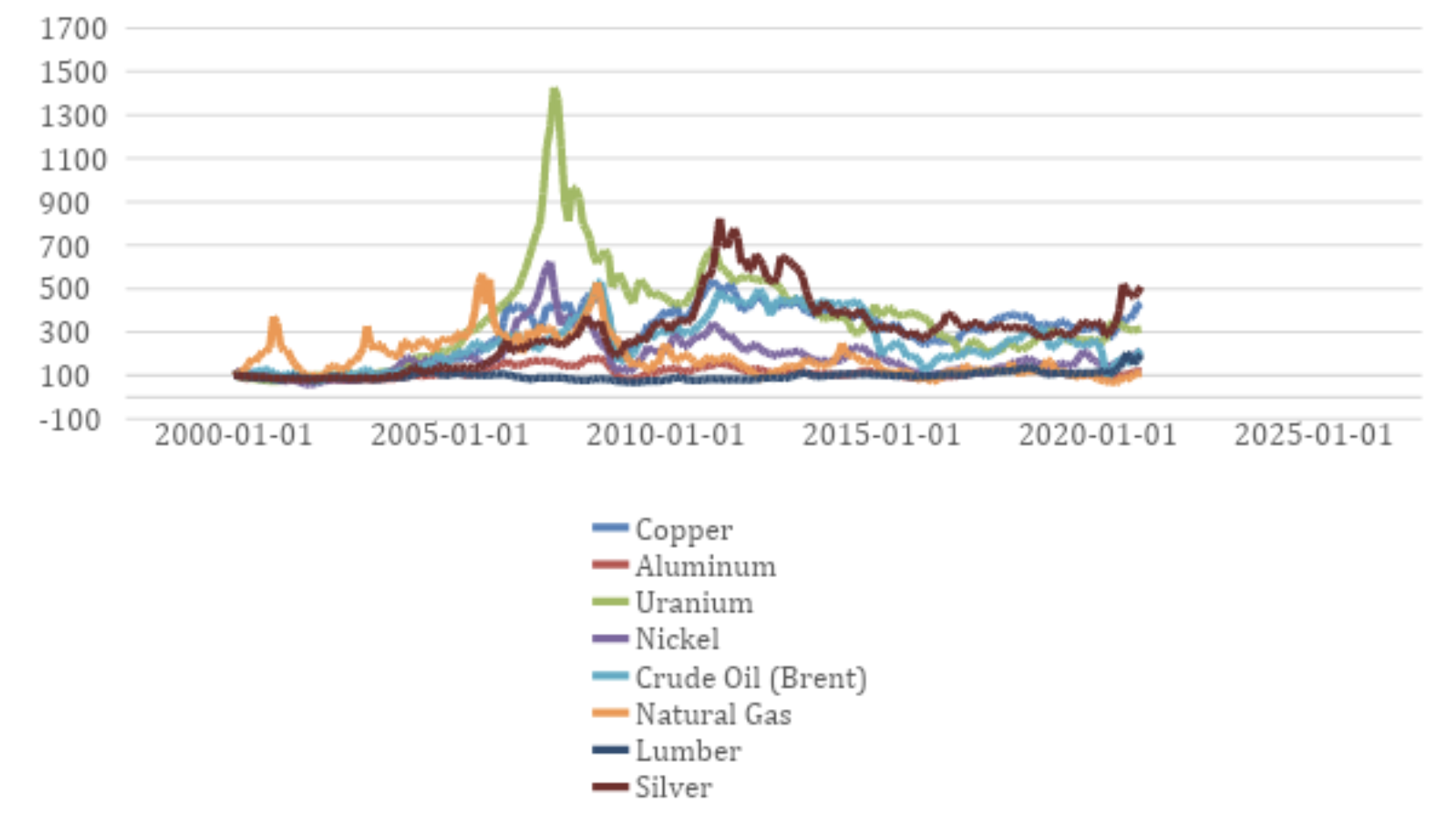

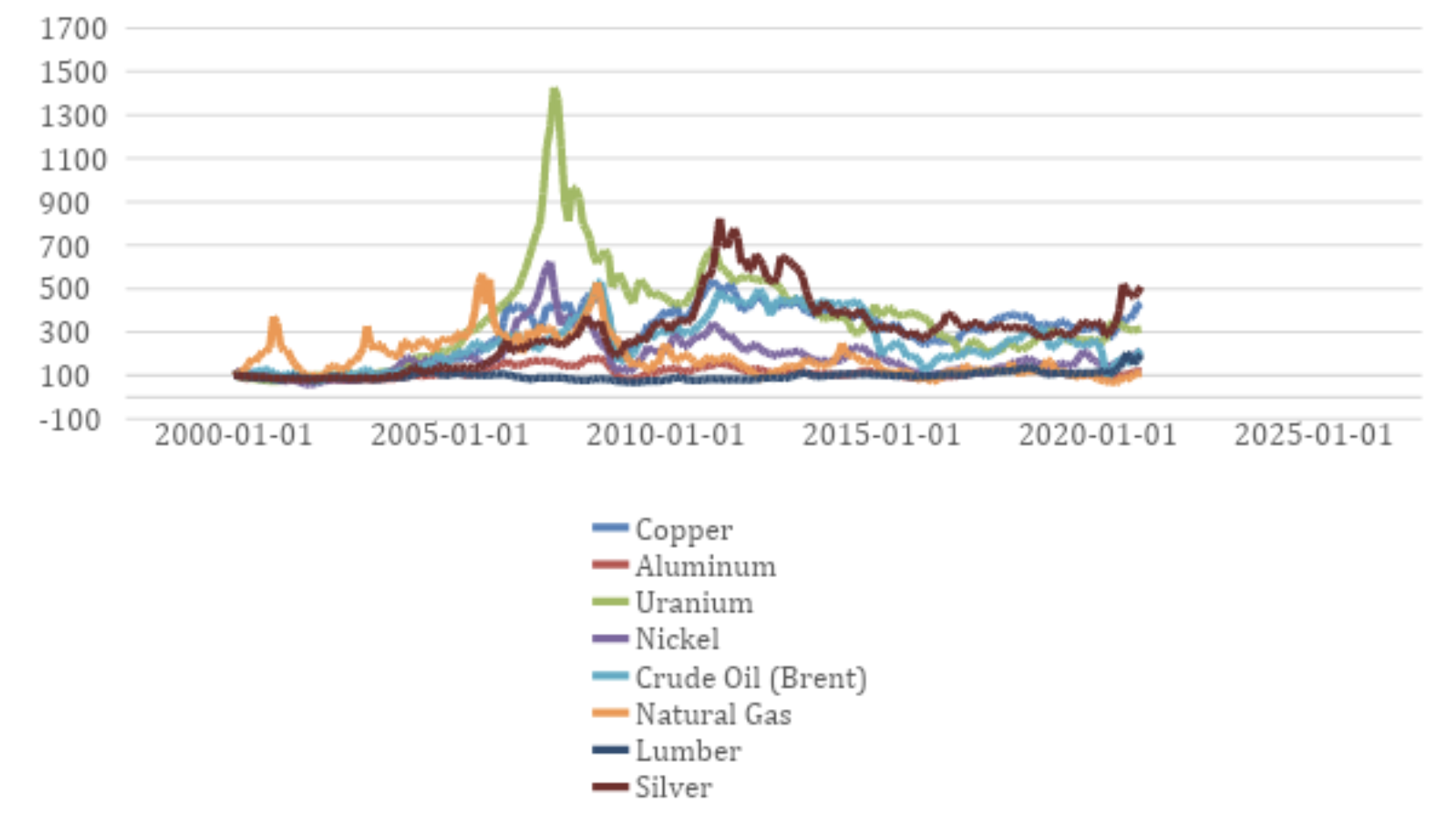

The picture is more nuanced if one looks at individual commodities:

Exbibit 2: Evolution of Selected Commodity Prices: 2000 to Present1 When viewing the above chart, it should be borne in mind that commodity prices are in nominal dollars. In other words, recent prices are even cheaper in real dollars.

When viewing the above chart, it should be borne in mind that commodity prices are in nominal dollars. In other words, recent prices are even cheaper in real dollars.

It pays also to understand the supply and demand relationships—there is a story behind each commodity.

For example, uranium was booming until the Fukushima meltdown, after which the bottom fell out of the market. Many reactors were shut down or mothballed. From a peak price over $130/lb in 2007, uranium dropped into the teens, in a market where it takes a at least $50-$60/lb. to bring new capacity onto the market. Many uranium mines, including some of the largest, shut down. For more than a decade, the industry used up massive amounts of inventory, which are expected to run out within a few years. The US, Europe and China have each set aggressive carbon neutrality objectives, where nuclear plays a significant role, particularly in China where over 200 reactors are either in planning or development stage. The price of uranium is still circling around $30/lb; the price of uranium miners have begun to climb, some with considerable room to run.

Another interesting story is gold. In 1980, when investors were losing confidence, gold reached ca. $20,000/oz (in 2021 dollars) compared to the current price of ca. 1760, despite having an excellent performance in 2020. Very few portfolios hold gold, which provides an excellent hedge or diversification. When investors lose confidence in fiat currencies, want to de-risk their portfolios or protect against negative real yields on bonds, they flock to gold. A few historical examples:

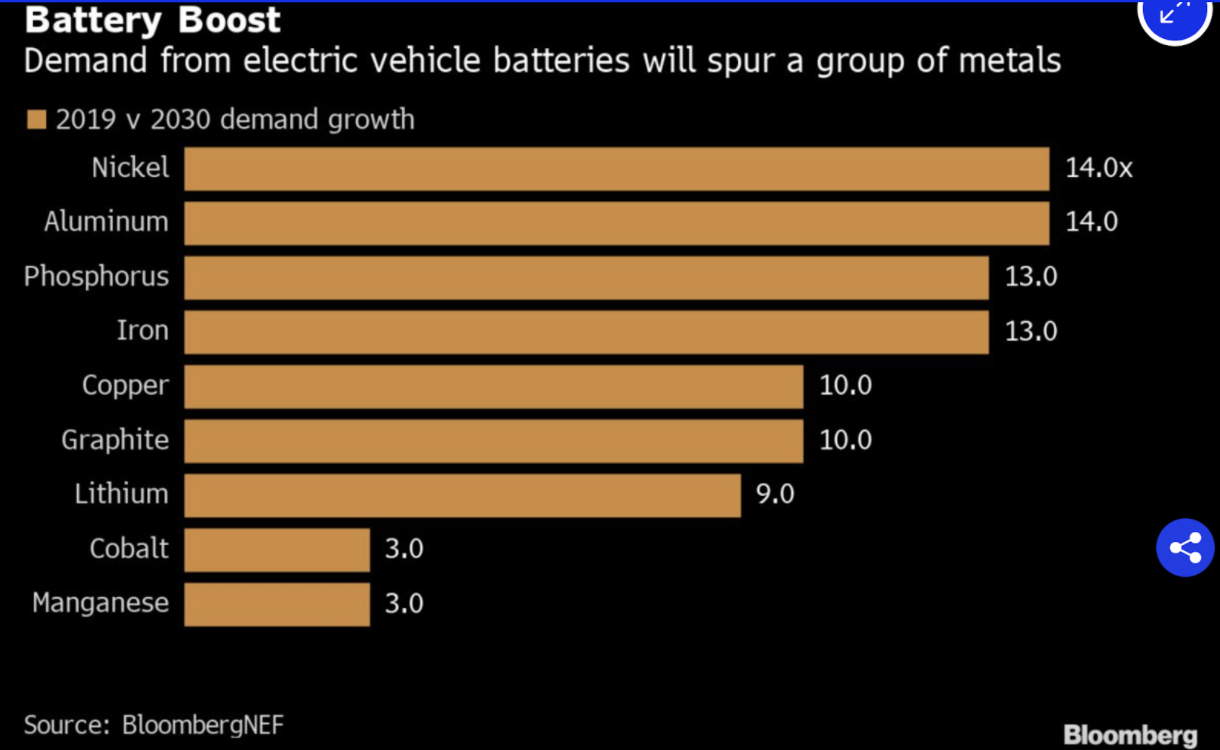

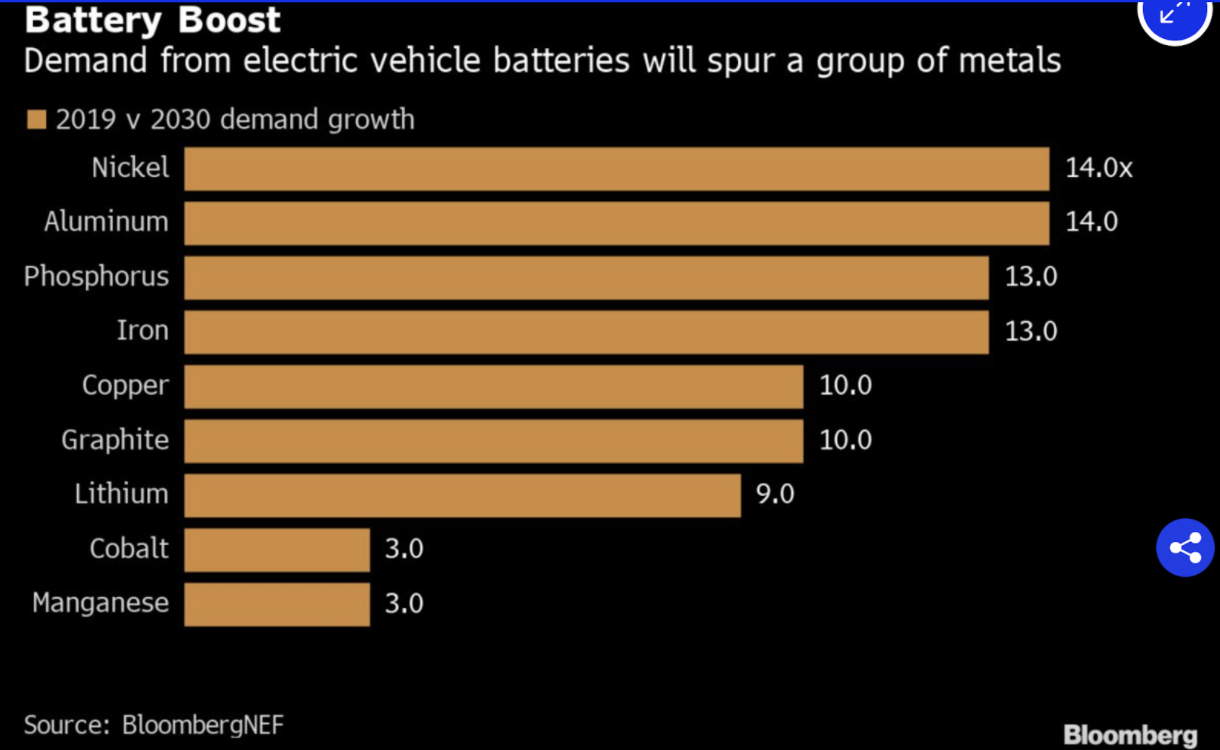

For the next decade, a big issue in commodities will be how to supply the massive rise in electric vehicles, solar panels, chips, etc. See below the commodity increases required just for electric vehicle batteries:

Exhibit 3: Demand Growth in various Metals to supply Electric Vehicle Battery Production Vast amounts of investment will be required. It will be an incredibly exciting and volatile time for investors.

Vast amounts of investment will be required. It will be an incredibly exciting and volatile time for investors.

b, Commodities feeding into inflation

Many commodities have seen high double digit or low triple digit price increases over the past year or two (e.g. lumber up 250%!), which have already begun to feed into supply chains, with farther to run. For example, uranium prices will need to increase from $30 to minimum $50 to bring new supply onto the market. Inflationary pressures may be even larger if the US and China establish their own supply chains for strategic materials.

Increases in oil and gas prices could become a major contributor to inflation. Over the past few years, low prices depressed capital and exploration drilling. If post-pandemic demand roars back, major energy price increases could be in the offing.

Future price movements of most commodities will depend to a great degree on recovery and growth of China, by far the largest consumer of commodities in the world. So far it is the post-pandemic leader among major nations in economic growth.

So next time you read that Janet Yellen thinks deflation is a greater danger than inflation, or that the Fed knows how to control inflation, think about it, and watch commodity pricing carefully. Once inflation takes hold, it has historically proven very difficult to put the genie back into the bottle.

The author owns positions in resource companies. Contents are for information purposes only. Investors should conduct their own due diligence or consult a financial advisor.

- If you are an investor, commodities may represent an excellent investment opportunity. While equities almost universally suffer from frothy valuations, commodities have only recently begun a recovery from cyclical lows, and there appears to be considerable runway for further growth. Many commodity experts are now talking about a “great rotation” from high-priced equities and bonds into commodities.

- If you are an economist, or trying to understand economic trends, there is a raging debate about whether inflationary or deflationary forces will prevail. Commodity inflation plays into the inflationist camp, and by studying what’s happening with commodities, you will have pretty powerful evidence of how inflation is creeping into the supply chain.

The majority of asset classes are overvalued, including most equities and bonds. Commodities, however, reached a cyclical low relative to equities in 2020:

Exhibit 1: GSCI Commodity Index vs. S&P500

Chart Source: Bloomberg, Macrobond

Chart Source: Bloomberg, Macrobond

The picture is more nuanced if one looks at individual commodities:

Exbibit 2: Evolution of Selected Commodity Prices: 2000 to Present1

When viewing the above chart, it should be borne in mind that commodity prices are in nominal dollars. In other words, recent prices are even cheaper in real dollars.

When viewing the above chart, it should be borne in mind that commodity prices are in nominal dollars. In other words, recent prices are even cheaper in real dollars.

It pays also to understand the supply and demand relationships—there is a story behind each commodity.

For example, uranium was booming until the Fukushima meltdown, after which the bottom fell out of the market. Many reactors were shut down or mothballed. From a peak price over $130/lb in 2007, uranium dropped into the teens, in a market where it takes a at least $50-$60/lb. to bring new capacity onto the market. Many uranium mines, including some of the largest, shut down. For more than a decade, the industry used up massive amounts of inventory, which are expected to run out within a few years. The US, Europe and China have each set aggressive carbon neutrality objectives, where nuclear plays a significant role, particularly in China where over 200 reactors are either in planning or development stage. The price of uranium is still circling around $30/lb; the price of uranium miners have begun to climb, some with considerable room to run.

Another interesting story is gold. In 1980, when investors were losing confidence, gold reached ca. $20,000/oz (in 2021 dollars) compared to the current price of ca. 1760, despite having an excellent performance in 2020. Very few portfolios hold gold, which provides an excellent hedge or diversification. When investors lose confidence in fiat currencies, want to de-risk their portfolios or protect against negative real yields on bonds, they flock to gold. A few historical examples:

- between 2000 and 2002, the Nasdaq declined by 78%; between 2000 and 2008, gold and silver mines went up fivefold.

- Similarly, in 1973-74, the S&P halved while gold mining stocks went up fivefold. 2

For the next decade, a big issue in commodities will be how to supply the massive rise in electric vehicles, solar panels, chips, etc. See below the commodity increases required just for electric vehicle batteries:

Exhibit 3: Demand Growth in various Metals to supply Electric Vehicle Battery Production

Vast amounts of investment will be required. It will be an incredibly exciting and volatile time for investors.

Vast amounts of investment will be required. It will be an incredibly exciting and volatile time for investors.

b, Commodities feeding into inflation

Many commodities have seen high double digit or low triple digit price increases over the past year or two (e.g. lumber up 250%!), which have already begun to feed into supply chains, with farther to run. For example, uranium prices will need to increase from $30 to minimum $50 to bring new supply onto the market. Inflationary pressures may be even larger if the US and China establish their own supply chains for strategic materials.

Increases in oil and gas prices could become a major contributor to inflation. Over the past few years, low prices depressed capital and exploration drilling. If post-pandemic demand roars back, major energy price increases could be in the offing.

Future price movements of most commodities will depend to a great degree on recovery and growth of China, by far the largest consumer of commodities in the world. So far it is the post-pandemic leader among major nations in economic growth.

So next time you read that Janet Yellen thinks deflation is a greater danger than inflation, or that the Fed knows how to control inflation, think about it, and watch commodity pricing carefully. Once inflation takes hold, it has historically proven very difficult to put the genie back into the bottle.

The author owns positions in resource companies. Contents are for information purposes only. Investors should conduct their own due diligence or consult a financial advisor.

1Fred Economic Data, IndexMundi

2Crescat Capital LLC

2Crescat Capital LLC